For five trading sessions in a row, the GBP/USD pair is trying to correct higher, but the gains did not exceed the 1.2180 resistance level recorded during Tuesday's trading session, and before stabilizing around the 1.2136 support at the time of writing, and before the release of the Fed's minutes. The importance of this meeting is due to the Fed reserve cutting US interest rates for the first time in ten years by a quarter of a point. US President Trump this week called for a one percentage point cut in the rate along with other stimulus plans to revive the US economy and counter any consequences of his trade wars. Trump's demands are unacceptable. Jerome Powell and his colleagues emphasized the Bank's policy independence, and that monetary policy members will monitor economic developments to determine the right policy. The White House this week dismissed expectations that the US economy will enter a recession in the coming months and stressed that the country's economic situation is stronger than ever.

On the British side, Brexit file is still the strongest and most influential factor on the pound's trends, especially with the new British Prime Minister Boris Johnson, who intends to leave the Union even without a deal. Johnson believes the consequences could be compensated in cooperation with other global economies, as was the case with the recent rapprochement with the US administration. German Chancellor Merkel will meet with Johnson on Wednesday to discuss the Brexit dossier and at the same time stressed Germany's readiness to deal with the exit of the United Kingdom without agreement.

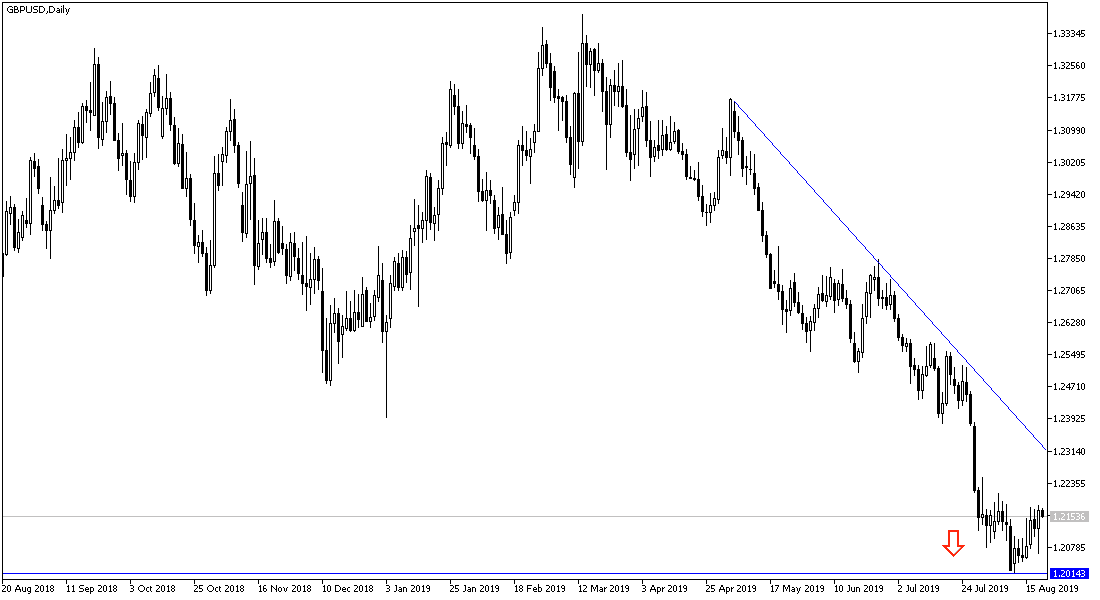

According to technical analysis: Despite recent attempts by the GBP/USD to correct upwards, the general trend is still strongly indicating the continuation of the decline. 1.2000 psychological support may be the next target for this trend. I still prefer to sell the pair from every upward level. Currently, the closest resistance levels are 1.2220, 1.2300 and 1.2390 respectively. Pound still faces pessimistic expectations of Brexit without deal. The technical indicators so far showed no strong signs of a change in direction.

On the economic data front: the economic calendar today includes the announcement of the net borrowing of the British public sector. From the United States, existing home sales, oil inventories and, most importantly, the minutes of the last Fed meeting.