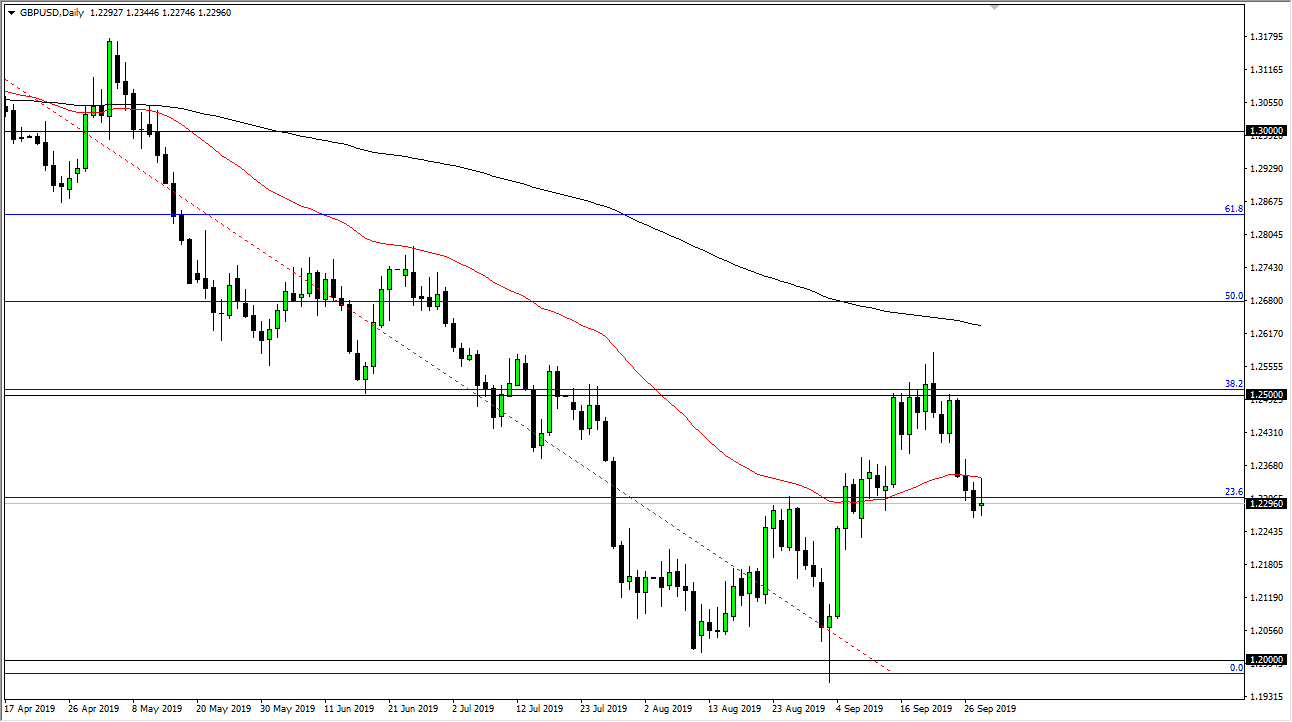

The British pound initially tried to rally during the trading session on Monday but found quite a bit of resistance and turned around of form a bit of a shooting star or inverted hammer if you will. The 50 day EMA offered resistance, as it was previous support. It is a technical indicator that a lot of people will pay attention to so it makes quite a bit of sense that the market would stutter there. At this point, if we can break down below the Monday or Friday candlestick, then it’s likely that the British pound will continue to the downside.

The recent bounce have seen a lot of selling pressure at the 38.2% Fibonacci retracement level, an area that of course will continue to attract a certain amount of attention not only because of the Fibonacci retracement level but also the large, round, psychologically significant figure. All things being equal, this is a market that should continue to go lower over the longer-term, but if we were to break above that and maybe even the 200 day EMA which is painted in black, the market could go much higher.

To the downside, the 1.20 level has been very supportive, and I think it will probably get tested again. Whether or not the market can break down below there is a completely different question. I don’t know that it can, and as Brexit is continuing to be a bit of a market situation, it’s almost impossible to make that assumption now. With that, I choose to focus on the next couple of days, and right now I break down below the 1.20 level just isn’t in the cards.

If we were to break above the 50 day EMA, then likely the 1.25 level will be the target, but again I don’t believe that it will be easy to break above there. Obviously, there could be a certain amount of headline noise coming out that throws this market around, so with that in mind all we can do at this point is trade the overall trend in attitude of the markets. At this point, the sellers still have the upper hand to say the least and it’s likely that will continue to be the case. Expect a lot of choppiness and noisy trading, but I still think that the downward trend trumps everything in this market currently.