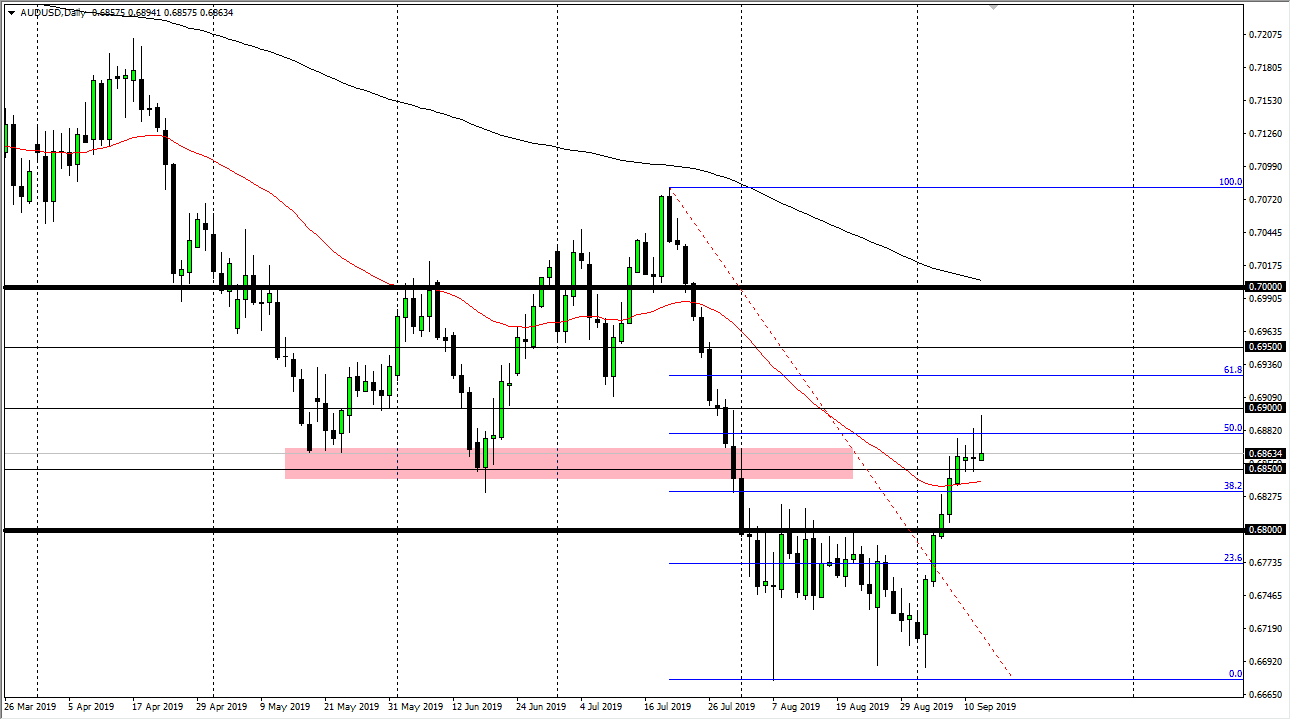

The Aussie dollar tried to rally again during the trading session on Thursday but found resistance at the 50% Fibonacci retracement level as well, and now it looks as if we are running out of momentum. With that being the case I think that we are getting ready to roll over as the Aussie dollar is a proxy for the US/China trade relations. That is of course is a situation that although better, is still miles away from some type of finalization.

This is a shooting star yet again, as we have formed a couple of them now. At this point, if we break down below the 0.6850 level is very likely that we will continue to see a lot of negativity and perhaps a move back down to the 0.68 handle. I don’t like owning the Aussie dollar right now, and although we have seen quite a bit of bullish pressure of the last couple of weeks, we are starting to run out of momentum and that typically is a sign that we are going to roll over quite significantly. The 50% Fibonacci retracement level of course is an area that a lot of traders pay attention to, and the fact that we pulled back there tells me that there is still a lot of sellers interested in this market.

If we did break above the top of the shooting star and by extension the 0.69 level, then the market goes looking towards the 0.70 level after that which is not only a large, round, psychologically significant figure, but also the scene of a 200 day EMA. All things being equal, I have no interest in buying this pair for a move until the United States and China come together with some type of an agreement. Beyond that, there’s also concerns about the Australian economy and housing situation which looks as if the bubble is starting to pop as well. Ultimately, this is a market that continues to show severe vulnerability, and therefore I still believe that it’s only a matter time before we get a massive “flush lower.” The lows could be attacked again, and if we get enough negativity out of the Americans and the Chinese, it will be very quick. Otherwise, we will continue to see a lot of this choppy nonsense going forward with a real fear of negativity.