The US dollar has been rising against the Canadian dollar over the last month or so, reaching towards higher levels in what has been very choppy trading action. At this point though, there are a lot of different moving parts that could continue to affect where this market goes next.

Keep in mind that the Canadian dollar is highly sensitive to the oil market, and the oil markets currently look horrible. As long as oil continues to fall in value it’s likely that the Canadian dollar will as well, propelling this market higher. Ultimately, the US dollar is a safe haven and therefore I think it will continue to catch a bit, especially against commodity currencies like the Canadian dollar. However, we are starting to run into a bit of exhaustion so I think short-term pullbacks are very likely. Those short-term pullbacks should be opportunities for traders to take advantage of the trend, as the market looks like it is ready to go reaching towards the 1.35 level above.

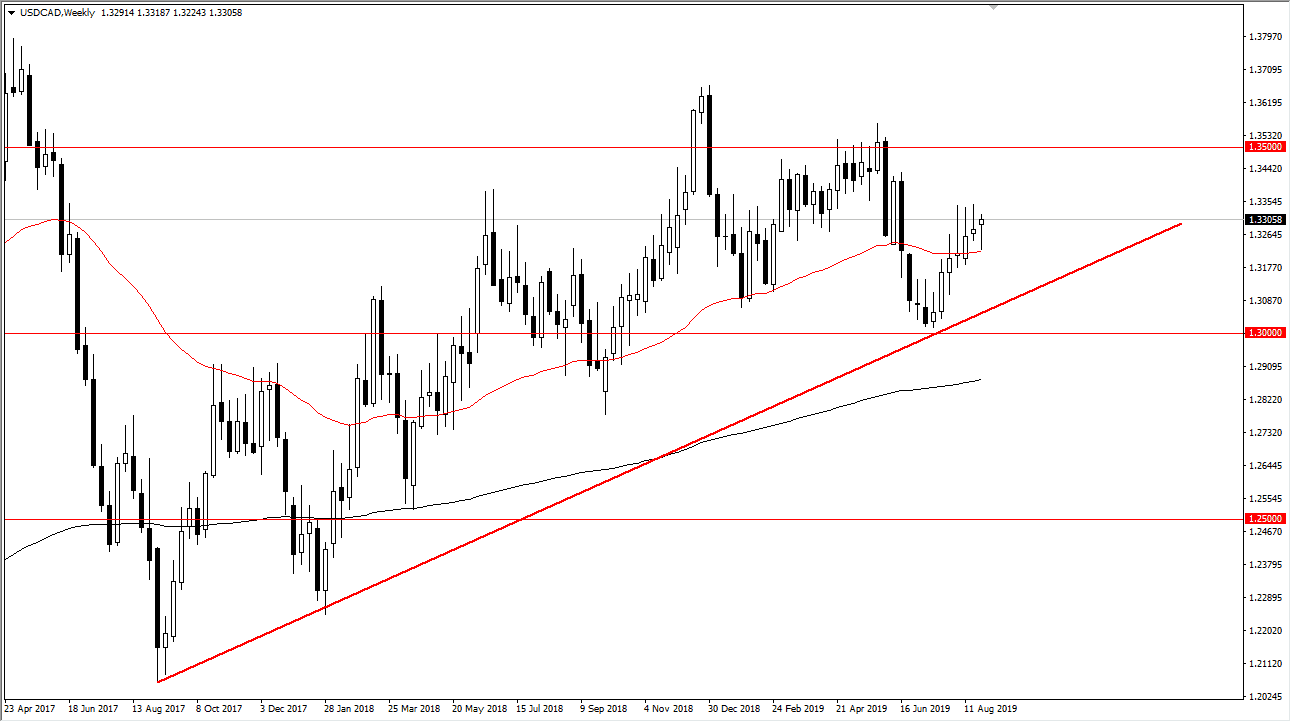

To the downside, the trend line should continue to offer support, and it should also be noted that the 50 week EMA has been reactive as well. In fact, you can see that it has offered support and resistance several times over the last couple of years. It’s not until we break down below the uptrend line that I would be interested in shorting this market, and even then you may have to see the market break below the 1.30 CAD level to start shorting for a longer-term move. In the short term I like the idea of buying these dips that will occasionally occur so that we can reach for value.

I don’t know that we can break above the 1.35 handle, but if we did that could be the next leg higher. I think this market is probably more likely going to be very choppy, so at this point I wouldn't expect much in the way of huge moves. However, I like the idea of picking up that value and placing small trades every time we dip a few handles. It is not until the oil market picks up that the Canadian dollar will strengthen significantly against the greenback. Ultimately, this market will be very noisy but that’s nothing new for this pair. It tends to be more of an investment than a short-term type of scalping market. I remain a buyer through the month. If economic conditions continue to deteriorate, I’m a buyer of even bigger positions.