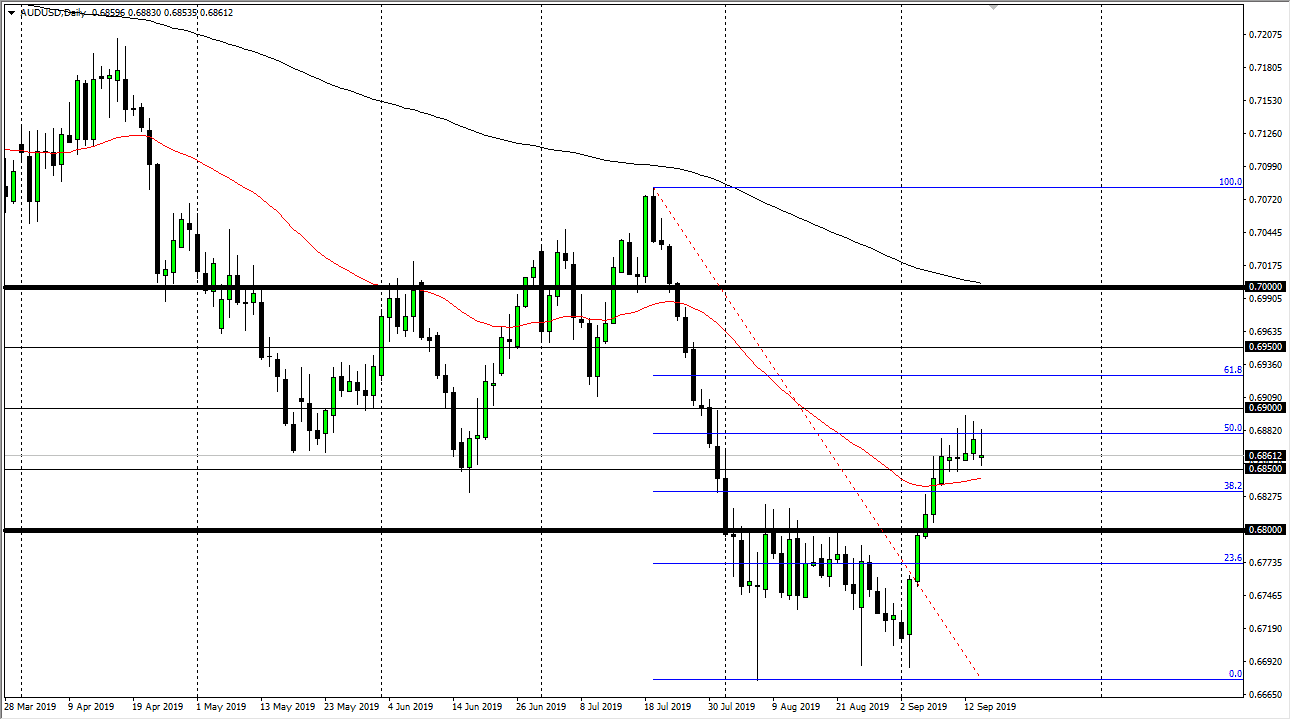

The Australian dollar has tried to rally a bit during the trading session on Monday again, but turned right back around to show signs of exhaustion and has formed a shooting star yet again. As you can see clearly, the 50% Fibonacci retracement level has caused quite a bit of trouble, and then of course above there we have the 0.69 level. All things being equal, the market should continue to roll over given enough time because we are in a huge “risk off environment.”

Looking at this chart, if we can break down below the 50 day EMA it’s likely that we could then go down to the 0.68 handle which was previous resistance and should now be supportive. Beyond that, it is a large, round, psychologically significant figure, so therefore it should attract a certain amount of attention anyway. If we slice through there then we could start looking at the absolute lows that we had recently had. Remember, the 50% Fibonacci retracement level typically finds a lot of volume flow at it, and the fact that the Australian dollar is a risk as said, it makes sense that we are going to continue to struggle overall.

That being said, if we were to break above the 0.69 level, then we could go looking towards the 0.6950 level, possibly the 0.70 level after that. All things being equal though, the pair is far too exposed to the US/China trade situation and therefore as we don’t have much in the way of clarity with that situation, it makes sense that this pair would eventually fall.

The pair has been somewhat parabolic as of late, so therefore exhaustion makes quite a bit of sense but if you are to look at the last four or five candles, you can see that they all have exhaustion in them. Because of this I fully anticipate that the market will break down a bit, but if we did break to the upside that could of course be very strong. Remember, the US dollar strengthens in times of concern because people by US Treasuries. We have seen a strong uptrend in the overall, but recently we’ve seen a bit of a pullback which coincides quite nicely with the Australian dollar strengthening. I do believe that it’s only a matter of time before that turns around, and I think breaking below the 50 day EMA is your first clue.