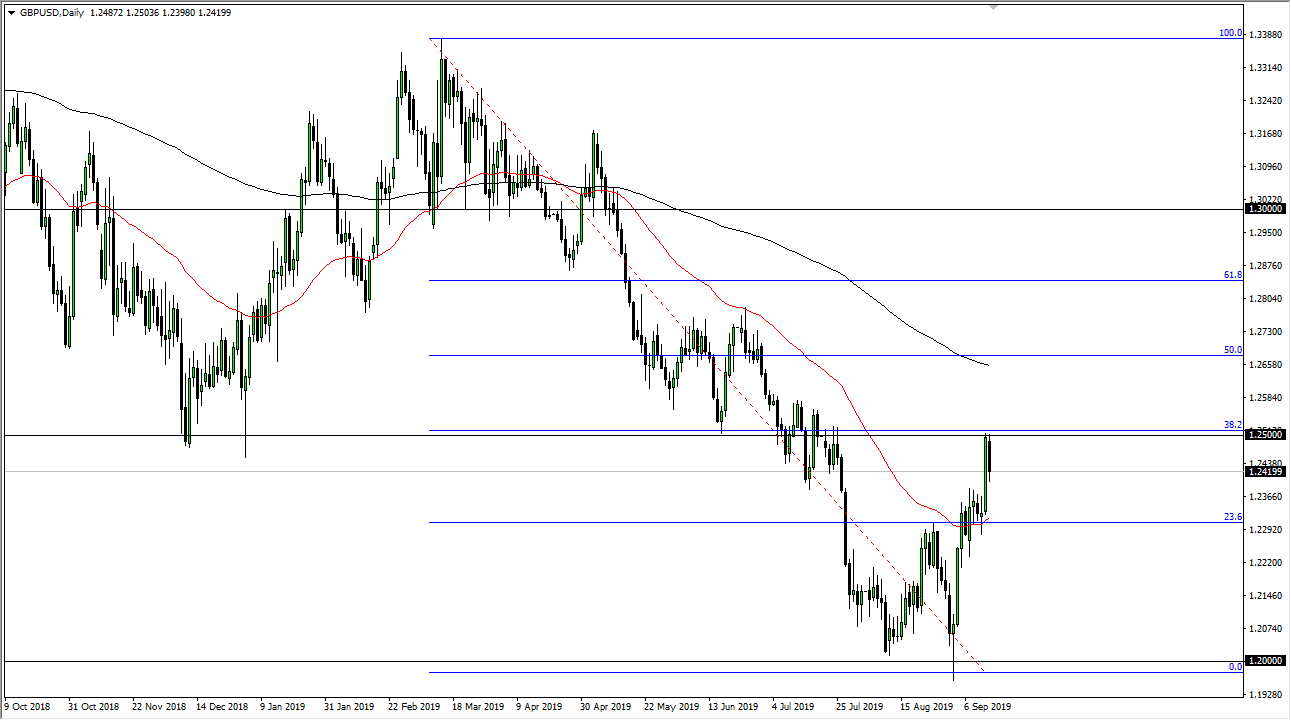

The British pound broke down during the trading session on Monday, as the 1.25 level has offered far too much in the way of resistance. It’s a scene where there has been quite a bit of selling pressure in the past, so the fact that we pulled back from the 1.25 level should not be a huge surprise. Beyond that, the market is far over extended as we have gained 500 points in just about seven or eight days. At this point, the Brexit is still a huge mess and it’s likely that the British pound will continue to show a lot of weakness in this general vicinity. Beyond that, there’s a lot of confusion when it comes to the Brexit situation and it of course is a moving target.

The 38.2% Fibonacci retracement level was right at the 1.25 GBP level as well, so it’s a confluence of interest in this area that sends this market back down. The massive selloff that started from here and the choppiness just before it certainly signifies that we should be looking at selling. It doesn’t mean that it’s going to be easy, and certainly the candle stick from the Friday session will be difficult to break through but once we do, this market should continue to go much lower, perhaps even reaching as far as the 1.20 level longer-term.

The US dollar has strengthened due to the insecurity around the world, especially considering the drone strike in Saudi Arabia. Treasuries do get a bit of a bid, and that of course drives up the demand for the US dollar. As soon as we get negative headlines involving the Brexit again, that will send the British pound right back down as well. There is a lot of noise just above, so it is going to be difficult to continue to go to the upside without some type of major catalyst. We have gone parabolic, we are running into resistance, and starting to react to it again. Looking at the chart, the fact that we have been this parabolic as of late, that tells me that there was probably a lot of short covering going on out there, so having said that there may not be any real momentum underneath the move that could continue to push this market higher for the longer-term as there is so much in the way of negativity.