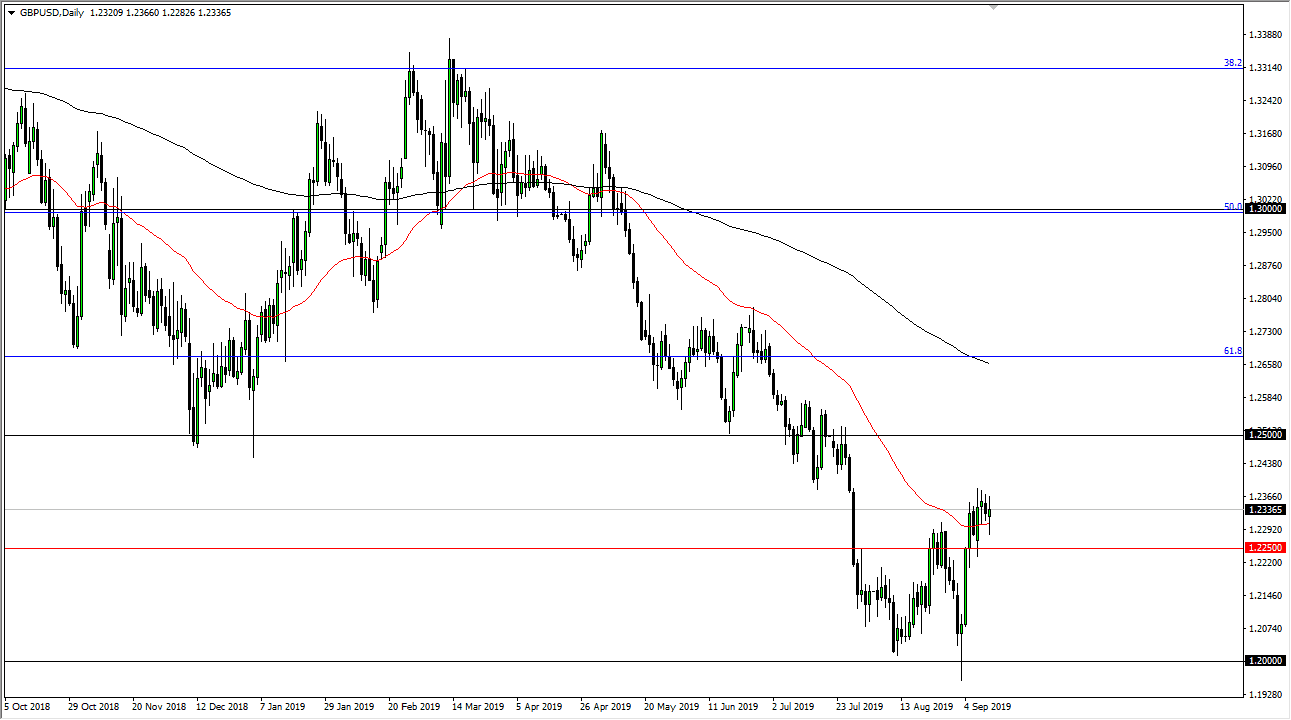

The British pound fell initially during the trading session on Thursday but found enough support underneath the 50 day EMA to turn around of form a bit of a hammer. This is a sign that we could bounce from here, and I think we do continue to see a little bit of short-term bullish pressure. The 1.2250 level underneath is significant support as well as the 50 day EMA which is marked in red on the chart, so therefore I think it’s only a matter of time before we rally from here and then go looking towards the 1.25 level above. That’s an area that has been structurally noisy, so I do think that there is a significant amount of resistance up there that will throw a lot of selling pressure into the marketplace.

Recently, the markets have been rallying a bit due to the idea of the British not being able to leave the European Union without some type of deal according to Parliament, but at this point that remains to be seen. I suspect that it’s only a matter of time before we get some type of negative headline that will send this market back down. One thing is for sure though, the British pound has stabilized a bit and that is exactly what needs to be seen. However, it doesn’t take a whole lot of imagination to suggest that perhaps we are trying to build some type of bearish flag as well, so all things being equal I believe that it is still very likely to be a negative market longer-term. Breaking above the 50 day EMA of course was a good sign, but we still have a lot of structural problems above.

You should keep in mind that the 1.25 level was previous support, even on the longer-term charts. At that point I would anticipate that sellers would come in and push this market lower. If they do, then it’s likely that we go down to the 1.2250 level and then the 1.20 level. Ultimately though, if we do continue to go higher and break above the black 200 day EMA, then we have to start thinking about the other direction from a longer-term perspective. However, we have not got that Brexit situation settled yet, which I think is what is needed before a trend change happens in earnest as we have been so negative and have been fooled more than once by signs of hope.