The Australian dollar initially tried to rally during the day on Thursday but has sold off later in the day as we continue to see a lot of noise in general. We are close to an area that has been very crucial for traders in both directions. That being the case, it’s very likely that we are going to continue to see a lot of choppy and noisy trading. Ultimately, the Australian dollar is going to be very sensitive to the Chinese situation which seems to be deteriorating over the longer-term. The Aussie dollar is representative of China itself as Australia has so much to do with supplying China with its raw materials needed for construction and manufacturing.

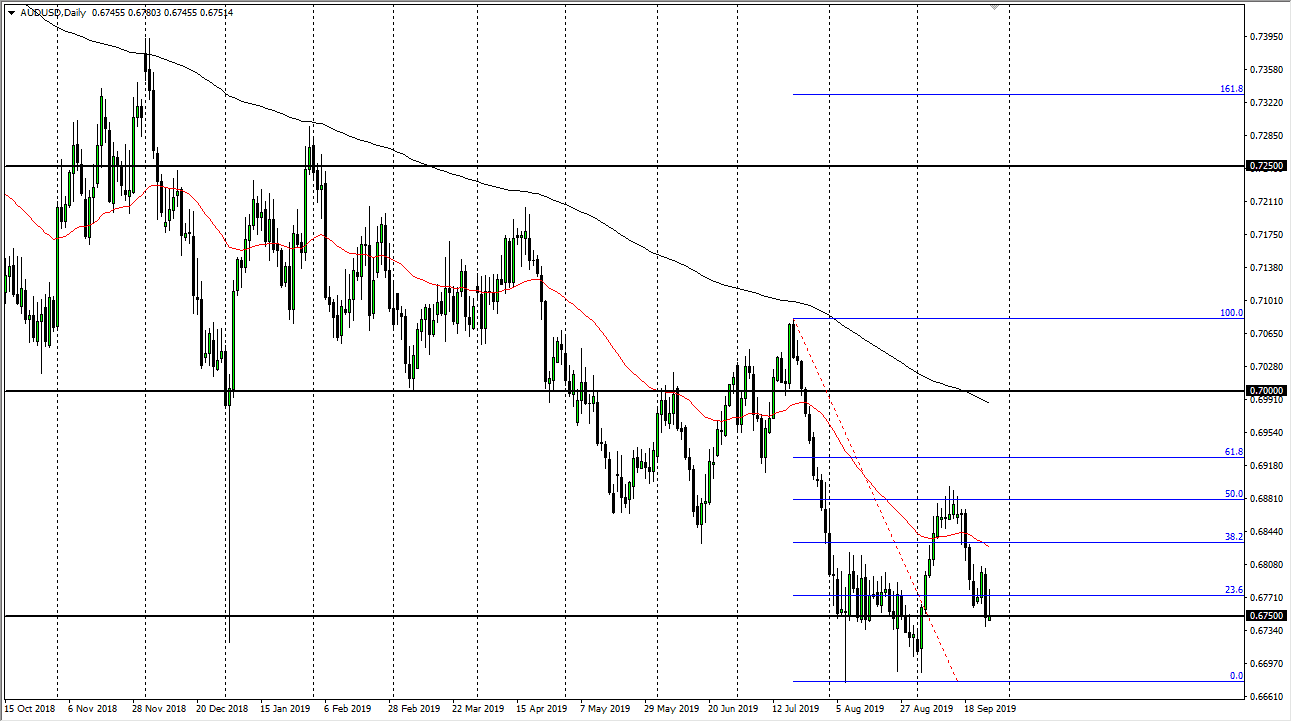

The daily candle stick of course looks very soft, so I do think that we will probably reach towards the lows again but there is a significant amount of noise between here and there that will continue to cause issues as well. I believe the easiest way to trade this market is to simply fade rallies, especially at the 50 day EMA which is painted in red on the chart. Above there, we have the 50% Fibonacci retracement level near the 0.69 level, so it’s very likely that we continue to see a lot of noise in this vicinity as well.

I don’t have any interest in buying the Australian dollar but would prefer to sell short-term rallies every time we run into a bit of trouble. To the downside, the 0.67 level is support as it was the lows a couple of times already, so it’s very likely that we will see the area tested again, but if we can break down through there then it’s likely that the market goes down to the 0.65 handle. This would more than likely be in reaction to a deterioration of the Chinese economy or perhaps even more likely: the US/China trade situation.

The alternate scenario of course is that the market were to break above the 50% Fibonacci retracement level which would open up the door to the 200 day EMA closer to the 0.70 USD level. That’s an area that is a large, round, psychologically significant figure, so it would make quite a bit of sense to see market participants jump in there and start shorting as well. Expect a lot of choppy and volatile trading, but I still think that selling is going to be much easier than buying.