The EUR/USD will remain in a limited range until the ECB's monetary policy decisions are actually announced. The pair bounced higher during last week's trading and tested resistance at 1.1085 before closing the week around the 1.1024 level, following the comments of Federal Reserve Governor Jerome Powell. Powell said a forum in Zurich, Switzerland, that the central bank has helped keep the US economy on firm ground amid uncertainty caused by Trump's trade war with China.

Powell added that despite the uncertainty caused by the trade war, the Fed currently does not expect a recession, noting that the labor market and consumer spending remain strong. He also reiterated that the Fed would "act as necessary" to maintain US economic growth.

Previously, data from the US Labor Department showed that nonfarm payrolls rose 130,000 in August after rising 159,000 in July. Economists had expected employment to rise by 158,000 compared to the 164,000 jobs originally announced last month.

The Labor Department also said the unemployment rate remained steady at 3.7% in August, unchanged from July and in line with economists' estimates.

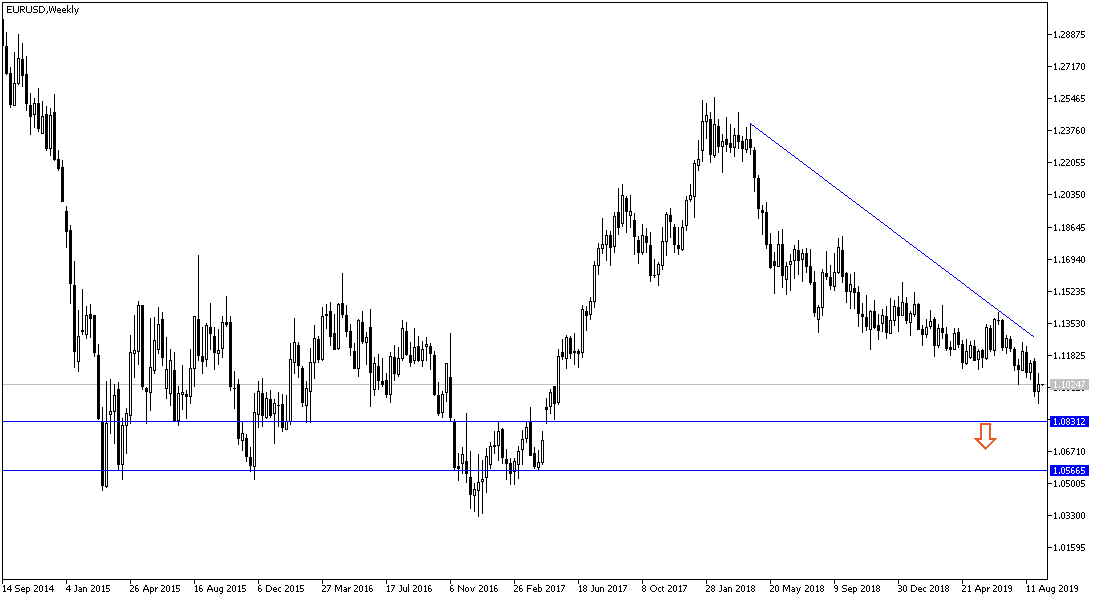

According to the technical analysis of the pair: The performance of the EUR / USD pair will remain around the level of 1.1000 until the announcement of monetary policy decisions of the European Central Bank. A fresh bearish momentum could see stability below it, reaching 1.0955, 1.0880 and 1.0800, respectively, which supports the strength of the bearish trend which remains the stronger. Completing a move higher could test the 1.1100, 1.1175 and 1.1260 resistance levels respectively.

On the economic data front today: There are no significant US economic releases today. The Euro will react to the release of the Eurozone trade balance as well as the Sentix Investor Confidence Index.