The British pound initially rallied during the trading session on Tuesday as word got out that Boris Johnson lost in the court system. Because of this, the UK Parliament should the get back to work, and that in theory could block a “no deal Brexit.” With that being the case it’s very likely that the hope still is out there that a “no deal Brexit” doesn’t happen. However, at this point, there are still plenty of issues out there when it comes to the British economy and of course the entire situation involving the Brexit in general. This is a market that is going to continue to deal with a lot of uncertainty and therefore it makes quite a bit of sense that we continue to drop given enough time.

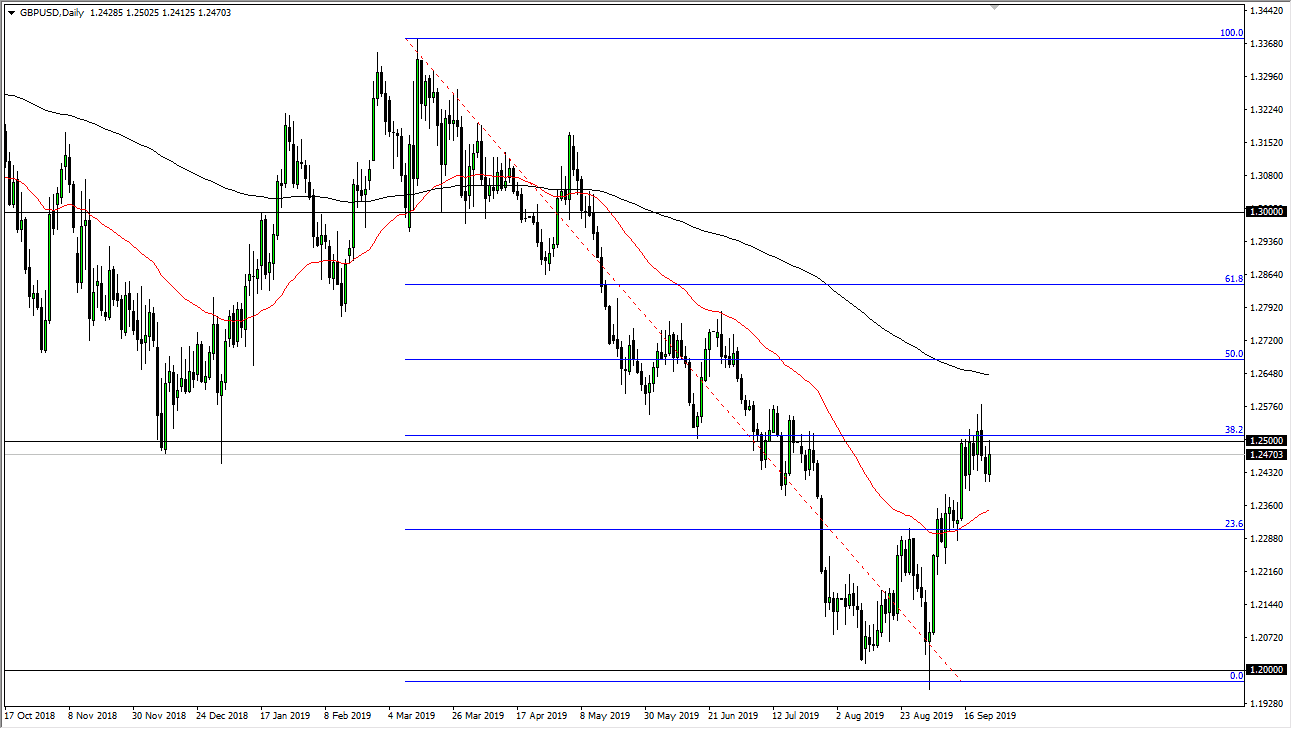

Looking at the British pound against other currencies, especially the Japanese yen, almost all of the gains have been given back, and it makes sense that eventually the British pound drop from here. The 50 day EMA underneath should offer support as well, near the 1.23 level. We have also seen the lot of sellers just above at the 1.25 handle as it is a large, round, psychologically significant figure, and it is also the 38.2% Fibonacci retracement level, so it makes quite a bit of sense that there is a lot of interest here.

The British pound is in a significant downtrend, and even though we have seen a significant bounce, it is still just a blip on the radar when it comes to the longer-term movement. Ultimately, the market is very likely to go looking towards the lows again and it thinks only a matter of time before something comes out that will push it back down. After all, we are talking about the British Parliament here and the ability for anything to actually get done.

At this point the trend is still very negative, and of course the 200 day EMA is sitting above near the 50% Fibonacci retracement level. With that, it is still likely to offer plenty of selling opportunities on any type of rally anyway. Expect a lot of volatility, expect a lot of noise, but at the end of the day expect negativity. The British pound continues to see a lot of order flow above anyway, so given enough time it’s likely we rollover going forward.