Continued downward pressure on EUR/USD and weak correction attempts, make traders wonder about the upcoming targets for the continuation of the current situation. In this analysis we try to develop a clearer vision for the future of this pair. The pair is struggling to move away from the 1.1000 psychological support, as it will give the current downtrend a stronger momentum to test new record support levels. As for the chance of the pair moving towards it, the economic weakness in the German-led euro zone will not make it difficult due to the global trade war and increasing expectations that the ECB will intervene to revive the region's economy, which are still supporting factors for the downturn. As I mentioned in previous technical analyzes, the divergence of economic performance and monetary policy between the euro zone and the United States would favor the US dollar strength.

After declining confidence in the German economy to the lowest level since 2012, it was confirmed that the economic growth of the largest economy in the Eurozone contracted according to expectations of -0.1%. The German administration is trying to alleviate fears about the recent economic figures by stressing that the German economy remains strong and that the latter results are transient and for temporary reasons.

At the American level. US consumer confidence remained strong, with a reading of 135.1 with expectations calling for a fall to 129.3 from 135.7 in the previous release. The US consumer ignored recent expectations from global institutions and banks that the US economy may be stagnant in the coming months. Thus, Trump's trade policy is still welcomed by the US consumer.

After the release of the Federal Reserve minutes, analysts noticed a split among members of the Fed's policy on the amount and timing of further rate cuts, some of whom demanded not to cut rates now, as the US economic performance remains strong.

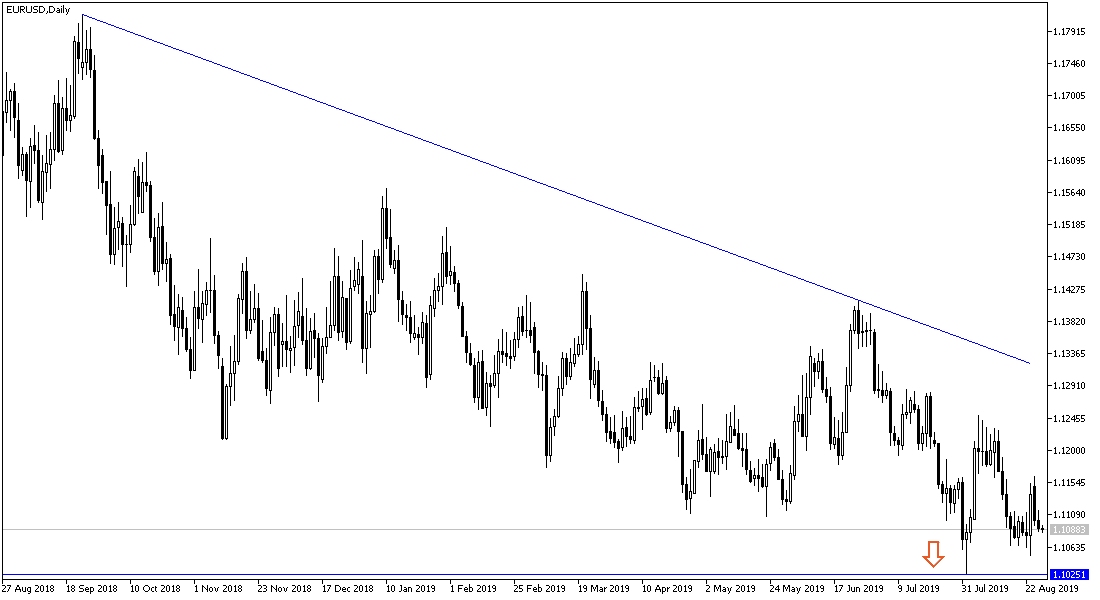

According to the technical analysis, the general trend of EUR / USD as seen on the provided daily chart below shows the pair's adherence to move inside its bearish channel. In case of moving towards 1.1000 psychological support, the pair will increase selling and may test 1.0945, 1.0880 and 1.0800 support levels respectively. Keeping in mind that testing 1.1000 will spur investors to buy for close targets until there are certain factors that might push the pair to correct higher. This will be supported by a resolution to the trade dispute between the United States and China. Currently the nearest resistance levels are 1.1175, 1.1260 and 1.1330 respectively. I still prefer to sell the pair from every bullish level.

On the economic data front: Today's economic calendar focuses on the release of the US GFK consumer climate index and then the Eurozone's money supply and private loans, and then the US weekly crude oil inventories.