Euro continues to show signs of weakness.

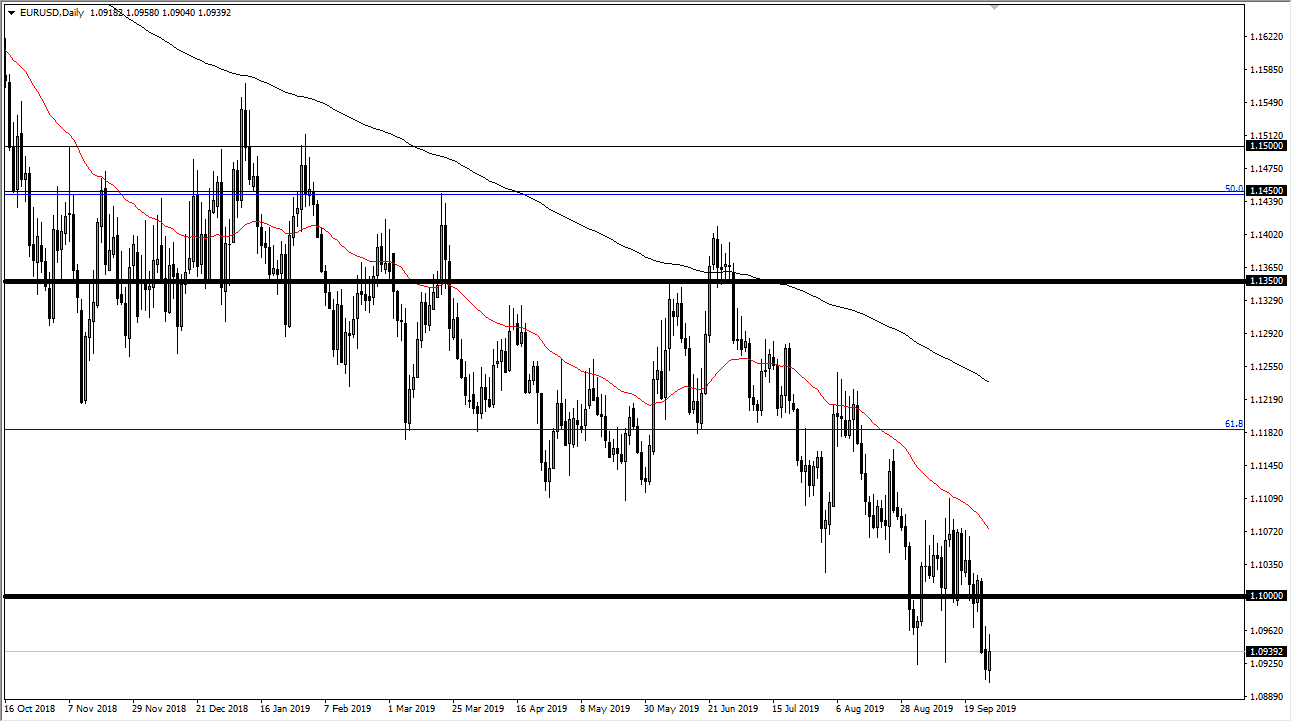

The Euro has gone back and forth during the trading session on Friday, but the most important thing that I see on the chart is the fact that there is a lot of resistance just above. That being said, the 1.09 level underneath offers quite a bit of support, so if we were to break down below there it’s likely that the market could continue to go much lower. From a longer-term perspective, the Euro has been falling for some time, as there are plenty of reasons to run away from the common currency.

All things being equal, the European Union is starting to head into recession, so it makes quite a bit of sense that money will flow away from the Euro itself. Beyond that, we also have a major interest rate differential between the economies, as most of the bonds in the European Union are negative yielding, while there are still positive yields in the United States. That in and of itself will cause a lot of monetary flow going forward.

While we have been in a long-term downtrend, the reality is that the move isn’t very smooth, so every time we rally, sellers come back in and signs of exhaustion should continue to be a major issue. Every time this market rallies and show signs of exhaustion, it’s likely that sellers will continue to step into this marketplace, because not only do we have a lot of issues when it comes to the European Union, but we also have a shortage of US dollars as recently shown by the Federal Reserve repo operations. Ultimately, this is a market from a technical analysis standpoint has a pretty big target attached to it.

Looking at the pair, we have broken down significantly below the 61.8% Fibonacci retracement level, and that typically will send this market down to the 100% Fibonacci retracement level. All things being equal, we also have a gap closer to the 1.07 level that has yet to be filled, so I think it’s very likely that we will see the market try to do so. There are a multitude of reasons to think that we continue to fall, so I don’t have much in the way of an opportunity to buy this pair anytime soon. If we did break above the 50 day EMA on a daily close, then we have to deal with the 1.12 level.