A New support for the recent GBP/USD upward correction after the British opposition leader, Jeremy Corbyn, pledged to prevent Brexit without agreement. Corbin believes that the rapprochement with the United States of America is not guaranteed, especially under the Trump administration, thus Brexit agreement is the best for the country. Therefore, the pair moved towards 1.2309 before settling around 1.2275 at the time of writing. On the daily chart, it seems clear that the gains have been temporarily halted pending stronger catalysts. We believe that gains will remain under threat of growing expectations that the new British Prime Minister Johnson will fail to conclude an agreement with the EU. Johnson believes the union will agree until the last minute. With the economic calendar devoid of any significant economic data from Britain or the United States, the pair will only react to Brexit developments.

The US dollar did not react much to the announcement of continued US consumer confidence strength contrary to expectations, which confirms that the US citizen is still confident in Trump's economic plans, and did not consider recent expectations by banks and international financial institutions that the US economy is vulnerable to recession in the coming months, especially if the trade dispute continues With China. The Federal Reserve has ignored US President Trump's demands and criticism for cutting US interest rates and introducing new stimulus plans. Tomorrow, the US GDP figures will be released and will have a strong reaction to the US dollar performance.

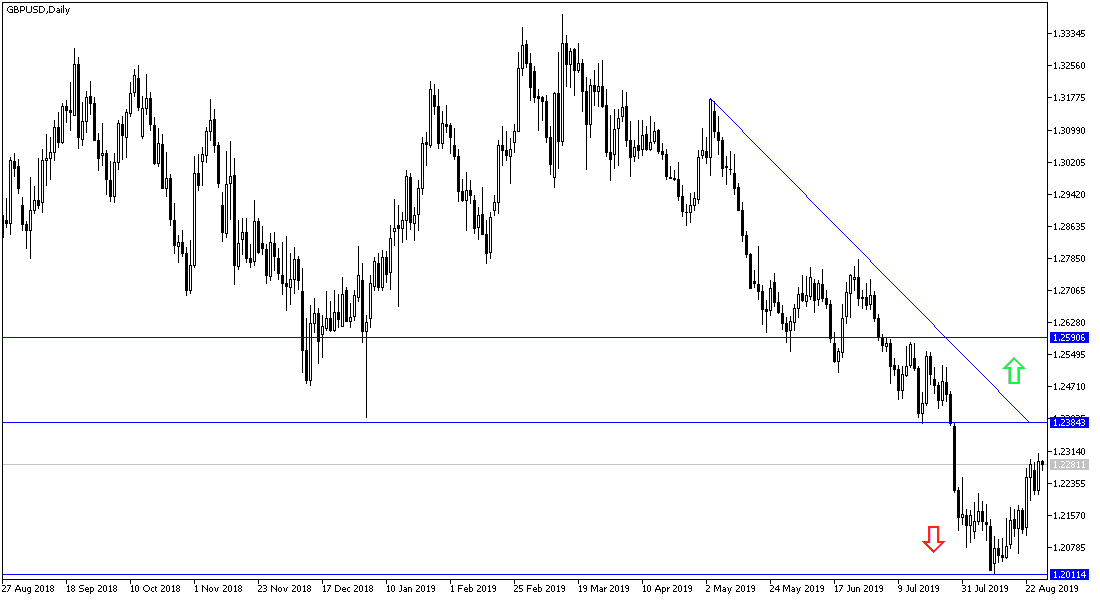

According to the technical analysis: Despite the recent correction of the GBP / USD, we still confirm that the move upwards will be a selling opportunity again and the closest resistance levels, which are the most appropriate to do so now at 1.2320, 1.2400 and 1.2465 respectively. If it moves towards the support areas of 1.2200, 1.2145 and 1.2080, the bearish momentum will increase again and move immediately to the psychological support of 1.2000 to complete the general trend which is still bearish so far.

On the economic data front: Today's economic calendar has no significant economic data from either the UK or the United States.