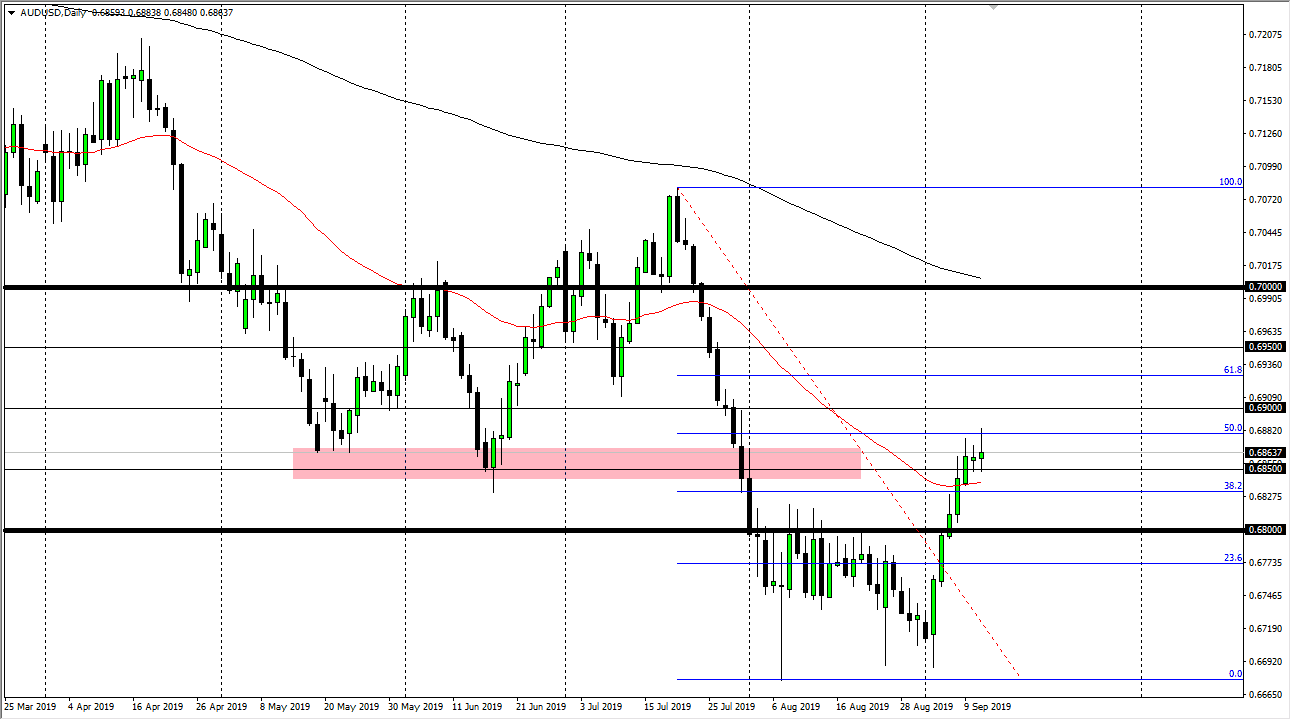

The Australian dollar went back and forth during the trading session on Wednesday, as we hover just below the 50% Fibonacci retracement level from the recent selloff. This is a market that I think will continue to find plenty of noise and therefore I think it’s likely that we will continue to see a lot of volatility.

Underneath, we have the red 50 day EMA which could offer support, so the opposite is obviously true as well, breaking through that level would be very bearish. All things being equal I think the Australian dollar is going to be held hostage to the US/China trade talks, which are a little bit more positive than negative over the last couple of days, but we’ve seen this move before and I believe that a lot of traders will be cautious about jumping all in based upon a few comments.

If we break above the top of the range for the trading session on Wednesday, that is a very bullish sign, which could send this market looking towards the 0.69 level, and then eventually the 0.6925 level which is the 61.8% Fibonacci retracement level. I am a seller of the Australian dollar and not a buyer, because I think there is quite a bit of noise out there and therefore it’s likely that it’s only a matter time before some type of negativity comes back in. After all, the move higher has been somewhat parabolic and I think at this point it’s a bit overdone. You can see the same thing about the move all the way down though, so this bounce of course makes quite a bit of sense. All things being equal I think that we probably roll over, the question is when it happens, which of course is an open-ended question.

At this point, I think that the 0.70 level is the absolute ceiling in the market, as the 200 day EMA is crashing into it. I think it’s only a matter of time before the 200 day moving average makes itself known, and longer-term traders will continue to short. If we were to break above there, it’s likely that we could go much higher but I don’t see that happening in this type of environment, unless of course the Americans and the Chinese get some type of negotiated deal.