The latest activity of new British Prime Minister Boris Johnson renewed optimism about the future of Brexit. Despite the lack of agreement and direct negotiations, these attempts may make both sides consider sitting at the negotiating table again. Therefore, the GBP / USD moved to the 1.2293 resistance level, the highest level in three weeks. A stronger dollar pushed the pair back to 1.2208 support in early trading today before settling around 1.2241 at the time of writing. Boris Johnson said he hopes to reach an agreement with the European Union, even at the last minute, before the Oct. 31 deadline for Brexit. Markets are still pricing that Britain will emerge without an agreement with each side sticking to their demands. Prior to Johnson's remarks, he turned to the United States, in defiance to the European Union, and announced a convergence of views between him and Trump to agree on strong trade relations. The growing rapprochement between Trump and Johnson could make the EU think about new clauses that reduce the chances of such a rapprochement and guarantee Brexit without agreement.

The Fed will continue to monitor economic developments and external risks to determine appropriate monetary policy. We noticed a split among members of the monetary policy board on the timing and amount of US interest rate cuts, some of whom went too far to refuse to cut US interest rates while the US economy continues to perform well. The US GDP figures on Thursday will have a strong reaction to the performance of the US dollar.

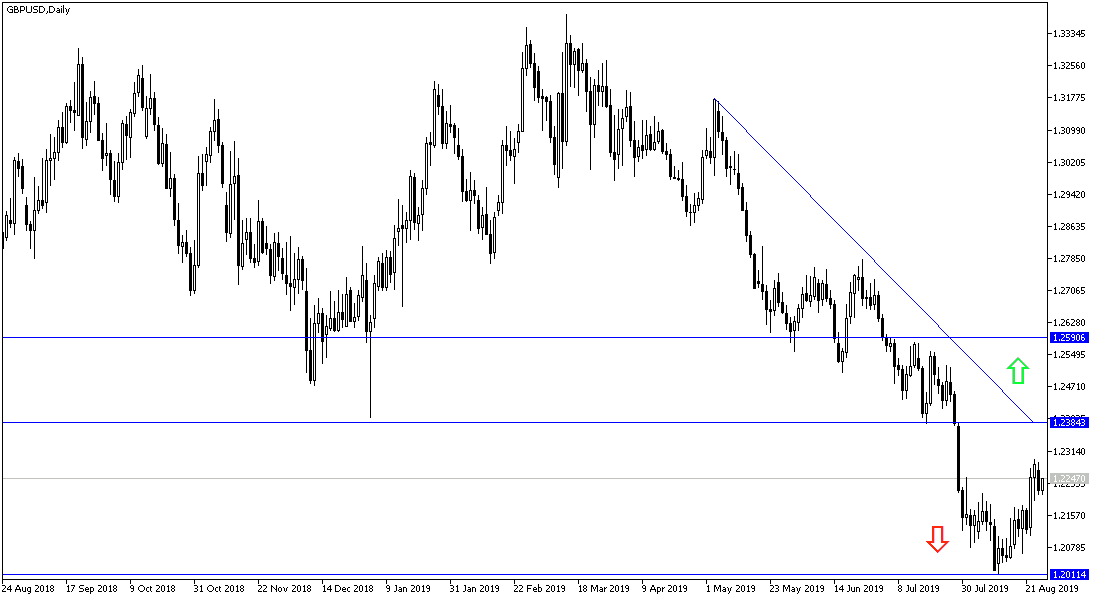

Technically, the recent correction of the GBP / USD is still in need of stronger catalysts to rise to the levels of breaking the general trend that is still bearish, and that may occur in the pair's move towards resistance levels at 1.2360, 1.2430 and 1.2585 respectively as a first stage. On the downside, the pair's move back below the 1.2200 support level will increase the bearish momentum again and the psychological support of 1.2000 may be the next target. I still prefer to sell the pair from every rise, as the Brexit future remains uncertain.

On the economic data front: the economic calendar today includes the announcement of mortgage approvals in Britain. During the US session, the US Consumer Confidence and Richmond Industrial Index will be released.