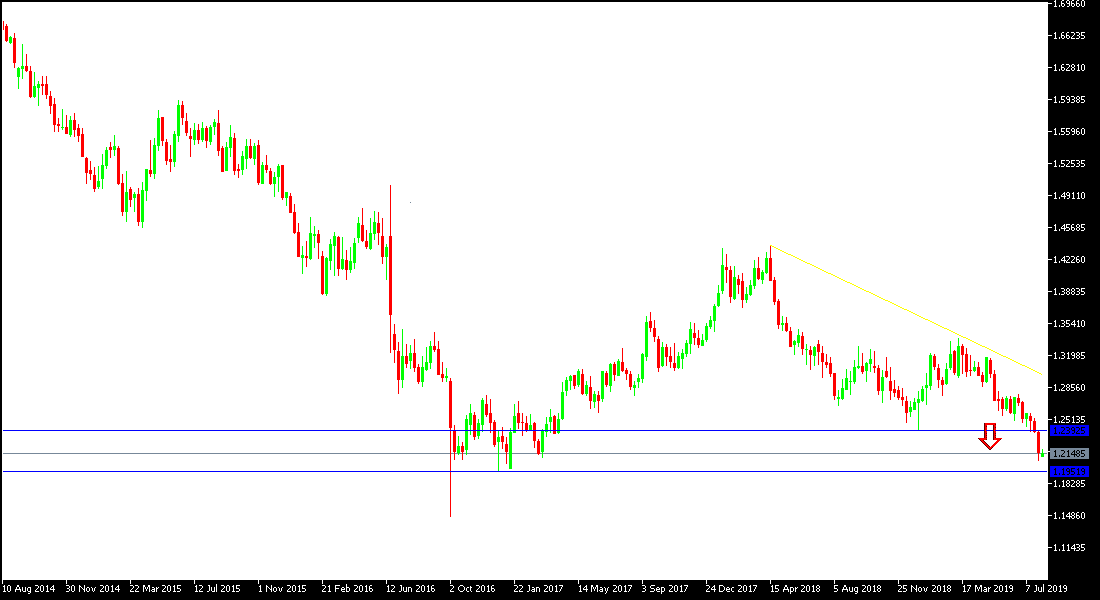

Every time the GBP/USD tries to bounce higher, investors seize the opportunity to return to selling the pair. For example, the pair rose at the beginning of the week to 1.2188 and quickly rebounded back to 1.2111 support at the time of writing. Its losses extended last week to 1.2080, its lowest level in 28 months. The unknown fate of Brexit will remain a strong pressure on the Pound against other major currencies. Expectations are growing that Britain is on its way out of the EU without an agreement. Those expectations forced the Bank of England to express pessimism about the future of the country's economy if the UK actually pulled out without an agreement. Therefore, the Bank has lowered its forecast for the country's economic growth and warned of a possible recession. They referred to growing doubts about Brexit, weak global economic growth and expansion of trade disputes. They stressed that the bank's policy will be in one direction if the last track of the Brexit is confirmed.

At the US level, the US Federal Reserve has cut interest rates for the first time in 10 years. At the same time, they stressed that the bank has not completely shifted its policy towards further rate cuts.

Technical analysis: GBP / USD's continued the strong decline and the move towards 1.2000 psychological support is the closest to its current trend. The pair is prone to test standard and historical support levels as soon as possible. Therefore, we still prefer to sell this pair from each ascending level. The nearest resistance levels are currently 1.2200, 1.2285 and 1.2360 respectively. There are no signs of a near correction despite the fact that all technical indicators have reached oversold levels. GBPUSD is still under pressure due to the future of the Brexit.

On the economic data front, the economic calendar today will focus on the announcement of the Services’ Sector PMI from the UK, and the ISM Services PMI for the U.S.