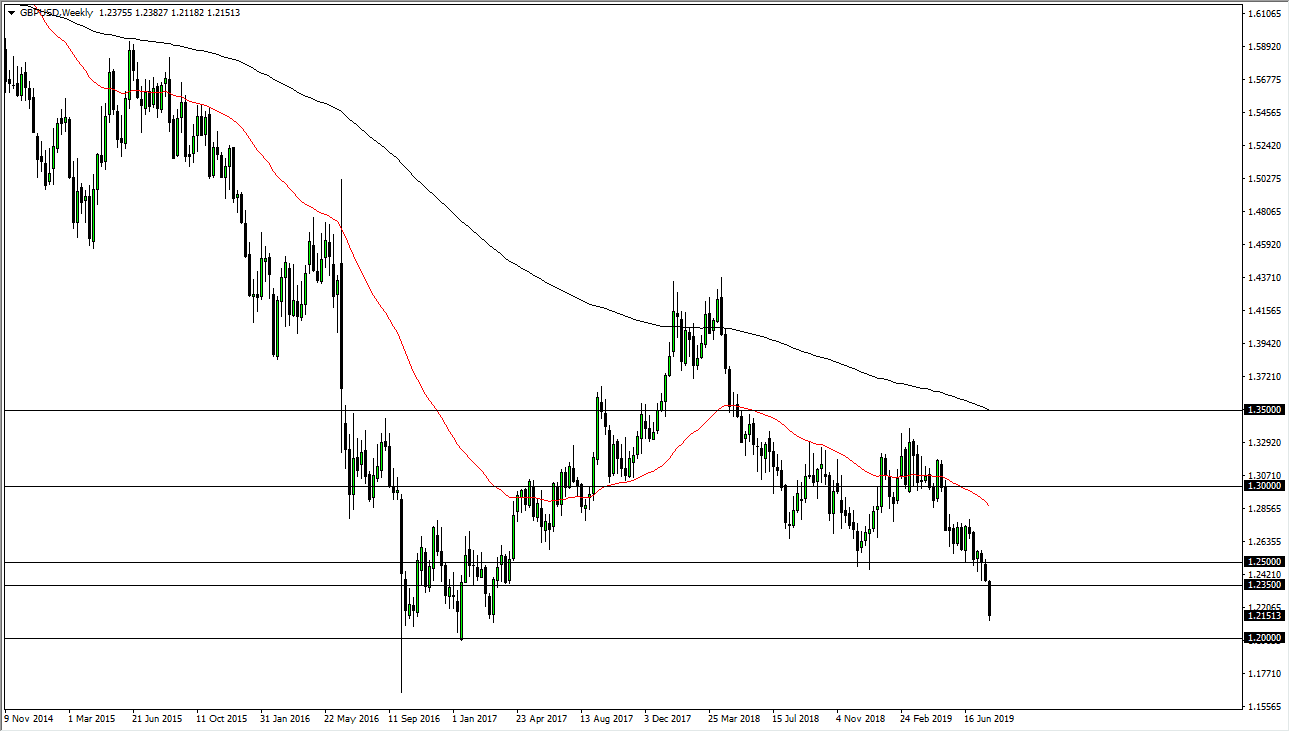

The British pound has continued to sell off during the month of July, closing below the 1.2350 level quite handily. At this point, it looks as if we are going to go down to the 1.20 level next, which is a large, round, psychologically significant figure. That being said, I am writing this just ahead of the Federal Reserve interest rate meeting, so there are some variables to keep in mind.

I believe at this point the beginning of the month may see a little bit of a bounce in the British pound against the US dollar, as we have the likelihood of an interest rate cut, and perhaps a statement that is even more dovish. If that’s going to be the case it should work against the value of the US dollar, which will probably show itself all around the Forex world, but I think it will be short-lived in this market.

The couple of hammers that we had formed on the weekly charts recently suggest that we are going to have even further downside. I believe that once we get over the initial shock of whatever the Federal Reserve does and says, we will then start to focus on the Brexit itself. That focus should continue to weigh upon the British pound as it will still be a lot of uncertainty out there waiting for those trying to pick up Sterling. I even believe that we could break down below the 1.20 level underneath, perhaps reaching towards the 1.15 level underneath.

I do believe that eventually we will get some type of “flush lower” in this pair, probably close to the Brexit which I believe at this point is very likely going to be a “no deal Brexit.” That should continue to weigh upon cable, but I think that once we get close to that October 31 deadline, we will get a massive selloff and perhaps a bit of a panic. I don’t know that it happens in August, but that’s what we are setting up for, some type of major break down. At that break down, one stability returns it will be a longer-term investment just waiting to happen. In fact, I believe that there are a lot of people looking to make careers out of the potential turnaround down the road. In the next several months though, August included, we should continue to sell rallies.