The Australian dollar is likely to find a lot of noise during the trading session on Wednesday as traders come to grips with whatever decision the Federal Reserve makes. While it is widely expected that the Federal Reserve cut rates by 25 bps, the real action will be with the statement and of course the press conference afterwards.

The Federal Reserve will more than likely find reason to sound dovish, but the question is exactly how dovish? If they are overly dovish, you may see a little bit of a bounce in the Australian dollar but at the end of the day it’s very difficult to imagine a scenario where the Australian dollar continues to go higher for the long term, as we have a lot of moving pieces out there that would cause issues for the Aussies. After all, they are highly levered to the US/China trade situation, and of course it’s very unlikely that the situation gets demonstrably better in the short term. Yes, the Americans and the Chinese are starting to talk to each other a little nicer, but at the end of the day the issues that they face are structural.

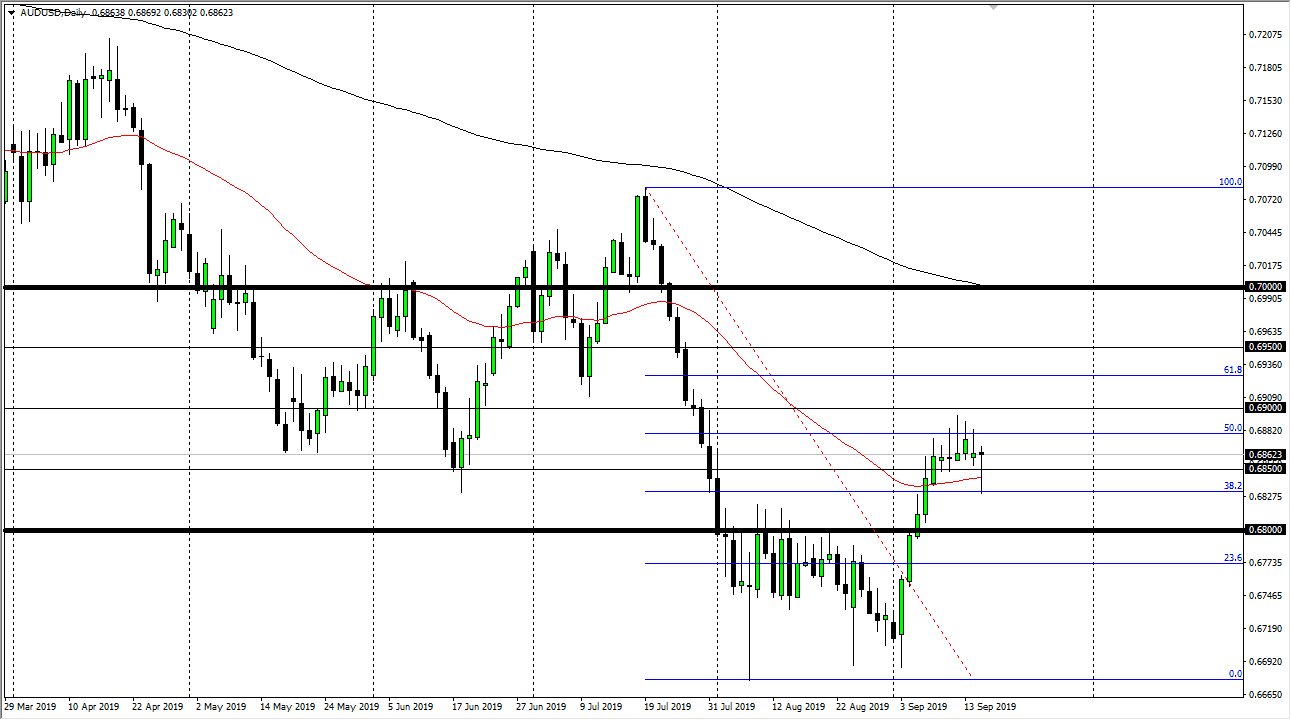

The candle stick for the trading session on Tuesday did end up turning things around to form a hammer, which of course is bullish but I think at this point it’s probably a lot of short covering ahead of the Federal Reserve announcement. The 50 day EMA underneath is massive from a technical analysis standpoint so that does offer a bit of support in the short term. The shooting star from last week tried to touch the 0.69 level, so I think at this point that’s probably the top. Either way, I like the idea of fading any rally that we get, even if it breaks through that level. I believe that the 0.72 level will be massive resistance as it is also the scene of the 200 day EMA. All things being equal, I’m looking for signs of weakness to take advantage of. I don’t necessarily think that we melt down, it’s just that the Aussie has no reason to strengthen for a significant move anytime soon. All things being equal it’s going to be a very noisy market, and therefore I believe that rallies are to be faded, but if we don’t get that then it’s going to be a lot of short-term back and forth.