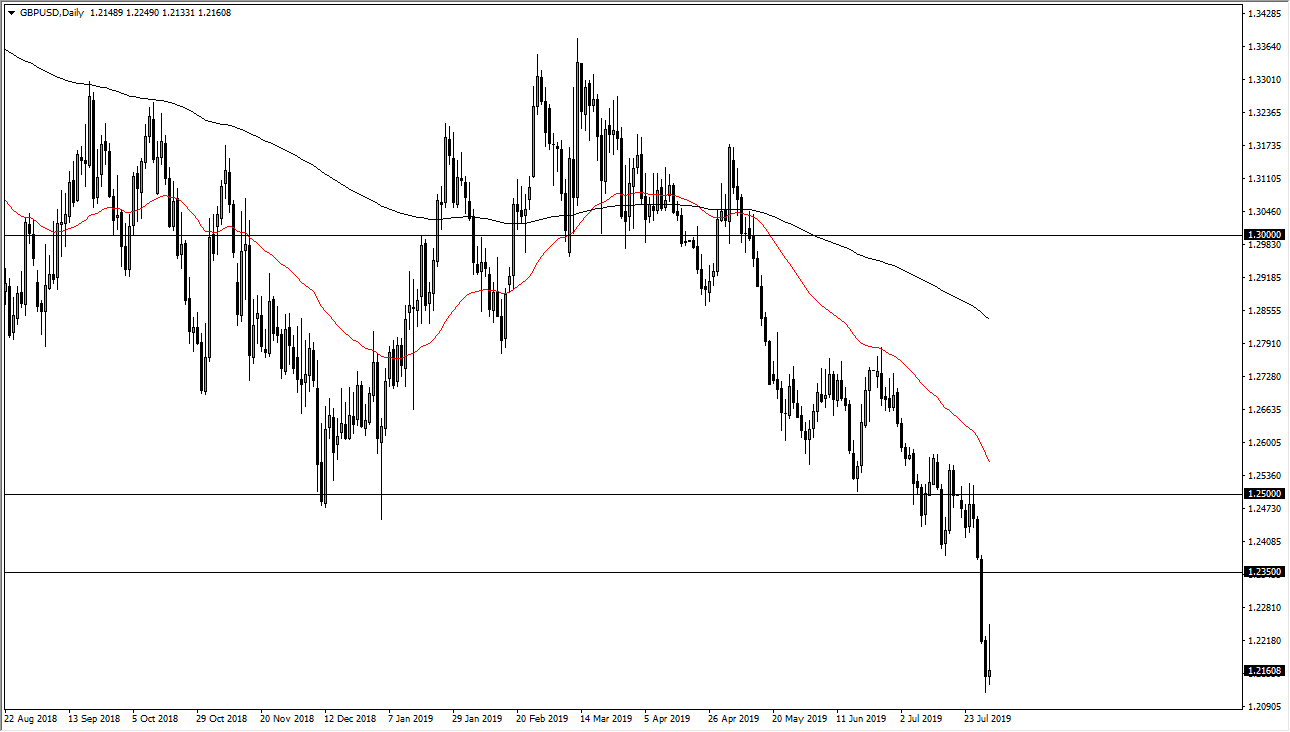

The British pound initially tried to rally during the trading session on Wednesday in anticipation of the Federal Reserve interest rate cut. We also got turned right back around as the interest rate cut was as expected, but it wasn’t necessarily overly dovish as people had hoped when it came down to the press conference. At this point, the market has formed a bit of an inverted hammer, so if we were to break down below the bottom of that inverted hammer the market should continue to much lower.

There’s almost no scenario in which I believe in buying the British pound. If you read my analysis yesterday, you know that I had been looking for an opportunity to sell after a rally, but unfortunately I don’t think we got a good enough rally to jump in. I believe that the 1.2350 level above is the beginning of massive resistance that extends to the 1.25 handle. I would love to see this market rally towards that area so I can start selling again on signs of exhaustion. However, that doesn’t look like it’s going to happen though, based upon what we had seen during the trading session on Wednesday.

If we break down below the candle stick from both the Tuesday and Wednesday, then the market should go down to the 1.20 level underneath. That is an area that will attract a lot of attention because it is a large, round, psychologically significant figure. That is an area that I would expect a bounce from, but I do believe it’s only a matter of time before the markets would revisit that level unless something massive changes when it comes to the Brexit. Right now, the Brexit is still completely up in the air and most likely to be a “no deal Brexit.” As long as that’s going to be the case, it’s difficult to imagine a scenario where people will want to buy the British pound and hang on to it. However, I do think there is only a matter of time before we flush much lower, and once we do I think that could be the beginning of a longer-term “buy-and-hold” opportunity that will make careers. Obviously, we still haven’t had what would essentially be the inverse of a “blow off top”, but once we do that should be a nice opportunity. In the meantime, I continue to look for opportunities to short this market after short-term rallies that show signs of failure.