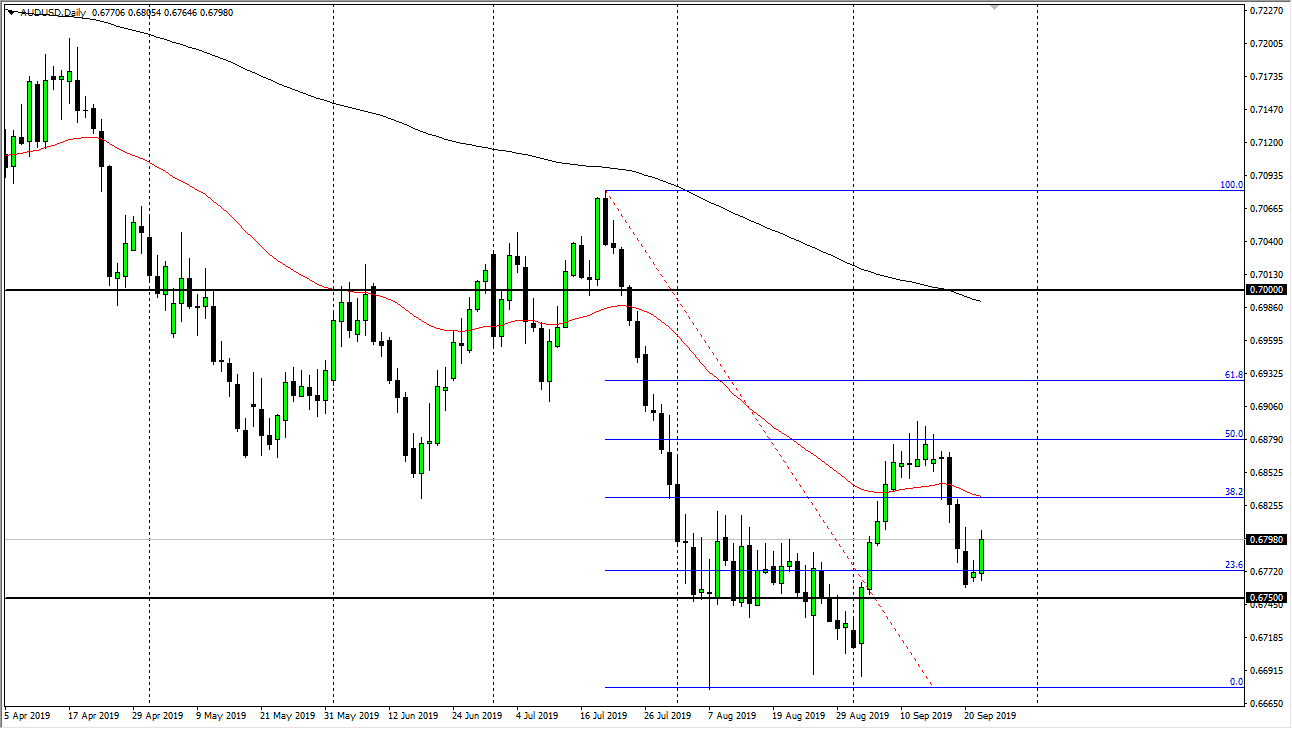

The Australian dollar rallied a bit during the trading session on Tuesday, breaking towards the 0.68 level. At this point in time I think that the 50 day EMA above continues to be important, which is painted in red on the chart. Any signs of exhaustion could be thought of as a selling opportunity, as we have been in a major downtrend for quite some time. The 50% Fibonacci retracement level has offered a lot of resistance after the initial pop higher, and it’s likely that will continue to be the case.

The Australian dollar is obviously very negative at this point in time, as the US/China situation continues only get worse, and with that being the case the Aussie will get hammered as Australia is so sensitive to the Chinese economy. Given enough time, it’s very likely that this pair will probably reach towards the low, but it isn’t necessarily going to be easy either. That being said, if we were to break above the recent cluster at the 50% Fibonacci retracement level, then we could go looking towards the 200 day EMA above which is closer to the 0.70 level.

The Aussie is not being lifted by the gold market overall, so this is clearly influenced by the Chinese situation more than anything else, and of course the global risk appetite. The global growth story is starting to slow down as well, so keep in mind that also will wear upon the Aussie. The US dollar continues to attract a lot of money as people jump into the US Treasury markets, giving a boost to the greenback in general. At this point in time, I believe that we continue to find exhaustion as an opportunity to start selling yet again, and although I do think we go to the lows, it’s very likely that we continue to see more back-and-forth with a slightly negative slant than anything else.

In other words, I’m bearish but I don’t necessarily want to jump into this pair with both feet, because it just doesn’t seem to have a significant amount of momentum in one direction or the other. You can see that it’s been parabolic and back and forth in both directions, but at the end of the day, we haven’t seen the lot of clarity so looking for extremes to short or buy probably remains the only possibility.