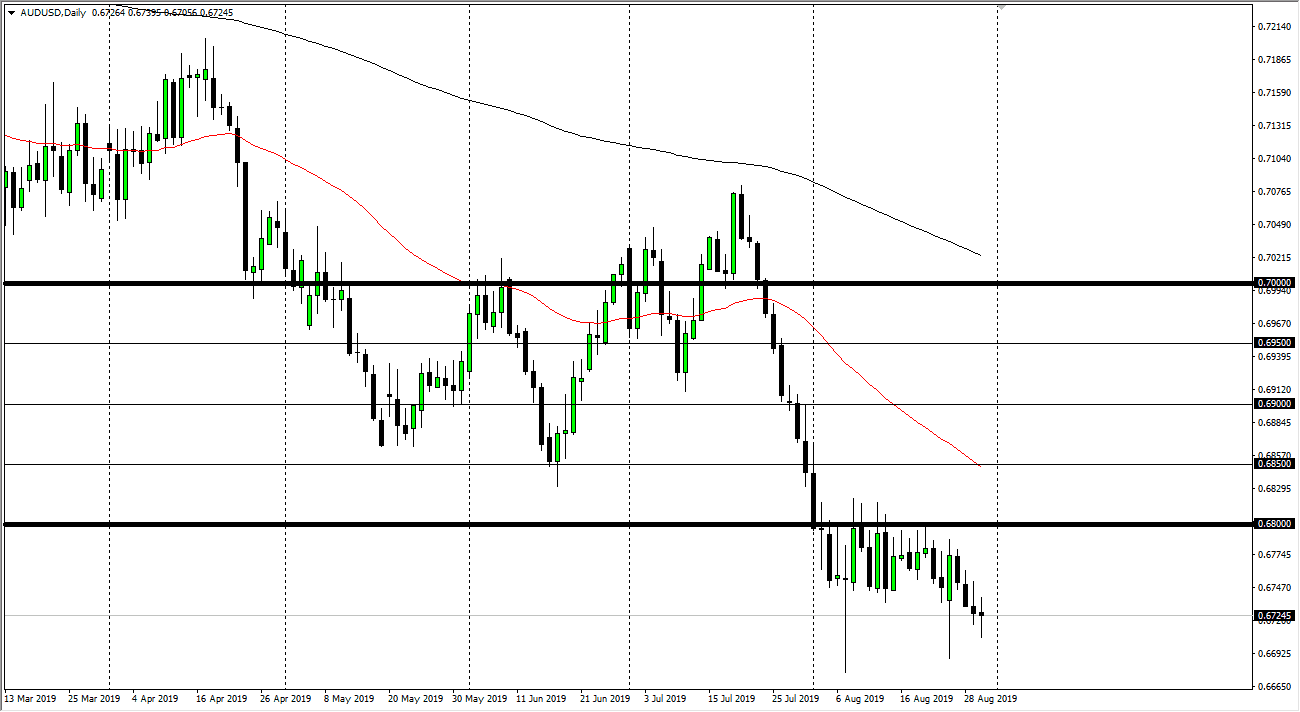

The Australian dollar has recovered quite nicely during the trading session after initially breaking down on Friday, as we have reached below the 0.67 level at one point. Having said that, I think that the market continues to find quite a bit of resistance above though, so I think rallies are to be faded. Ultimately, the Australian dollar is highly levered to the US/China trade relations and that of course is an absolute mess. Even though the Americans and the Chinese seem to be calming down a bit, I think it’s only a matter time before something flares up yet again. Even if we are starting to play nice at this point, the reality is that it’s very unlikely we will come with some type of agreement anytime soon. Because of this, one would have to think that there is still a lot of risk to the downside.

Above current levels, the 50 day EMA just crossed below the 0.65 zero level, and therefore I think it is going to make a beeline down to the 0.68 level as well. Once the market rallies back into that area and then fails again, I think longer-term traders are going to continue to short this market. The alternate scenario of course is that the market breaks above there in continue to go higher but at this point I think it’s only a matter of time before one of the next 50 pip lines causes problems and we start selling off again. Ultimately, I’m looking at the signs of exhaustion as an opportunity to sell. I think ultimately it’s good to be very difficult to buy this market until of course we get some type of trade deal. It’s not going to happen anytime soon, perhaps not ever at this point. I think one thing is for sure, this is very unlikely to happen in the short term and that’s really all we can focus on at this point. The Thursday candle stick looks very week, while the Friday candlestick looks very supported. With that being the case I think it’s only a matter time before the sellers come back and that’s the way I’m going to have to pay attention to this market. I look at this rally as a potential opportunity, and will probably drop down to the hourly chart to start selling again.