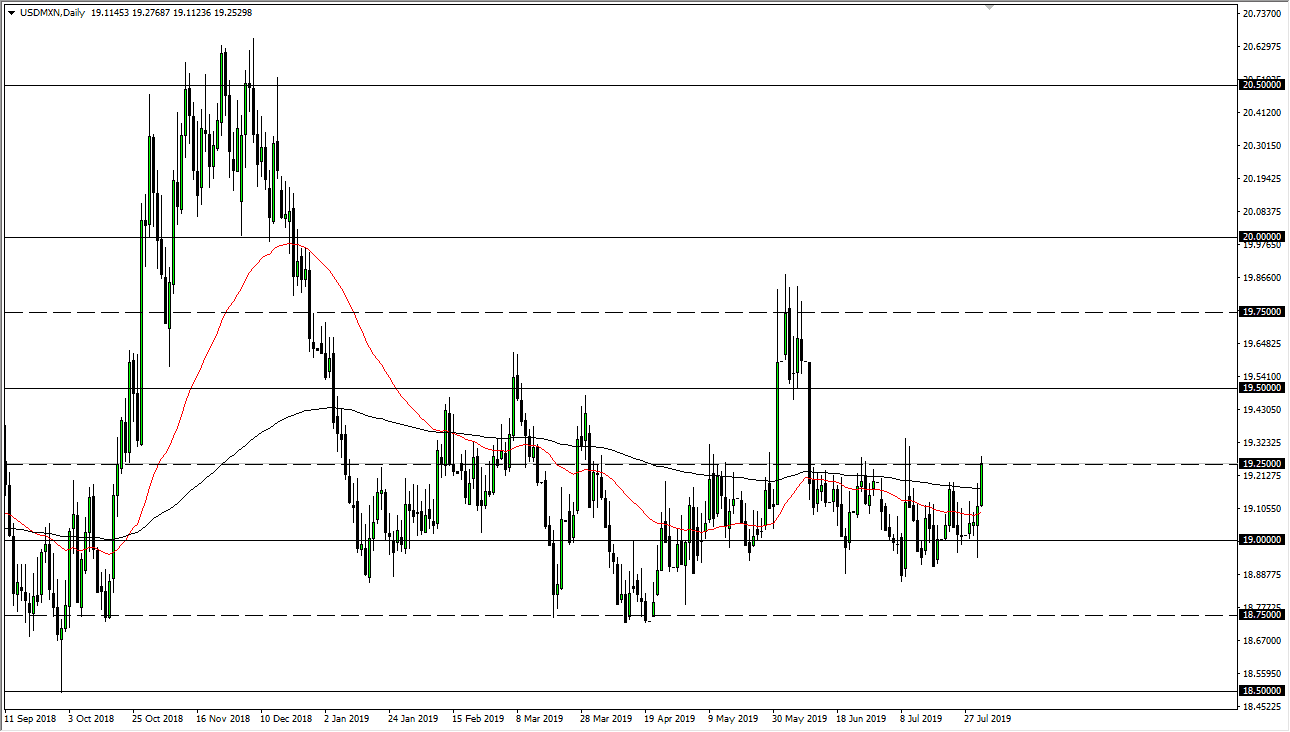

The US dollar has rallied a bit during the trading session on Thursday, reaching towards the 19.25 pesos level. This is an area that has been massive resistance as of late and as we head into the jobs number on Friday, it looks very likely to break to the upside. At this point, it’s only a matter of time before the market moves in one direction or the other, and it is starting to look very much like it’s the upside that we will favor.

Looking at the structure over the last couple of days, you can see that we certainly have been pressing the issue, and don’t look very likely to break down anytime soon. With that, I think there is a bit of a rush to safety, and therefore it makes sense that the US dollar would gain against currency such as the Mexican peso, being an emerging market.

Jobs number

With the jobs number coming out on Friday there will be a lot of volatility when it comes to the US dollar, and when you are talking about exotic currencies it does tend to move the even further. With this, it looks like the US dollar is strengthening, which makes a significant amount of sense as the Federal Reserve cut rates but not as drastically as people had anticipated or even wanted. This has had people looking into the US dollar as it should continue to be relatively strong, and as we have gained against other currencies, the Mexican peso won’t be any different.

Technical analysis

The technical analysis for this pair looks very likely to continue to favor the upside, as although we have recently been in a consolidation area, it’s very likely that we will continue to see interest near the 19 pesos level. I look at that as the short-term “floor” in the market, and therefore would be a bit surprised if we break down below there.

The 50 and the 200 day EMA both look very flat, so that suggests to me that we aren’t quite ready to go anywhere, so therefore we are certainly waiting for some type of catalyst to get moving. I think it will be found in the jobs number, and if the jobs number is relatively strong that could have people concerned about whether or not the Federal Reserve will continue to loosen monetary policy. If they look likely to keep it somewhat tight, then it makes sense that the US dollar will strengthen.

At this point, if we can break above the 19.25 pesos level then it’s very likely that we will go looking towards the 19.50 pesos level. Underneath, if we were to break down below the 19 pesos level would be extraordinarily negative, at least to this pair but it would also signify that there is more of a “risk on” move. I believe that we have gone back to the perverse “bad news is good news” situation when it comes to risk appetite.