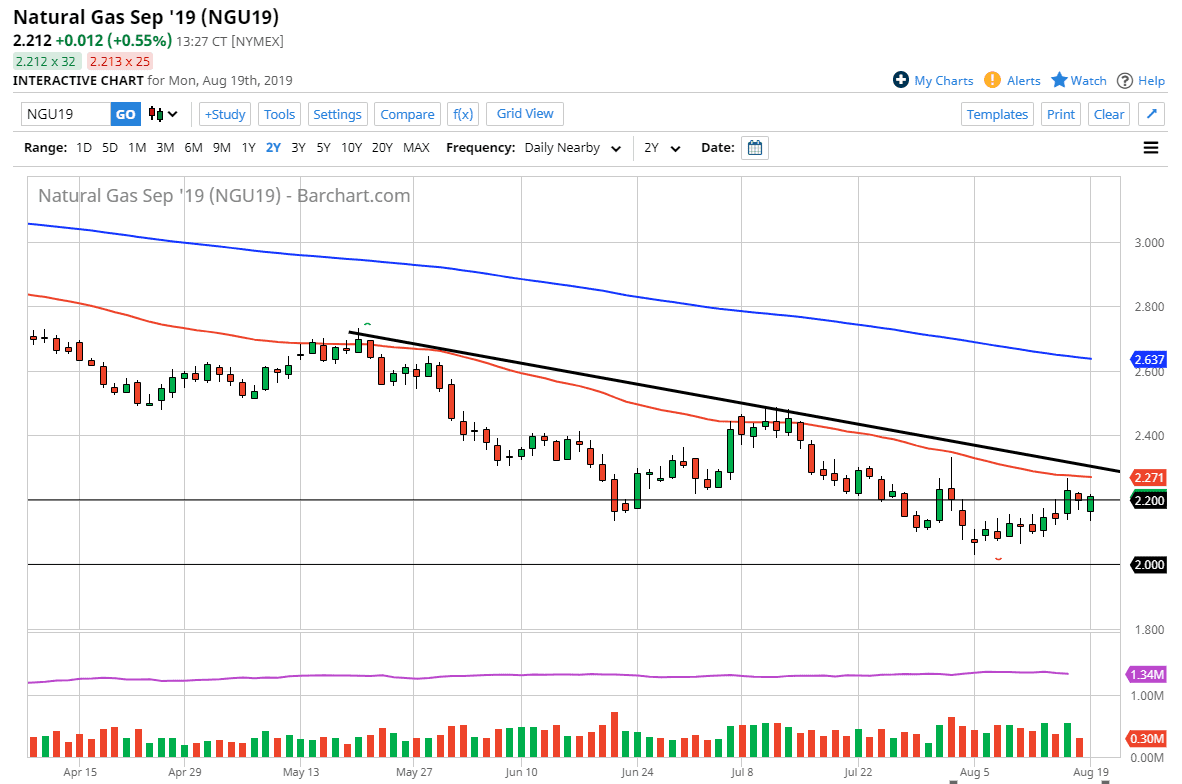

Natural gas markets gapped lower to kick off the trading session on Monday, showing signs of negativity but then they turned around to show signs of resiliency as well. We filled the gap, which of course is They filled the gap, which of course was crucial. At this point though, we are still in a downtrend so even though we have filled the gap and have held there, I think it’s only a matter of time before the sellers come into the market and push much lower.

Looking at this chart, you can also see that the 50-day EMA is just above, hanging at the $2.25 region. In my professional opinion, it’s only a matter of time before sellers come in at the first signs of exhaustion. Above that 50-day EMA there is also a downtrend line that comes into play, which will create the perfect opportunity for sellers. Ultimately, if we did break above both the 50-day EMA and the downtrend line, I think the market probably goes looking towards the $2.50 level where I think there’s even more resistance.

Longer-term, I do think that the buyers will return due to cold weather, but we are obviously nowhere near that yet, and probably have to wait a couple of months in order to get the benefit from the cyclicality of cold weather. Until then, the eager sellers are likely to push this market lower because of the downtrend and of course the major oversupply of natural gas out there.

Looking at the chart I recognize the $2.20 level as a major resistance barrier, but it’s more of a thick zone than anything else. I think it’s very likely that we will probably try to get down towards the $2.00 level, which is essentially the “floor” in the market right now. I don’t know if we can break down below there but if we do it opens up a bit of a trap door to much lower pricing. Regardless though, traders will probably at least attempt to get bank down to that level as it is such a large, round, psychologically significant figure that people will be tempted to try to run those stops. Short-term charts that show signs of exhaustion are probably the best way to enter this market at this point.