The recent gains of the GBP/USD pair, which hit three-week highs at 1.2293, will not last, as the Brexit future grows darker, and expectations grow that Britain will leave the EU without agreement. On the sidelines of the G7 summit, British Prime Minister Johnson told European Council President Tusk that his country would be out of the bloc on October 31, whatever the circumstances and in any situation, and that he was still ready to negotiate with member states within the EU even after the failure of his tour last week to Germany and France. Boris Johnson wants to put pressure on the EU with the recent rapprochement with the United States, announcing the imminent agreement on strong and continuing trade relations, and US President Trump urged the British government to think well in the future.

From the United States, the US Federal Reserve Governor Jerome Powell said in Jackson Hole, along with the contents of the minutes of the Bank's recent meeting, that economic developments and global risks will determine the fate of the monetary policy of the bank and that it will not change its policy according to the US administration. Powell ignored recent sharp criticism from US President Trump and his demand for a full percentage point cut. Therefore, the release of the results of the upcoming US economic indicators will be of particular interest to investors as US GDP figures are expected this week.

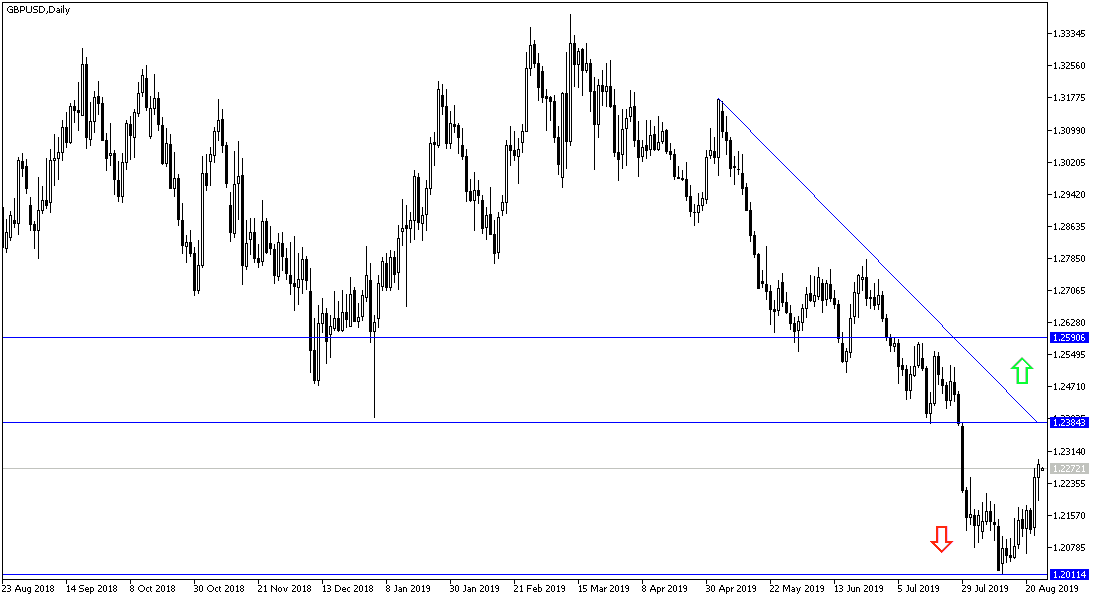

Technically, the recent correction in the GBP / USD pair is an opportunity to return to the sell-off as the Brexit future remains uncertain and closer for a no-deal Brexit, bringing more losses to the Pound. Currently, the nearest resistance levels are 1.2320, 1.2400 and 1.2485 respectively. As expectations continue to fall, the closest support levels for the pair are currently at 1.2245, 1.2180 and 1.2090 respectively. On the daily chart, 1.2000 psychological support will remain the next target.

On the economic data front: Today's economic calendar has no significant UK economic data as there is an official holiday there. From the United States, durable goods orders will be announced.