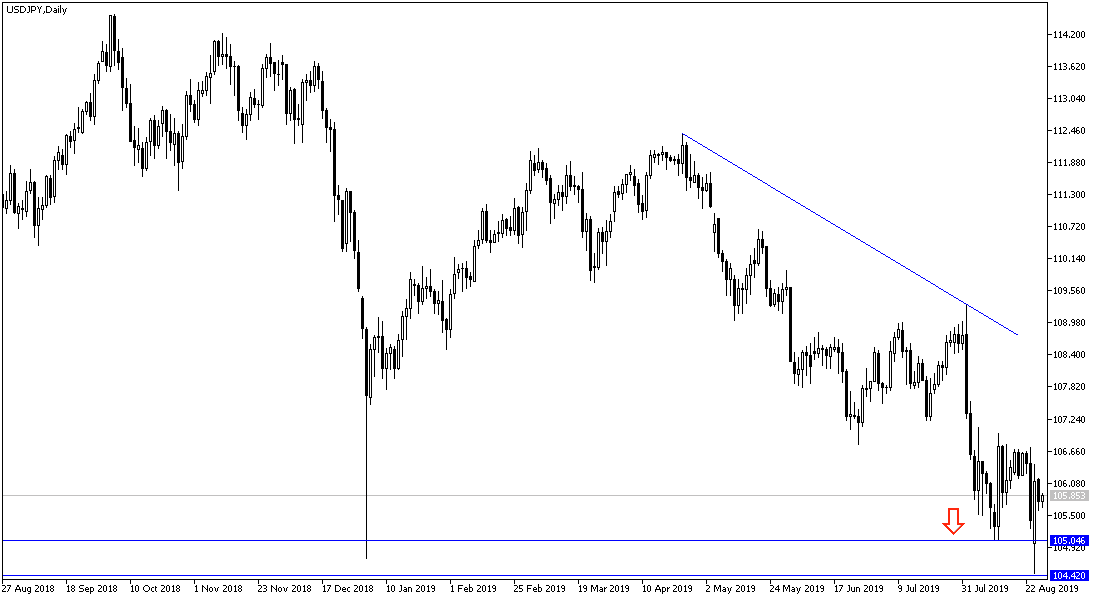

Bearish pressure on USD/JPY remains intact and testing the 104.44 support at the beginning of this week, the lowest in 32 months, has consolidated the strength of the general trend. The pair is stable around 105.80 at the time of writing, and has not been much affected by the continued strength of US consumer confidence nor after Trump's recent tweets calling for a truce and the possibility of negotiating with China and postponing tariffs. Trump has often promised a truce and eventually makes trade sanctions even at the time of negotiations between the two sides. The pair will not have a stronger chance of upward correction without investors taking risks and abandoning safe havens. This may only happen if they reached terms of agreement to end the trade dispute between them, which threaten the future of global economic growth as a whole.

The U.S. dollar has been negatively affected by recent signals from the Federal Reserve Bank led by Jerome Powell, as the Bank remains firm in its position to monitor economic developments and external risks to determine appropriate monetary policy amid total disregard for Donald Trump's recent criticism, calling for a full percentage point cut to help his economic plans succeed. The minutes of the latest meeting of the US central bank showed a split among members of the bank's policy on the timing and amount of interest rate cuts and from those who demanded no cut rats at present as the US economic performance remains good.

According to the technical analysis: USD / JPY attempts for an upward correction are still weak with continued investor fears, and therefore investors’ appetite to buy the Japanese yen as one of the most important safe havens. And as we expected in the latest technical analysis, and confirm now; if the price moves around and below the 105.00 psychological support level, It may test new record support levels, the closest now are 105.35, 104.80 and 103.65, respectively. With an upward correction, the closest resistance levels will be at 106.25, 107.00 and 107.85 respectively. Technical indicators have reached strong oversold areas but investors are still unwilling to take risks now.

As for today's economic data, the pair is not expecting any significant economic data from Japan or the US.