The British pound initially fell during the trading session on Tuesday, but then rallied towards the 1.25 handle. At this point, it’s very likely that the British pound will react to whatever the Federal Reserve does, or perhaps better put: the US dollar will. At this point, it is obvious that we’ve had a nice bounce in the British pound as the Brexit seems to be heading to the back burner, at least for the short term. While Boris Johnson has his day in court, the market is simply waiting around to see what happens.

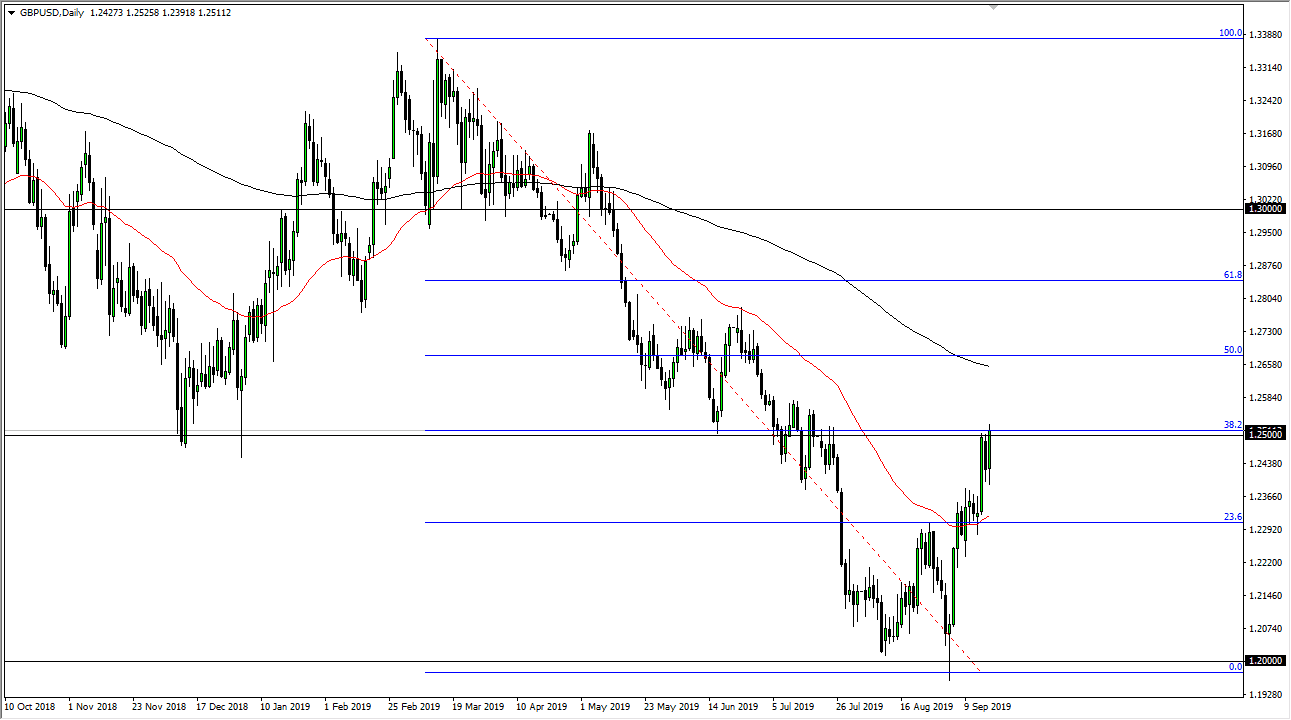

The candle stick is very strong, but at this point when the Federal Reserve speaks at 230 in the afternoon New York time, it will throw this market into a huge tizzy. At this point, the 1.25 level should offer a significant amount of resistance, especially near the 38.2% Fibonacci retracement level. There is a lot of noise just above as well, so don’t be surprised at all if we get a huge reaction to the Federal Reserve statement and more importantly the press conference.

The market has got a bit parabolic, and if the Federal Reserve disappoints, or at least sounds not nearly dovish enough, it’s likely that the market will start to buy US dollars. Beyond that, the US dollar is in high demand when there are a lot of concerns out there, and there probably are. The 200 day EMA above is also near the 1.2650 level, so that could be an area that would cause a lot of resistance as well. The British pound has no business rallying this way, so I still believe that this is probably more or less going to be a short covering rally. Signs of exhaustion will be jumped on and we could possibly get that after the Federal Reserve statement/press conference.

If we do break above the 200 day EMA, then it would be a longer-term signal for large funds, and it could be the end of the negative trend. I find that difficult to believe though, as the British political class continues to give us plenty of reasons to sell the currency. It doesn’t matter which side of the Brexit you are on, it’s obvious that nothing seems to be getting done with any type of conviction. If treasury bonds start to get bought up, that could also have people running toward the US dollar.