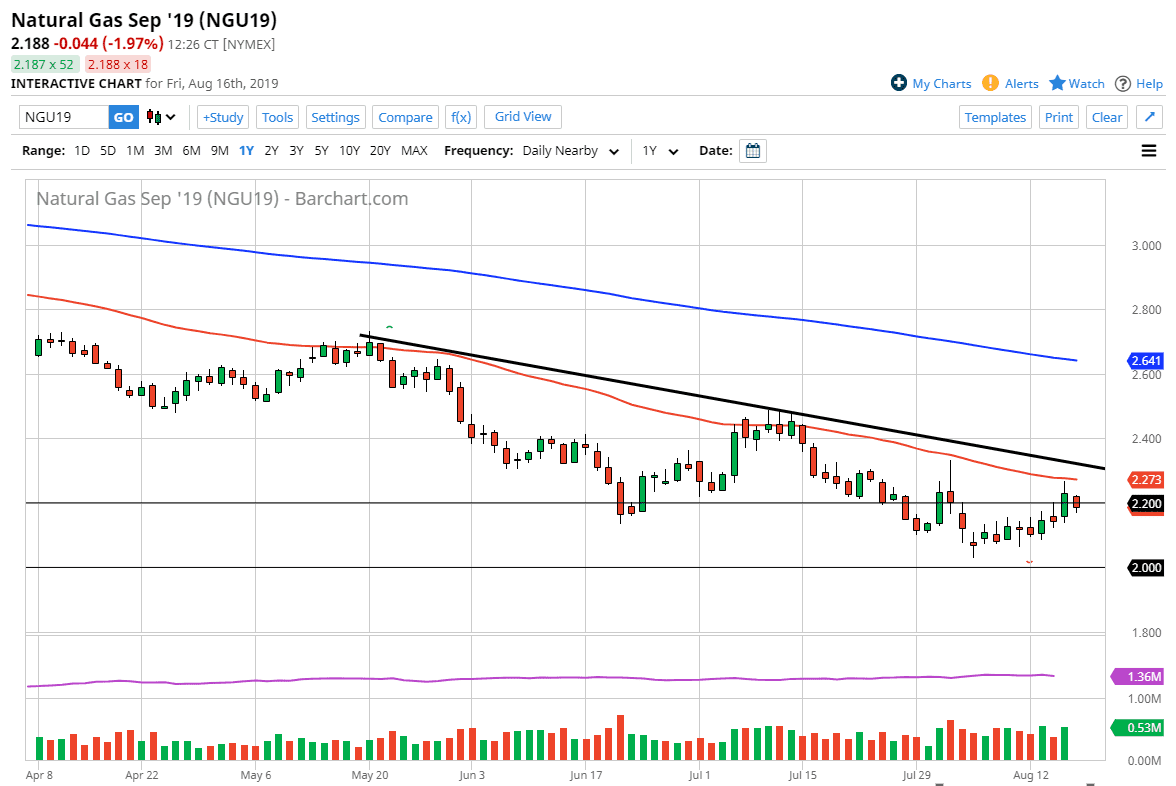

Natural gas markets fell rather steeply early on during the trading session on Friday, reaching down below the $2.20 level. By doing so it showed that the market continues to struggle to hang onto gains, although this past week has been somewhat decent. Ultimately though, when you look at the natural gas markets, it’s likely that you will continue to see sellers jump into this market and push to the downside.

Ultimately, the 50-day EMA is just above and that should continue to cause a lot of resistance. The downtrend line is just above, so I think at this point it’s likely that sellers will continue to return to this market every time it tries to rally. When it comes to the natural gas markets, I believe that there is far too much supply in the market. This may lead us to seeking the $2.00 level underneath which of course is a target, and a large, round, psychologically significant figure.

If we were to break to the upside, I think that the 50-day EMA will continue to attract a lot of algorithmic trading as a negative sentiment has been prevailing lately. I think at this point it’s not until we break above the $2.50 level that you could start to think about buying. Overall, this is a market that has been sold off due to not only the oversupply but also the time of year as demand for natural gas is typically rather low during the warmer seasons. Having said that, once we get closer to the cold months of the year, we will get more demand and natural gas prices should continue higher until we break out and make a huge move. In the meantime, I’m a seller of rallies. This has been the way to trade this market for several months now, and as we are still only trading the September contract, I think we are still going to need to follow that prescription. If we can break below the $2.00 level, then it’s very likely that we could go to the $1.75 level but that would be a major break down and take a bit of a push. In the meantime, I think we are simply going to bounce around in this area with a negative slant.