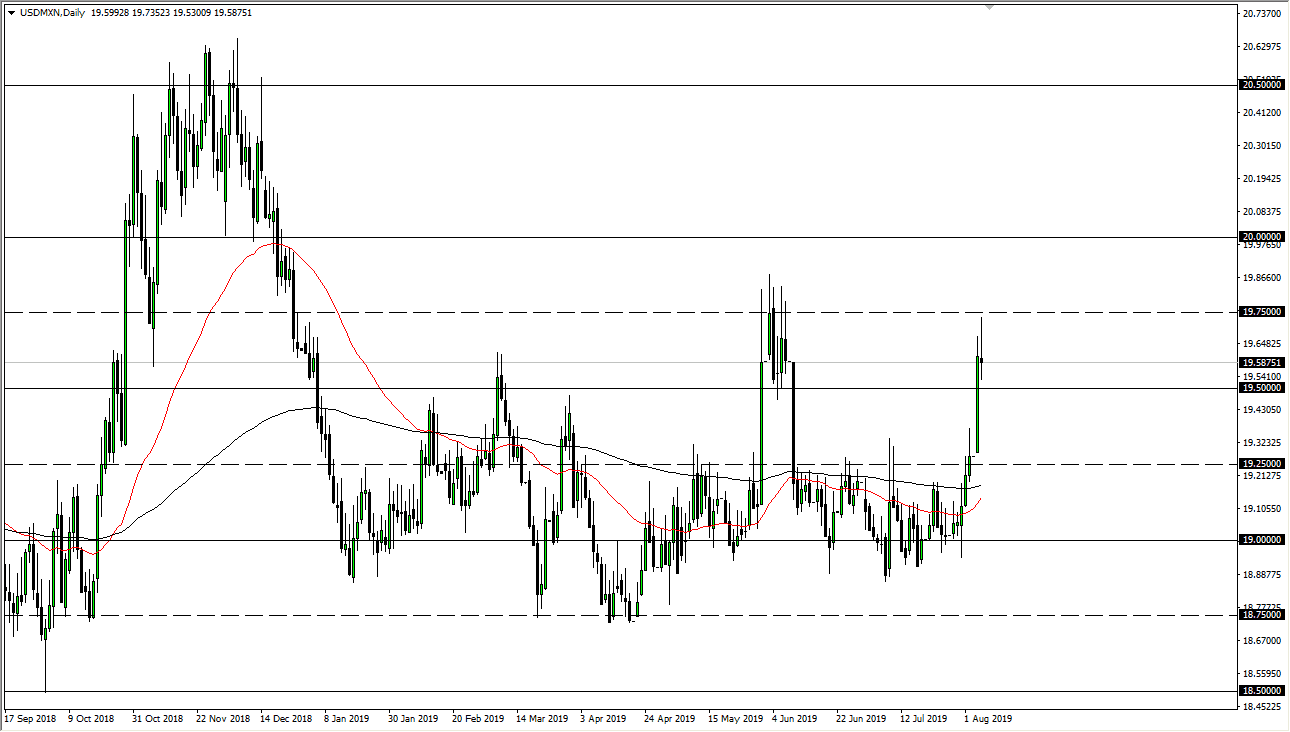

The US dollar has been very volatile against the Mexican peso over the last 24 hours, as we had reached towards the 19.75 pesos level before pulling back. At this point, the market is forming a bit of a shooting star and it looks very likely that we are going to continue to see the overall consolidation area as continuing. If we break down below the shooting star for the trading session on Tuesday, it opens up an attempt on the 19.50 MXN level. If we can break down through that level, it’s likely that we could pick up another move towards the 19.25 MXN level.

Looking at the chart it’s obvious that we are a bit overbought, as we have been a bit parabolic over the last couple of days. That of course suggests that at the very least we need some type of pullback to get back to the realm of normalcy. Beyond that, we should also keep in mind that this is a bit of a proxy for crude oil, moving in an opposite direction. For example, if crude oil rallies it is typically good for the Mexican peso in general. Obviously, as crude oil has gotten absolutely hammered of the last couple of days, we have turned around in this pair reaching towards that crucial 19.75 MXN level that was the most recent barrier.

If we can break above that area, then it’s very likely we go looking towards 20 pesos. However, the candle stick does suggest that we are getting a bit exhausted, and that we could stay in the same consolidation area that we been in for a while. I loosely defined that as 18.75 MXN on the bottom to the 19.75 MXN level on the top. That suggests that “fair value” is probably closer to the 19.25 MXN level. That would be a complete wipeout of the impulsive candle stick from the trading session on Monday, which is a pretty significant move, probably taking several days as the market typically isn’t quite that impulsive when it comes to this pair. Remember, you should also keep in mind the time of day which you are trading as most volume of course will be done during north American trading. All things in equal though, it certainly looks as if a pullback is waiting to happen and more than likely.