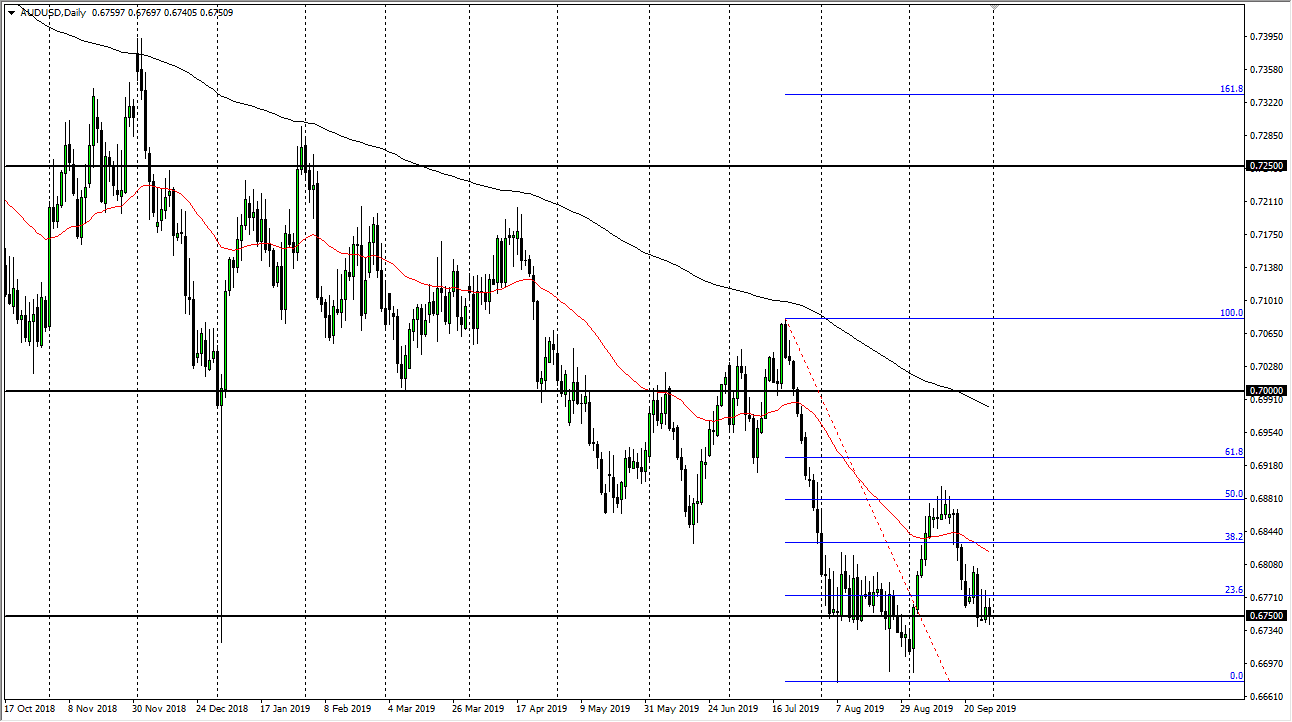

The Australian dollar went back and forth during the trading session on Monday, reaching towards the 0.6750 level. This is a market that has been magnetic when it comes to this level, so it’s not a huge surprise to find ourselves there again. At this point, I believe that the market is going to continue to go back and forth and simply tread water at this level. Overall, this is a market that is being held hostage to the US/China trade relations, and of course that talks coming up on the 11th. Between now and then I would expect very little out of this pair, but short-term scalpers may be attracted to it.

All of that being said, the technical analysis is very bearish overall, with the 50 day EMA turning lower and reaching towards current trading. If that’s going to be the case, sooner or later longer-term traders will start to sell as well. At that point I would anticipate that the market may try to make a move towards the 0.67 handle underneath which was the recent low. Whether or not we can break down below there might be a completely different question, but at this point it certainly looks as if it would favor of move lower than higher. Obviously, after the meeting between the Americans and the Chinese there could be a massive shift in sentiment, but I don’t anticipate that being the way things play out.

The market simply have nowhere to be between now and then, so you should keep that in mind. Longer-term, the 50% Fibonacci retracement level at the 0.69 level has offered significant resistance and I think that will continue to be the case going forward because of that I believe that the market will continue to fade rallies, but I would expect major meltdowns. Overall, the market has been grinding in about a 50 pip range between 0.6750 and 0.68 over the last couple of days, just as it did back in July and August. I expect a return to “dead money” in that range, which is great for short-term scalpers, but anybody looking for a bigger move than a bounce around in that 50 pip range is probably going to find this market a waste of their time. At this point, it just comes down to your timeframe more than anything else in this market.