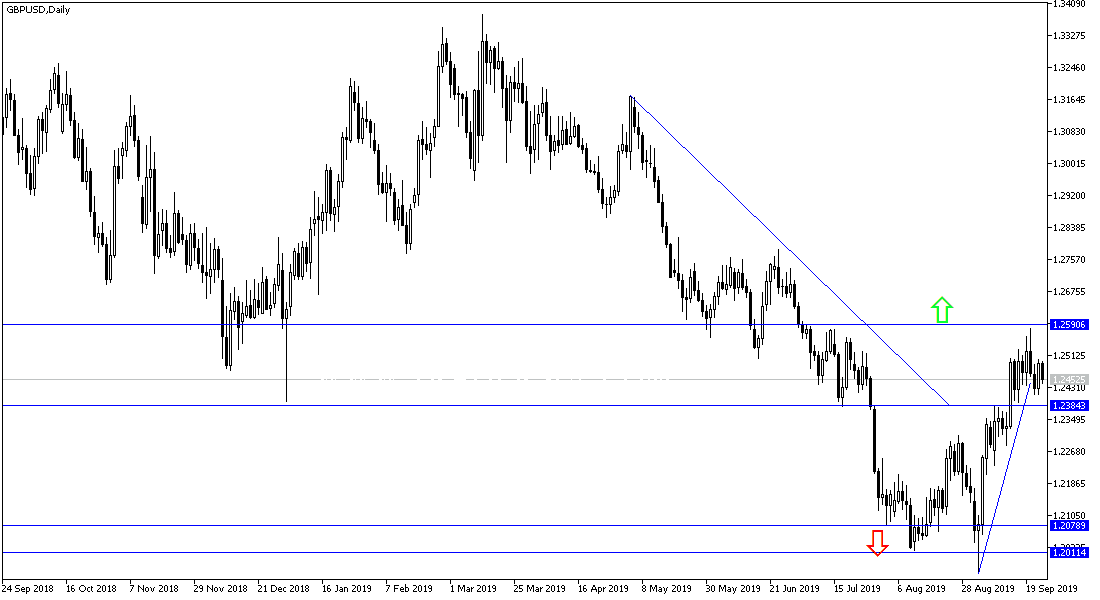

The US dollar has rebounded against major currencies, but the Pound is trying to hold. For three trading sessions in a row, the price of the GBP/USD pair is moving down from the 1.2581 resistance, the highest level in more than two and a half months, tested last Friday, and the pair moved towards 1.2412 support, before settling around 1.2430 at the time of writing, awaiting any developments. The recent performance did not lose its upward trend.

In terms of Brexit developments, which has the strongest influence on the Sterling performance; The UK Supreme Court is set to announce its ruling on the legality of the British parliament suspension this week, and the court's decision may determine whether to leave the union without a deal, or other political chaos. If Prime Minister Johnson's decision to suspend parliament is illegal, it could give lawmakers room to prevent Britain from leaving the EU "without a deal" by October 31, as well as to prevent another attempt to close the parliament.

Meanwhile, the US dollar is on a date with a series of important comments by Federal Reserve monetary policy officials over the course of this week, and dovish comments may lead to further easing, putting more pressure on the greenback, while reassuring comments may provide further momentum for the US dollar. For the time being, risk sentiment is likely to drive dollar pairs as well, mostly depending on developments in the US-China trade talks, as well as other geopolitical risks.

According to the technical analysis of the pair: The gap between technical indicators widens to reflect stronger selling pressure, while the SMA 200 is around the top of an important area as resistance. The RSI indicator seems ready to fall shortly after reaching an overbought area, indicating that sellers are keen to return. Stochastic is also pointing to the overbought level and started falling again to show that the downward pressure may return to the pair's performance again. This will happen if the GBP / USD falls to settle below the 1.2400 level as selling will increase to test the support levels of 1.2335, 1.2250 and 1.2190, which strengthens the bullish outlook and terminates the current bullish opportunity for the pair.

On the economic data front: Today's economic calendar will focus first on the release of mortgage approvals in Britain. From the US, there will be announcements for Consumer Confidence and the Richmond Industrial Index data.