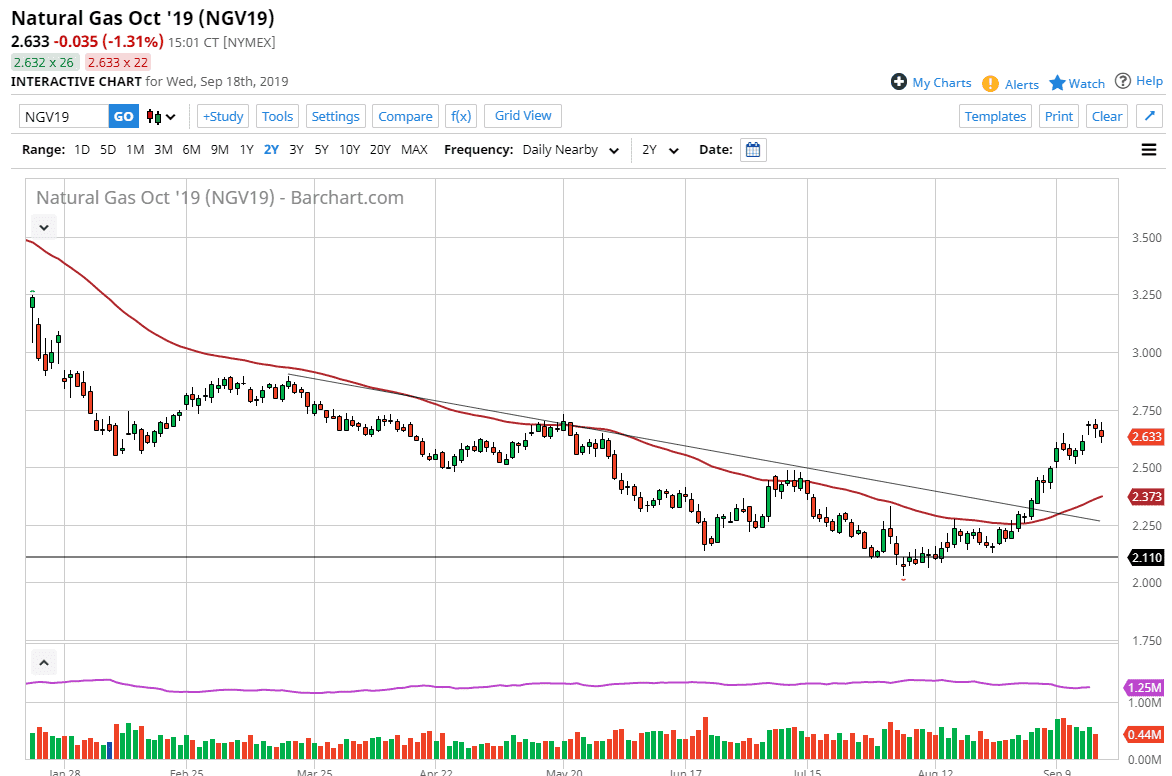

Natural gas markets have gone back and forth during the last couple of days, as we have shown signs of filling the gap from the beginning of the week. Now that we have actually done that, the market is ready to go higher but keep in mind that this is also a market that is very cyclical in nature, so we need to see whether or not we have the wind to rally under way, or just simply a short covering. That being the case though, it’s likely that the market will make some type of significant decision for the next several months. That being said though, I do favor the upside.

The bullish flag suggests like we are going to continue to go towards the $3.00 level based upon the measurement. The $2.50 level is the bottom of the flag itself, so as long as we stay above there I think that it’s only a matter of time before the natural gas markets continue to go higher. The 50 day EMA is turning higher, as we had broken above the downtrend line that had been such a major influence on the market.

This is a market that tends to move higher this time of year, based upon the fact that the market is highly sensitive to demand based upon heating in the United States and Europe. As we are entering the cold months and the fact that the market is so low, it makes sense that we would go higher. We are starting to trade the November contract, and that of course is a cold weather month that has fairly high demand. In fact, it’s very likely that we will rally until early 2020, when traders tend to start selling off as they look forward to the spring. That being the case, then you have a nice buying opportunity now, and an excellent selling opportunity later based upon probably some type of exhaustive candle stick on the weekly chart. That being said, we have made a “lower low” this year, so it looks very likely that we probably won’t make a “higher high” looking at longer-term charts. With that, I anticipate that we are probably going to go towards the $3.50 level before rolling over. All things being equal, this is a market that is offering a lot of opportunity at this point.