The British pound has broken down a bit during the trading session on Wednesday, as we continue to see a lot of noise in this market. After all, the Brexit continues to be a thorn in the side, and it seems to be very unlikely that we get any significant movement in the British pound due to the fact that there is no deal forthcoming in the short term. Beyond that, the UK Parliament has been dismissed by the Queen, so therefore some type of settled negotiation between the British seems very unlikely.

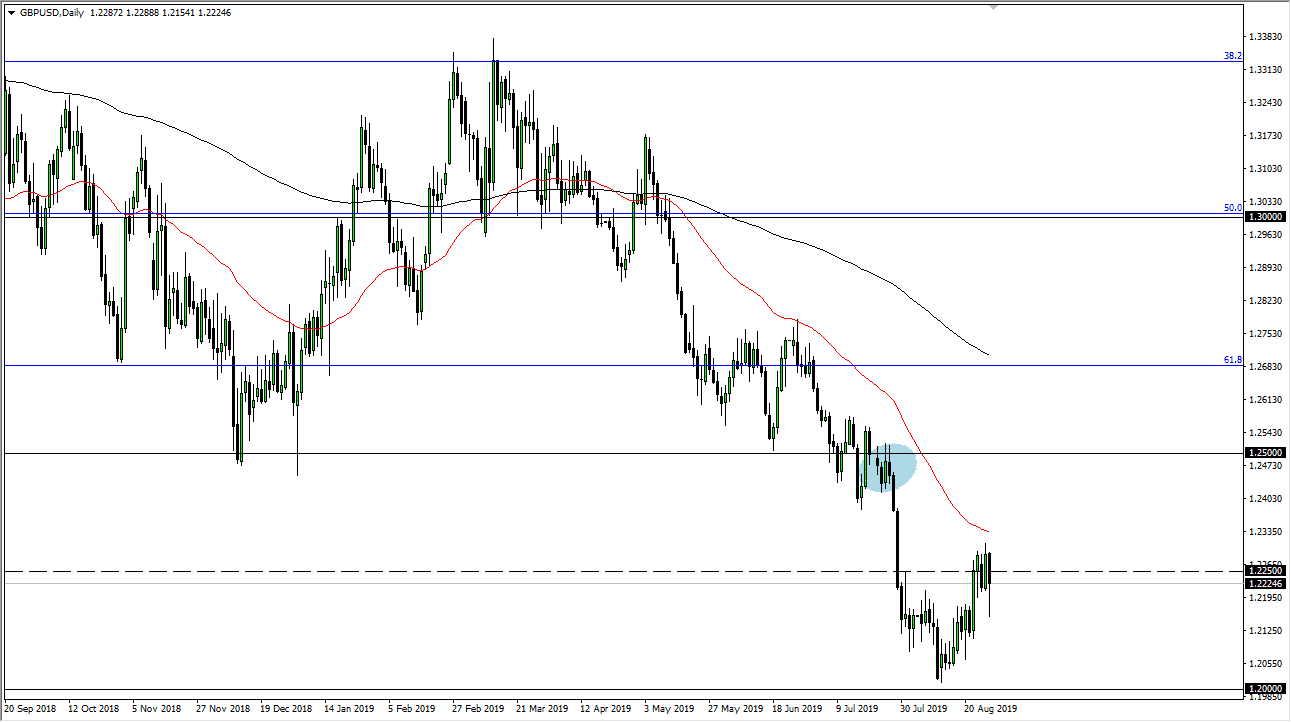

Looking at the candlestick during the trading session on Wednesday, it shows that there is significant downward pressure, and at this point it’s likely that we will continue to see downward pressure going forward as well. The 1.2250 level is an area that attracts a lot of attention in both directions but ultimately this is in a downtrend for good reason. Simply put, we have the Brexit on one side of the equation in the US dollar which is a safety currency on the other. In that scenario it makes quite a bit of sense that we continue to go much lower.

We have recently seen a nice bounce from the 1.20 level, and while noteworthy it is still rather minor in the big scheme of things. The 50 day EMA is just above and offering significant resistance. I think that if we were to break above there somehow, the 1.25 level will be even more resistive and almost impossible to break without some type of deal. With that being the case, it is a market that offers value in the US dollar every time we rally, because it is a favorite currency by traders around the world, so therefore we still want to trade the same direction.

That being said, if we do get some type of true momentum heading towards a Brexit deal, then the British pound will start to recover. All things being equal though it’s very unlikely that happens in the short term and a trade deal is almost a dead thing. If we get some type of massive flush lower, the British pound will eventually stabilize, and then it’s very likely that it will be, a “buy-and-hold” scenario. We are quite far from there though, so in the meantime I’m simply shorting this market every time it pops a little bit. Short-term selling opportunities persist.