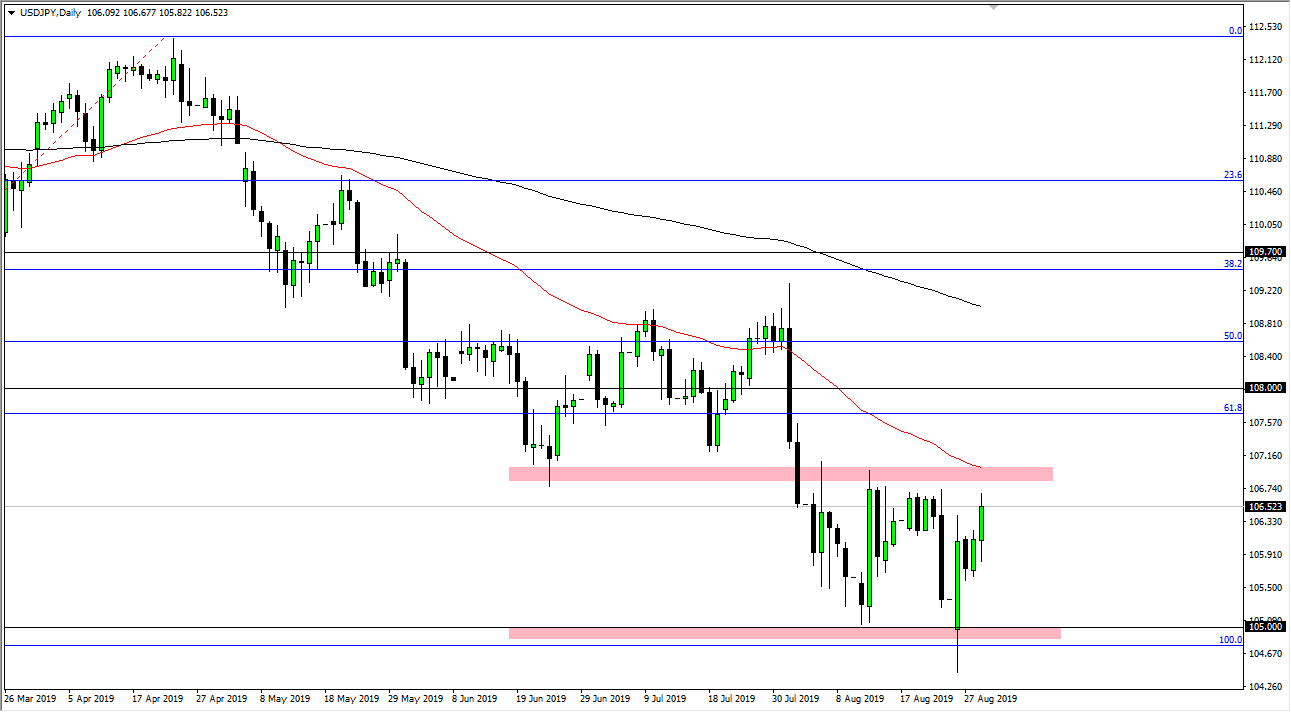

The US dollar has rallied significantly after falling against the Japanese yen on Thursday due to headlines suggesting that the Chinese weren’t going to retaliate against the Americans and the tariff war. At this point, it’s likely that the market will eventually see that this is just more smoke and mirrors, because nothing’s changed. With that, I don’t see the structure breaking down and I do think that the US dollar will continue to see quite a bit of resistance above at the ¥107 level, and of course the 50 day EMA is sitting right at that level. At this point, I think it’s only a matter of time before the sellers get involved as we approach that, assuming that we even get that far.

Remember that the Japanese yen is obviously a safety currency, so therefore it makes quite a bit of sense that if we get any type of negative news whatsoever that we will see this market roll over and start heading south again. To the bottom I think that the ¥105 level should be the bottom of the market and very supportive in the short term. Having said that, if we do break down from there it’s likely that we will continue to see the market drift down to the ¥102.50 level, and then possibly the 100 young level.

We have seen the US dollar failed to rally against the Japanese yen time and time again, and certainly hasn’t held onto the gains. All one has to do is look back a couple of weeks to see a very large impulsive candle stick that has been wiped out. We are getting close to the top of that candlestick where the sellers came back in as well, and that’s another reason to sell again.

That being said, of course the alternate scenario is that if we were to break above the 50 day EMA, then it’s likely that the market could continue going higher but we need to see a lot of really good news for that to happen. All things being equal, I think that it’s only a matter of time before Japanese yen strength continues, as it has been the favorite currency for quite some time. We have light volume going into the month of September, so don’t be surprised at all to see this market chop around.