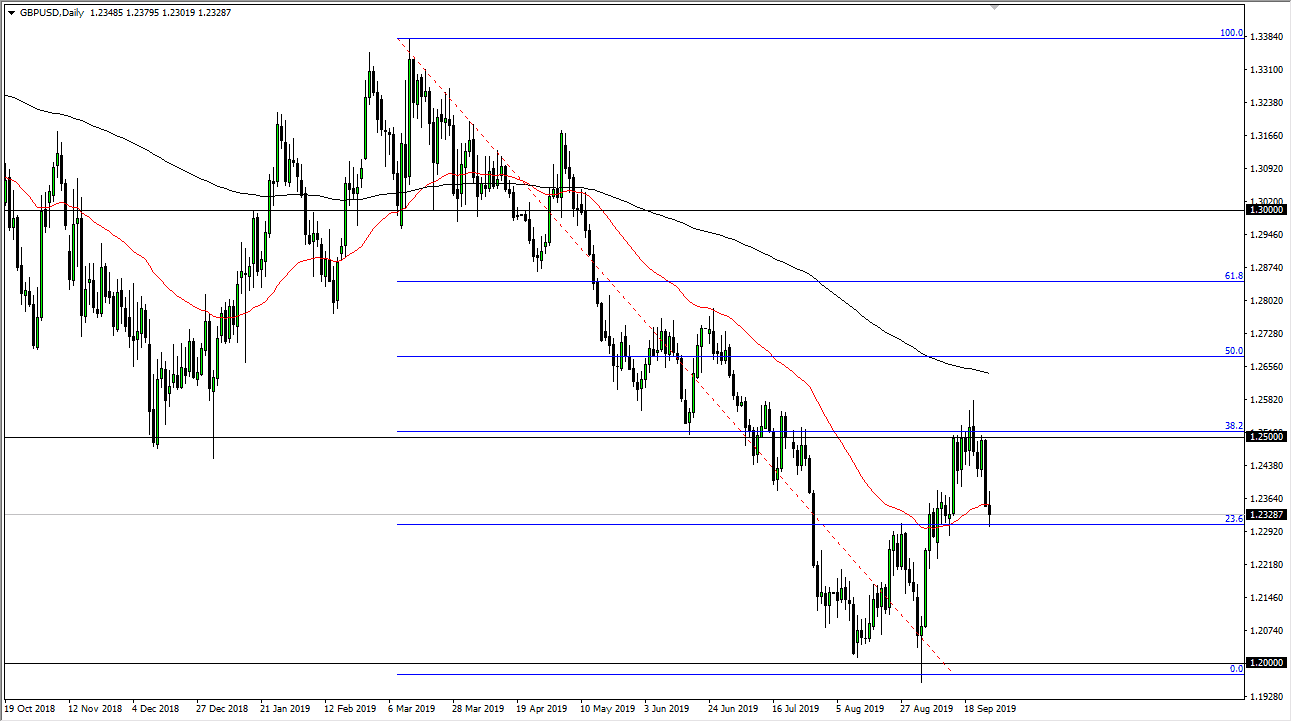

The British pound went back and forth during the trading session on Thursday, as we are bouncing around the 50 day EMA. That’s an area that of course attracts a lot of attention by technical traders as it will kick off algorithms and of course longer-term trend trades. At this point, the 1.23 level underneath it looks to be supportive, but if we break down below it, and more specifically the low of the day, it’s likely that the market probably goes down to the 1.20 level eventually which was the most recent low.

To the upside, there is a huge barrier in the form of the 1.25 handle, so I believe that any rally at this point in time will probably be faded rather quickly, as the Brexit is still a major issue, and nothing has truly been settled. Above the recent high we have the 200 day EMA which would also come into play as well, so it’s really not until we clear that area on a daily close that you can say that the trend is starting to turn around.

To the downside, I do believe that the 1.20 level will hold initially, but it is possible that we get down below there. Obviously, that’s 300 pips away so it isn’t going to happen in one clear shot, but don’t be surprised at all if we test that area yet again as the Brexit continues to be a major overhang and the US dollar is being used as a safety currency these days anyway. There are a lot of concerns when it comes to global growth, so it makes sense that the British pound suffers in that sense as well.

The United States is the only economy in the G 10 right now that looks likely to continue to strengthen, so ultimately this is a market that should continue to favor the downside, at least until we get some type of major shift in the Brexit scenario, which right now is chaos at best. It’s very likely that fading rallies for short-term trades will continue to work in this marketplace, just as the volatility will continue to be a major issue. Keep in mind that headlines can throw things into disarray immediately, so money management will be crucial when it comes to trading Sterling in this type of environment.