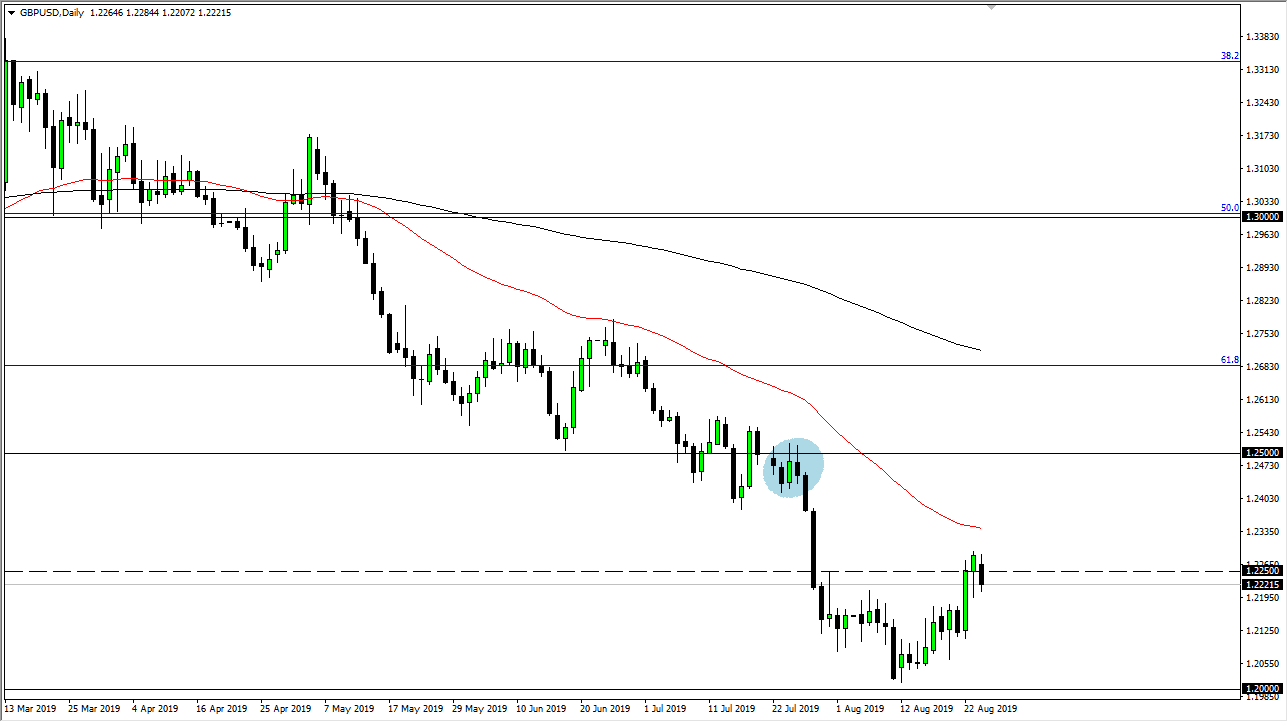

The British pound initially tried to rally during the session on Monday, but as you can see has rolled over to show signs of weakness. This was mainly due to more of a “risk off” attitude, and of course some of the optimism that may have been seen on Friday about the Brexit coming together seems to have been wiped out. At this point, it’s likely that the British pound will continue to attract sellers, mainly because the Brexit is still an absolute mess. At this point, Boris Johnson looks likely to continue to press the issue about the backstop, which of course the European seem hell-bent on getting around.

At this point, it’s very likely that the US dollar will continue to attract a certain amount of money as bonds are attractive in this type of environment. At this point in time I think that the 1.2250 level is going to continue to cause issues, as the 50 day EMA is just above and causing issues. Ultimately, I think that we will probably try to go down to the 1.20 level underneath, as it was where we had bounced drastically from. At this point, I suspect were going to try to finally break through there and go much lower. We are well below the 61.8% Fibonacci retracement level, so typically what that means is we will go looking towards the 100% Fibonacci retracement level. In the meantime, I think it makes quite a bit of sense that we go down to the 1.15 handle, as the Brexit situation is light years away from being better.

At this point I think it’s simply a “sell the rallies” type of situation, as it has been for quite some time. To the upside, the 50 day EMA of course is major resistance, just as the 1.25 level above will be. It’s not until we break above that level that I would consider buying.