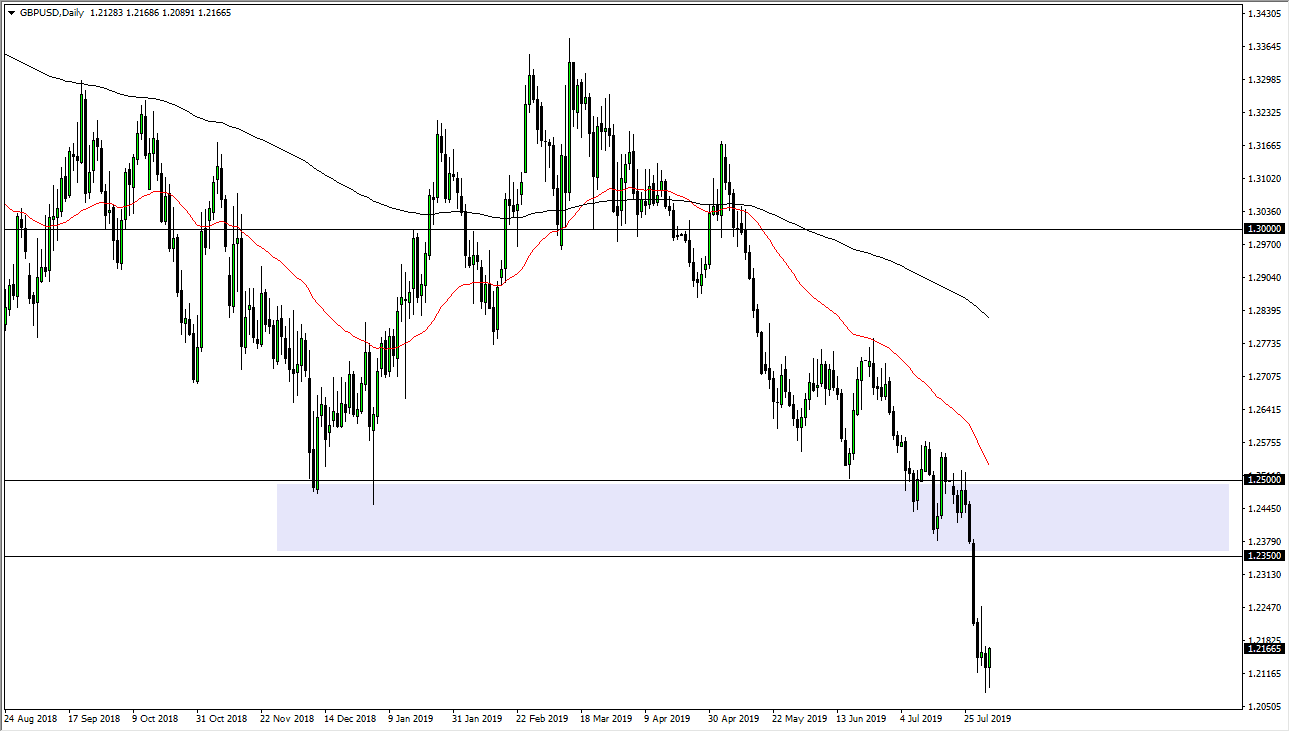

The British pound fell initially during the trading session on Friday, but just as we had seen on Thursday, buyers came in to pick up the market. This could be a bit of short covering ahead of the weekend, as the market has been oversold to say the least. The last three candlesticks feature a shooting star, a hammer, and then another hammer for Friday. This tells me that we are more than likely going to continue to consolidate in this area as the market tries to decide whether or not we are in an area that traders are comfortable with.

If they are in fact comfortable with this level, then it’s likely that we will break down below the bottom of these couple of hammers, which would be an extraordinarily negative sign. If the markets are not comfortable, then we will break the top of the shooting star from the Thursday session, and perhaps go looking towards the purple box that I have on the chart near the 1.2350 level. That begins resistance to the 1.25 level, so that’s an essentially a “zone” that we can take a look at.

Ultimately, I think that this pair should be shorted in that area, as it would fulfill the overall downtrend, with the 50 day EMA coming into the picture in that general vicinity as well. I believe that signs of exhaustion in that area will be jumped all over, and that’s the best trade I see potentially presenting itself in this market. However, if we were to break down below these couple of hammers then I think we go reaching towards the 1.20 level underneath, perhaps even breaking through there rather quickly.

I do believe that as the Brexit is dead lined for October 31, it’s very unlikely that we get much in the way of confidence between now and then. With that, I like the idea of selling rallies as they occur, all the way down until we get to at least the 1.20 level, if not the 1.15 level. I don’t see this pair turning around anytime soon, unless of course there is some type of agreement with the Brexit, but that seems to be almost an impossibility to consider this point. Boris Johnson has suggested that he is ready to leave the EU without a deal, and that is probably because that’s the most likely scenario.