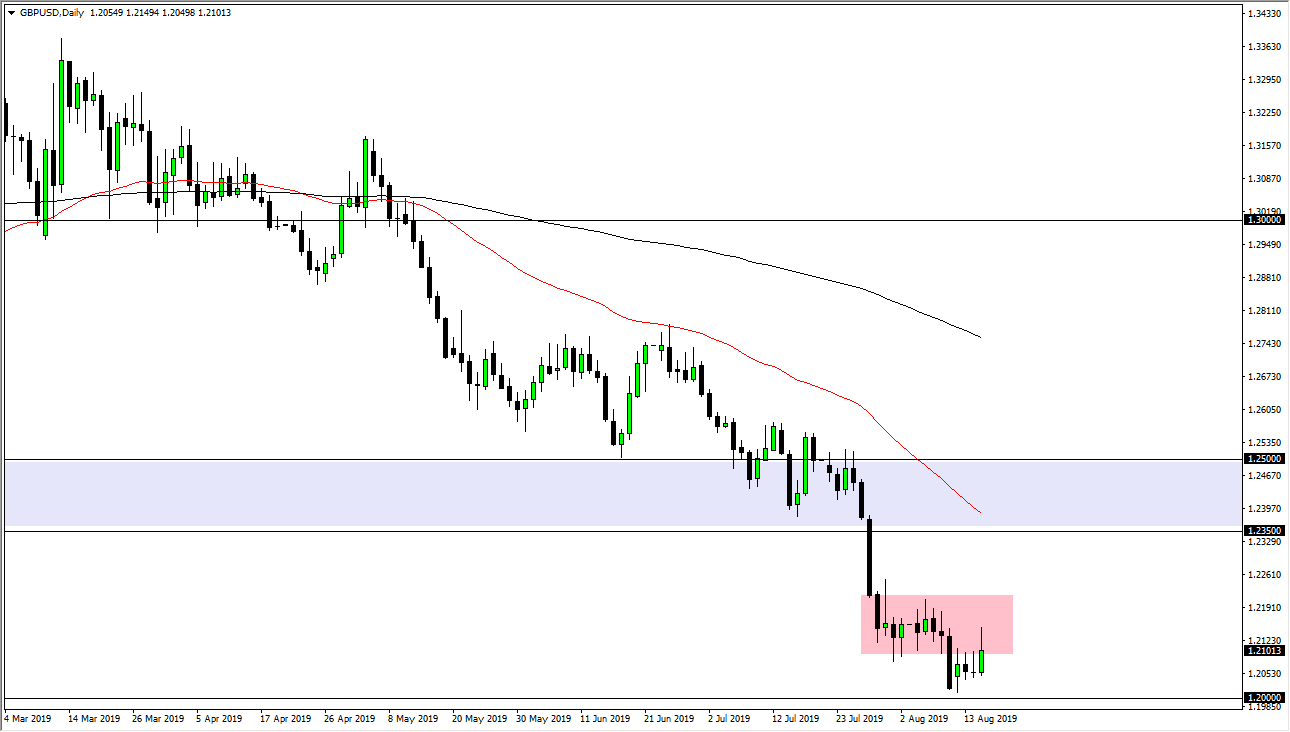

The British pound should continue to rollover at this point, although we have rallied quite nicely during the trading session on Thursday. That being said we ended up rallying right into the previous consolidation area, and as you can see it has caused quite a bit of trouble. As we had given up quite a bit of the gains during the trading session at the end of the day, I suspect that Friday will see a bit of selling. This makes a lot of sense of course, because we are in a downtrend and the British pound should continue to sell off due to the fact that the Brexit is massive confusion just waiting to happen.

The market continues to favor the US dollar due to the Treasury market and of course the bond market needs those US dollars to function. It builds up demand for the greenback, and in a scenario where we are worried about the Brexit and the uncertain coming out of the United Kingdom, it makes sense that this pair favors the continuation of the downtrend.

To the upside, the 1.22 level is the top of the previous consolidation area so I look at that as a major resistance barrier. Beyond that, the 50 day EMA has sliced through what was previous consolidation and support, so I think the 1.2350 level will be a bit of a “ceiling” in the market. To the downside, I see the 1.20 level as an area that should offer quite a bit of support as it is psychologically important, but it’s only a matter of time before we break down below there and go looking towards 1.18 level next. The closer we get to the Brexit, the more dangerous the British pound is going to be to own as there just is nothing along the lines of certainty in this market, and as you probably know, financial markets hate uncertainty.

Eventually we will get some type of resolution to the Brexit, even if it is to have no deal. Once we get the last “major flush lower”, I think that will be a career making buying opportunity for large traders out there. In the meantime though, we are nowhere near that as the deadline isn’t until October 31 for the United Kingdom to leave the European Union. Expect a lot of choppiness between now and then, but the negativity should continue.