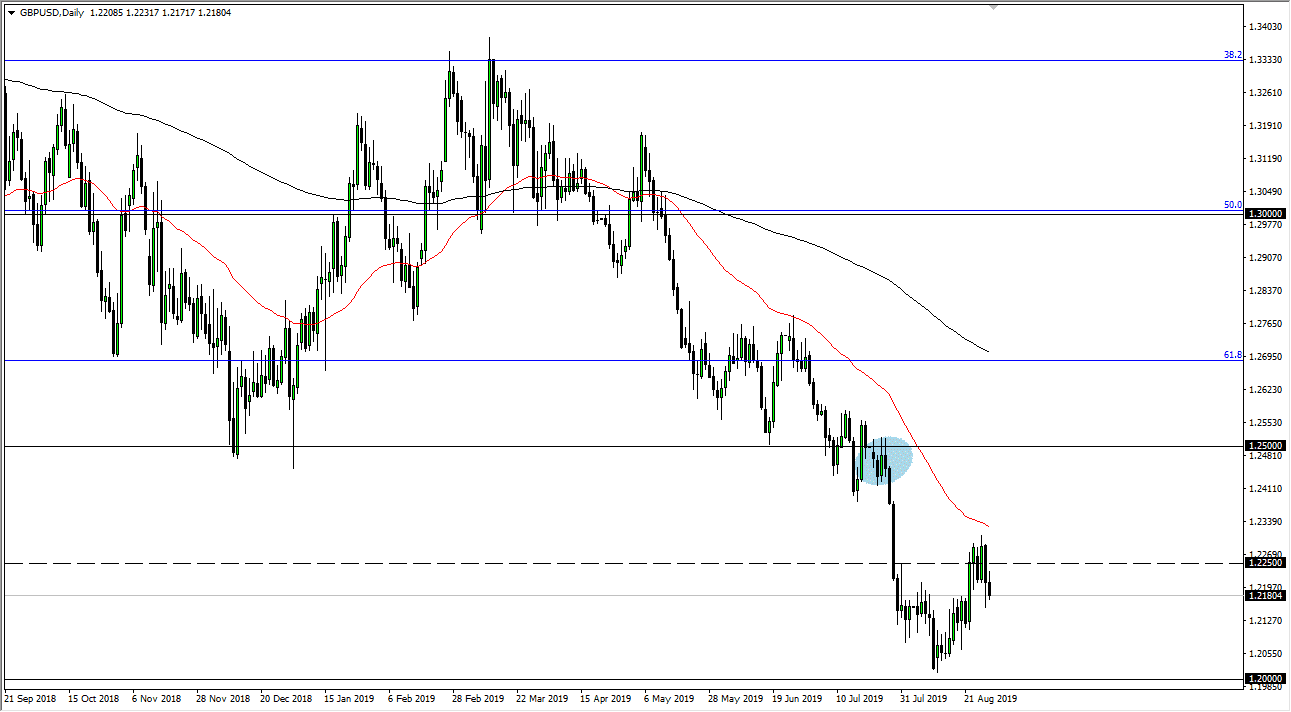

The British pound has initially tried to rally during the trading session on Thursday but then sold off as we got close to the 1.2250 level. That is an area that is halfway between the “floor” in the market at the 1.20 level, and the “ceiling” at the 1.25 handle. Beyond that, the cluster that we are trading in has the 50 day EMA sitting just above it, and that should continue to cause quite a bit of resistance. We are in a downtrend in rightfully so. The Brexit of course is going to be a “no deal Brexit”, and therefore it’s likely that we will have another big flush lower.

Ultimately, the US dollar is favored right now because of the Treasury markets are offering positive yields, which continues to drive money towards the greenback. Beyond all of that, we also have the “risk on/risk off” variable involved, and that should continue to favor the greenback against most currencies. In this particular case there are multiple reasons to think that we are going to continue to fall so I think at this point you simply look for short-term rallies to start selling.

At this point, the 1.20 level offered a bit of a “dead cat bounce”, and it makes sense as it is a large, round, psychologically significant figure. If we can break down below that level, then the market should flush much lower, perhaps going down to the 1.15 level after that. All things being equal I have no interest in trying to buy this market, I am simply looking for some type of exhaustion that I can take advantage of, as nothing has changed fundamentally in the situation with the Brexit or the British economy to warrant going long at this point. There will come a point where we can do that, but I think it is going to have to wait until after the final result of the Brexit, regardless of whether it’s good or bad, there will eventually be some sense of certainty, and that’s basically what this market desperately needs at this point. I believe that there are a lot of geopolitical and economic concerns out there as well, so that should continue to work against the value of anything that isn’t the US dollar. In other words, we continue to go much lower and I have no interest in buying.