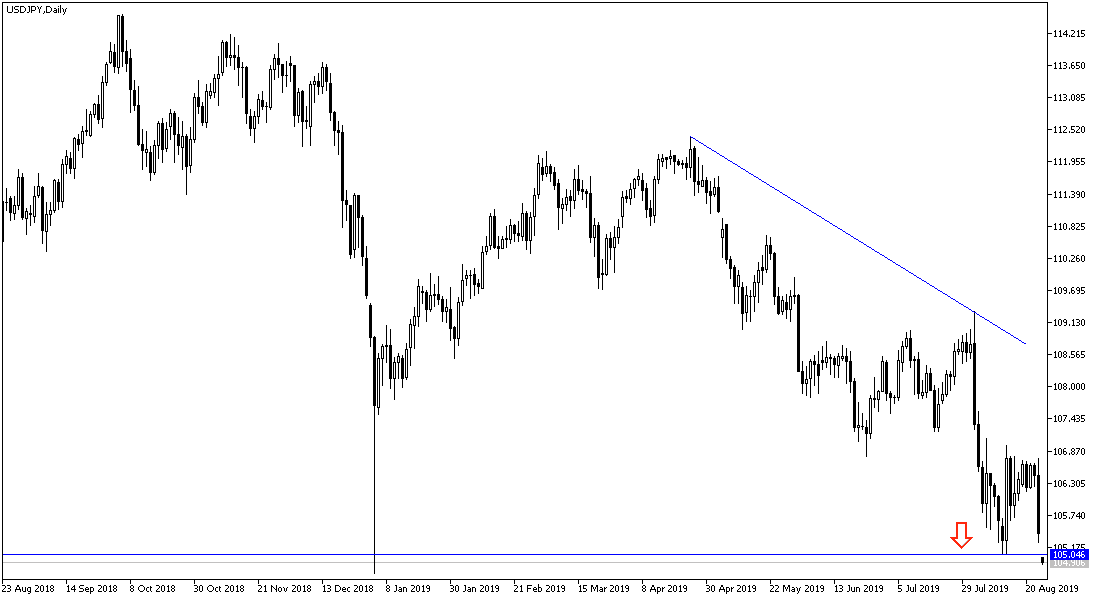

In the latest USD/JPY technical analysis, we noted that the failure of the pair to penetrate above 106.70 formed a consolidation area foreshadowing the next strong move, which is closest to the downtrend, and has already occurred at the beginning of this week, where it formed a bearish price gap that pushed towards the 104.44 support level, the 32-month low, before settling around 105.35 at the time of writing the analysis. The pair's losses have increased amid strong investor appetite for safe havens led by the Yen, amid mounting global trade and geopolitical tensions, most recently by China imposing retaliatory tariffs on US products worth 75 billion dollars at the end of last week. The immediate response from the US administration was to impose new tariffs on China imports. Prior to that, the pressure on the dollar increased mainly after the comments of the Federal Reserve Governor Jerome Powell at the Jackson Hole symposium, in which he stressed the Bank's adherence to monitoring economic developments and external risks to determine the appropriate monetary policy amid total disregard of Trump's recent criticism and his demand to reduce US interest rates continuously for his economic plans to succeed, in order to revive the country's economy.

According to Jerome Powell's remarks and the minutes of the recent meeting of the US central bank, the future of the bank's policy depends on economic developments and increasing external risks represented by the consequences of the global trade war. Concerns eased slightly after Chinese Vice Premier Wen Jiabao's remarks this morning that Beijing is willing to negotiate quietly with the United States and that it does not want to escalate matters further than the current situation. The official is China's top negotiator with the US in talks to resolve their trade dispute.

Technically, the bearishness of the USD/JPY pair has been confirmed by the move below the 105.00 psychological support, and after the bearish price gap today, the closest support levels will be 104.45, 103.90 and 103.00 respectively. With a correction higher, the nearest resistance levels to the pair will be 105.85, 106.60 and 108.00, respectively. As mentioned before, we now confirm that the pair's bullish correction will not strengthen without moving towards the 110 psychological top.

As for the economic data today: the economic calendar today has no important Japanese economic data. The focus will be on the release of durable goods orders numbers from the United States.