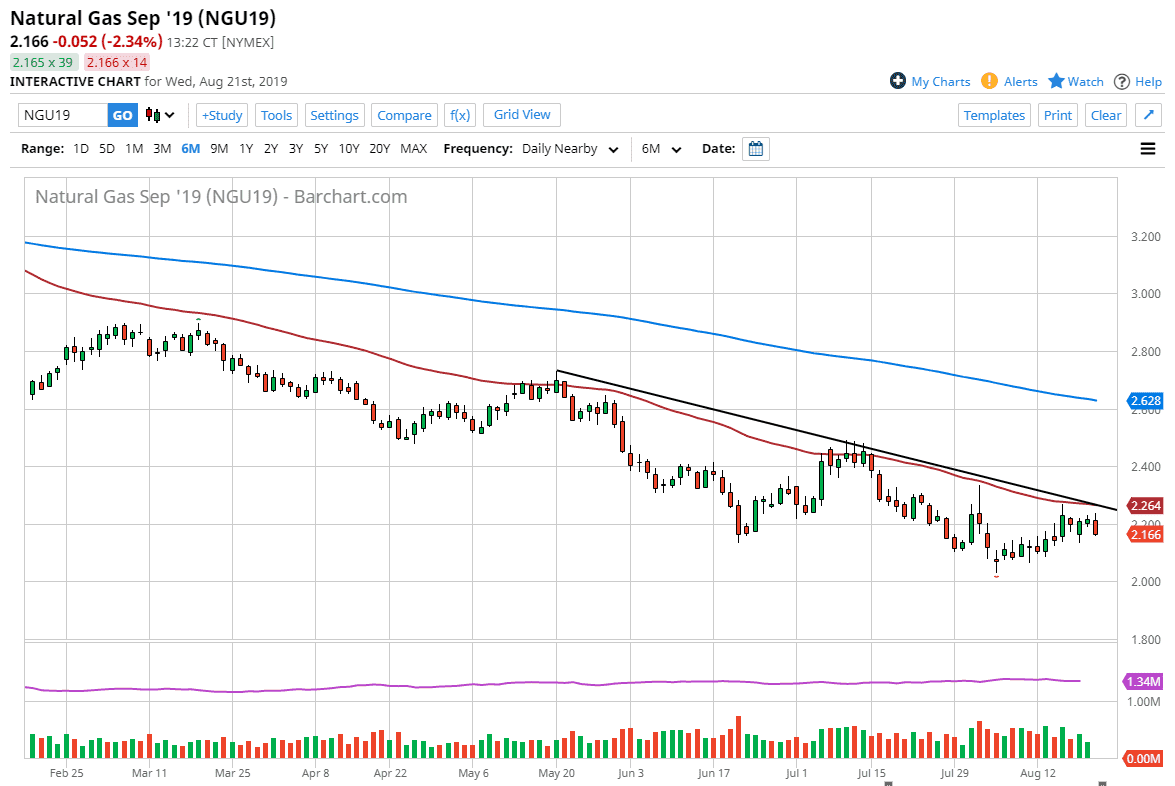

The natural gas market tried to rally a bit during the New York trading session on Wednesday but faced a selloff yet again as they continued to look at the 50 day EMA as a bit of a “ceiling” in the market. This is a significant indicator on the chart that continues to attract a lot of attention. That being the case, I believe it makes sense for natural gas to fall from here.

Above the 50 day EMA is the major downtrend line that the market has been playing with as well. The $2.50 level was the last time we had this type of confluence tested, and it looks as if we are ready to continue the move to the downside. The $2.00 level will more than likely end up being a massive support level, and I think given enough time it’s very likely we will have to try that level. If we can break down below it, it’s likely that we could go down to the $1.75 level, but I think it is going to take a lot of momentum to get down through that area, and it would be a bit of a “trapdoor” opening up. If that happens, the move could be rather brutal.

To the upside, if we could break above the trend line, we could reach towards the $2.50 level. Ultimately, I think selling is the only thing that we can do at the moment. At this point, it’s likely that the downtrend will continue going forward, mainly because we are still trading the September contract. That obviously isn’t the coldest of months, so it’s probably only a matter of time before we roll over. Still, I think that given enough time we are going to see traders start to focus on the wintertime. We have a few months before that but once we do, we can start buying as the market is very cyclically driven. At this point, we aren’t using a lot of natural gas to warm houses in the northern hemisphere. Smart traders will follow the trend for a while, but once we start trading something along the lines of November or December, the market will turn around, at least for the short term and then we can start selling yet again and repeat this cycle that this market has been in for several years.