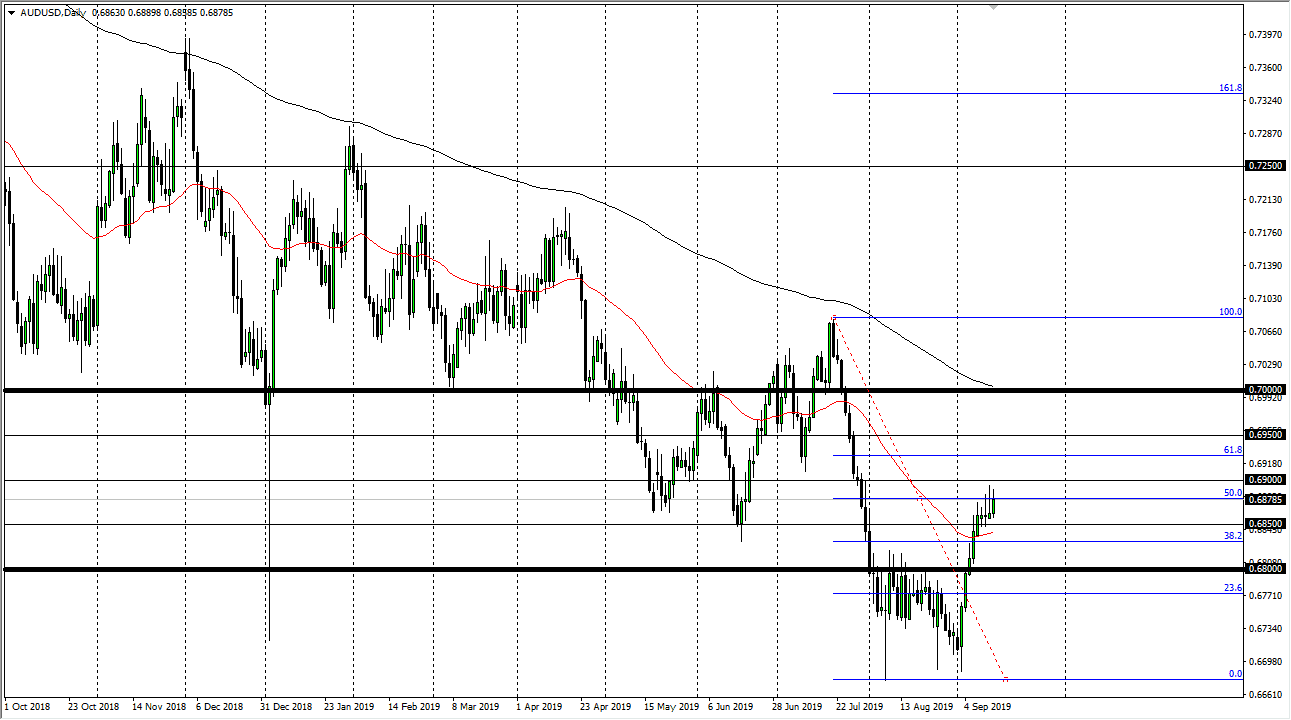

The Australian dollar rallied a bit during the trading session on Friday, and unlike the last couple of days managed to hang onto signs of the gains. That being said though, the shooting star from the Thursday session right at the 50% Fibonacci retracement level. That being the case, it’s likely to see a lot of resistance in this general vicinity since there is so much in the way of noise.

All things being equal it looks very likely that we are going to continue to see volatility in the Australian dollar as the Aussie dollar is so unfortunately attached to the Chinese economy. With the US/China trade situation being what it is, it’s very likely that we continue to see a lot of concern. The 50 day EMA is underneath so that does help, so a break above the top of the shooting star would signify that we have more momentum coming into the market to send it much higher. At that point, the market then goes to the 61.8% Fibonacci retracement level. At that point, it’s very likely that we are going to see sellers, and a break above there could open up the markets to reach towards the 0.70 level. The 200 day EMA above should offer plenty of resistance as well, so I think that even if we do get a nice move to the upside it’s going to be somewhat limited.

Any signs of crumbling of the US/China trade situation will send this market lower, as Australia exports its raw commodities hand over fist to the Chinese. As the Chinese economy continues to struggle a bit, it’s very likely that the Aussie will as well. Beyond that we also have a housing crisis in Australia just waiting to flareup, as the bubble gets pop. To the downside, it’s very likely that the 0.68 level could offer a bit of support, but beyond their we could go down to the lower levels that were tested recently. The move higher has been a bit parabolic so the very least you can make an argument for a market that is running out of steam and should pull back. With that being the case, the US dollar has been strengthening longer-term due to the bond market, and that could come back into play at the first signs of trouble globally. One thing you can count on here is a lot of choppiness.