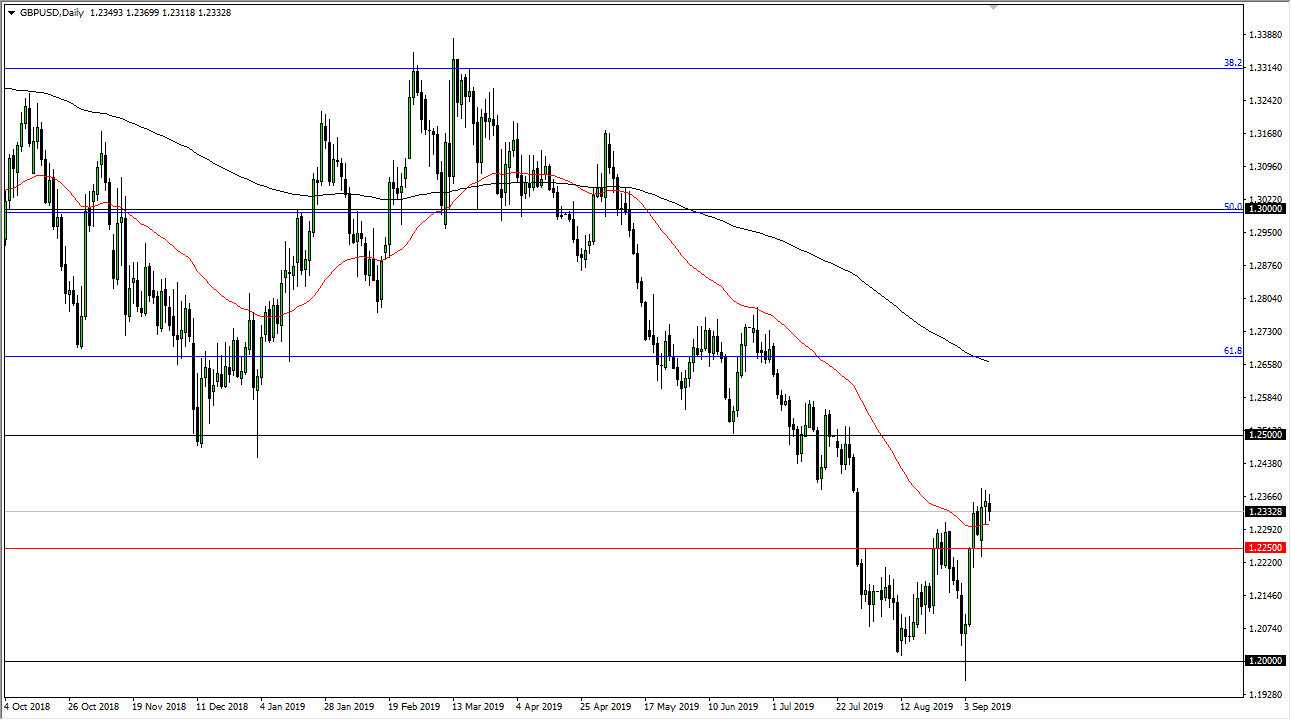

The British pound is likely to continue sideways as we have taken a bit of a break after the volatile move over the last couple of weeks. At this point, it’s very likely that the market is simply waiting to see how the entire Brexit situation flushes out, and at this point we could get a massive move in one direction or another. You should look at the 50 day EMA underneath as support it. At this point, it’s very likely that we will see a major move one day or another due to some type of headline.

To the upside, the 1.25 GBP level should cause quite a bit of resistance as it is structural choppiness and resistance just waiting to happen. Any sign of exhaustion near that area will probably be a selling opportunity, as we have certainly been in a downtrend for some time and it’s very likely that the overall attitude continues to the downside as the Brexit continues to be a huge mess. Currently, people believe that the British won’t leave the European Union without a deal, but that isn’t necessarily a done deal at this point. After all, an extension for the Brexit hasn’t been requested, and beyond that you would have to recognize that the Europeans haven’t necessarily said they are willing to give one. At this point, it’s very likely that we will see volatility regardless, but at this point it’s very likely that it’s only a matter of time before we sell off and reach towards the bottom again.

All things being equal, we are probably ready for another “flush” lower, given enough time as the situation is getting more and more restless. All things being equal, it’s likely that we could go towards the 1.15 handle underneath, which is closer to the 100% Fibonacci retracement level. Now that we are well below the 61.8% Fibonacci retracement level, quite often that will happen. All things being equal I like the idea of fading rallies but right now it seems like volatility has essentially been run out of the market which of course doesn’t make for ideal trading conditions. Regardless, simply waiting for signs of negativity should offer an opportunity to go much lower, as the 1.20 level underneath should be a nice target. A break down below there should flush more money into this market.