The British pound initially fell during Friday’s Wall Street session, as the 1.2250 level has offered a bit of resistance in the short term. However, we have turned around to break above there as the Federal Reserve concluded the Jackson Hole meeting by having a speech from Jerome Powell. This included what could have been read as a slightly dovish statement, so with that in mind it makes sense that we would see the US dollar fall a bit. Beyond that, we have seen the Chinese place retaliatory tariffs on the Americans, as the trade war between the United States and China continues to heat up overall.

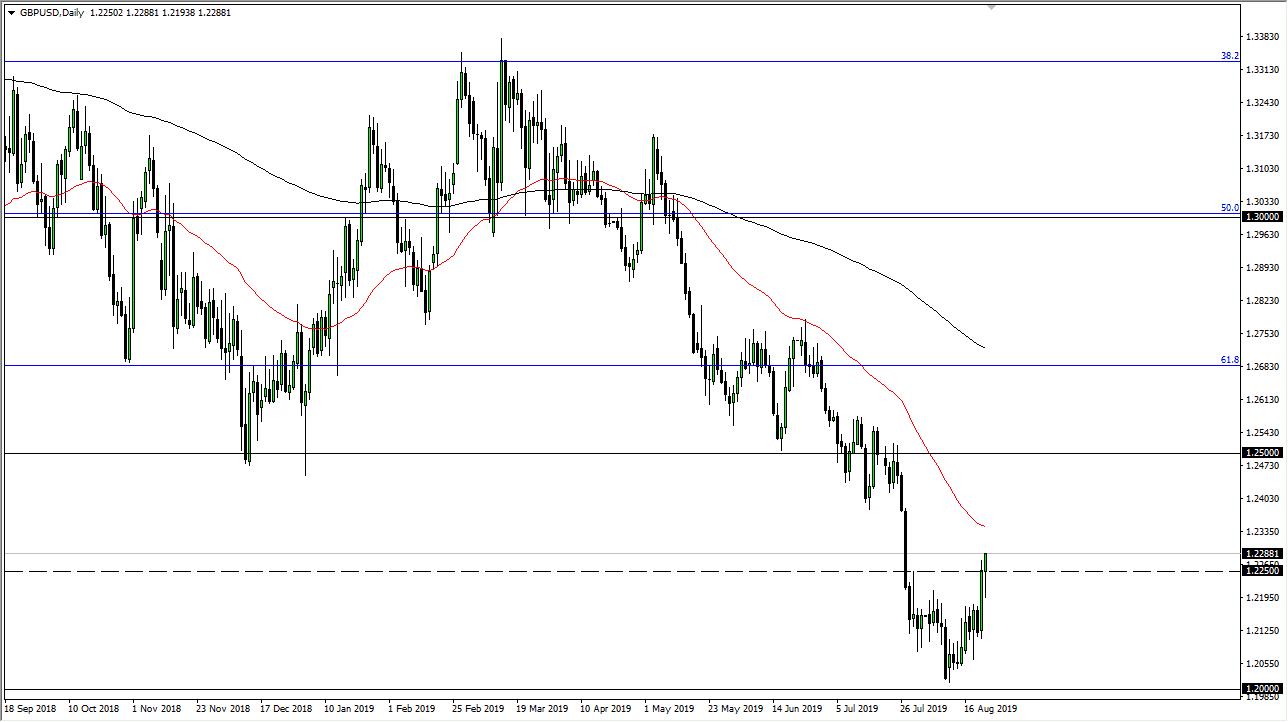

With that backdrop, we have seen the greenback fall a bit during the trading session on Friday but quite frankly the British pound will be the place to run for safety. While it does look like it is trying to recover in the short term, I think most of this is a bit of a “dead cat bounce”, as the market has been oversold for quite some time. We are starting to reach towards the 50 day EMA which is red on the chart, and closer to the 1.2350 level. I think any signs of exhaustion in that area will probably be looked at as a nice selling opportunity.

Above there I see a ton of resistance that extends all the way to the 1.25 handle, so therefore it’s only a matter of time before we see an exhaustive candle with the long wick to the upside that we can start selling. At this point, I think we are simply going to find value in the greenback going forward and not only have we seen a significant bounce after being oversold, we also bounce from the psychologically important 1.20 level underneath which attracts a lot of attention. That’s an area that if we can break through it, the market can go much lower. After that, the market could probably go down to the 1.15 handle given enough time. I don’t think that’s going to be easy to do though, and it will probably take several attempts to smash through the 1.20 level. In order to do that, we need to bounce like we are right now to build up the necessary momentum. It is because of this that I am on the sidelines and simply waiting for a sign of exhaustion to jump on.