Australian dollar showing signs of confusion.

The Australian dollar has initially tried to rally during the trading session on Friday as the 0.6750 level continues to attract a lot of attention. At this point, the market looks very like it is going to continue to be magnetized towards this level, as it is essentially “fair value” at this point. The market looks very likely to turn around every time he gets about 50 pips away from that level, and at this point I think that the market remains a very short term type focus, so it’s difficult to imagine a scenario where you can hang onto a larger position.

Quite frankly, the Australian dollar is far too levered to the Chinese economy to think that you can divorce the two from each other. Quite frankly, the Australian dollar represents Australia, which of course is a major supplier of raw materials to the Chinese mainland. As long as that’s going to be the case, then it’s very likely that the market will move right along with the US/China trade situation, and therefore as long as that’s a bit of a mess it’s unlikely that the Australian dollar will strengthen at all.

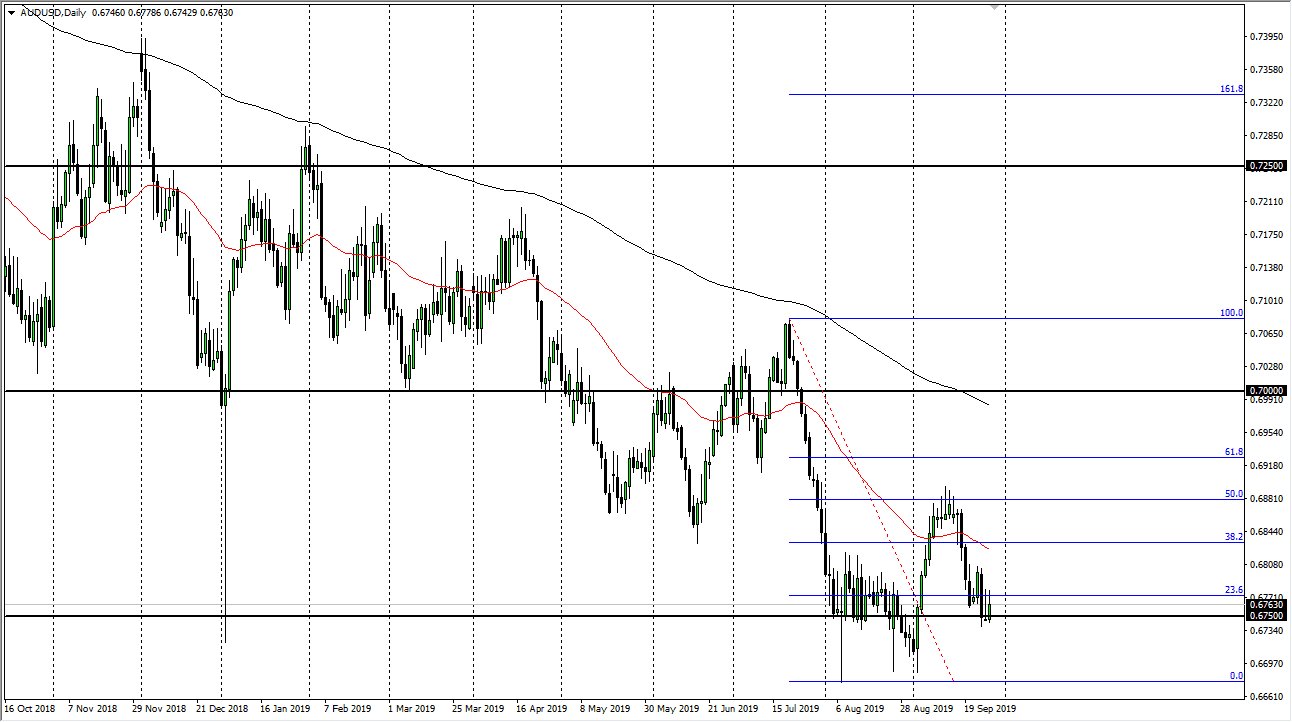

As you can see, we had recently rallied pretty significantly, but then broke down at the 50% Fibonacci retracement level. The market had formed a couple of shooting stars in a row, and then at that point the market rolled over due to exhaustion. After all, the market has ran out of steam as it had gotten a bit parabolic, especially considering that it’s against the longer-term trend. The longer-term trend obviously has been negative and until we get some type of change in the US/China situation, it’s difficult to imagine a scenario where things turn around suddenly. Beyond that, the Reserve Bank of Australia is very likely to cut rates, so that continues to put bearish pressure on this pair as well.

The US dollar of course is a safety currency, as it is a place where people will hide in times of uncertainty. The US Treasury market of course offers a safe haven and obviously it needs to be paid in US dollars, so ultimately this will continue to drive where this pair goes next. All things being equal, I think that the market continues to offer value in the US dollar every time we rally, especially in this pair.