Despite the recent decline of the US dollar against other major currencies, especially after the release of the Federal Reserve last minutes of meeting, and the remarks of Governor Jerome Powell at the symposium Jackson Hole last weekend, the EUR/USD attempts for bullish correction did not exceed the 1.1163 resistance level hit early Monday. During last Friday's session, the pair rebounded from the support 1.1051 level to 1.1153 resistance level in response to the Federal Reserve Governor Jerome Powell's important statements in which he explained that the Bank will monitor economic developments and external risks to determine the appropriate monetary policy, and admitted that the US economy faces some risks that will affect Negatively on its growth path. The global trade war would negatively affect the good performance of the economy. Powell ignored the many and continuing criticism of US President Trump for the bank's policy under his leadership, which underlines that the bank maintains its independence.

The minutes of the latest meeting of the US Federal Reserve showed a split among members of the Fed's policy on the amount and timing of further rate cuts, including those who demanded no cut at the current stage and to wait for real and persistent weakness in the US economy performance.

For the European Central Bank, as the economic performance in the Eurozone, led by Germany, continues to weaken, the bank may have to ease its monetary policy and introduce more stimulus plans, including cutting interest rates. Suddenly and unexpectedly, Germany sold a 30-year bond at a negative interest rate for the first time, as the German economy contracted.

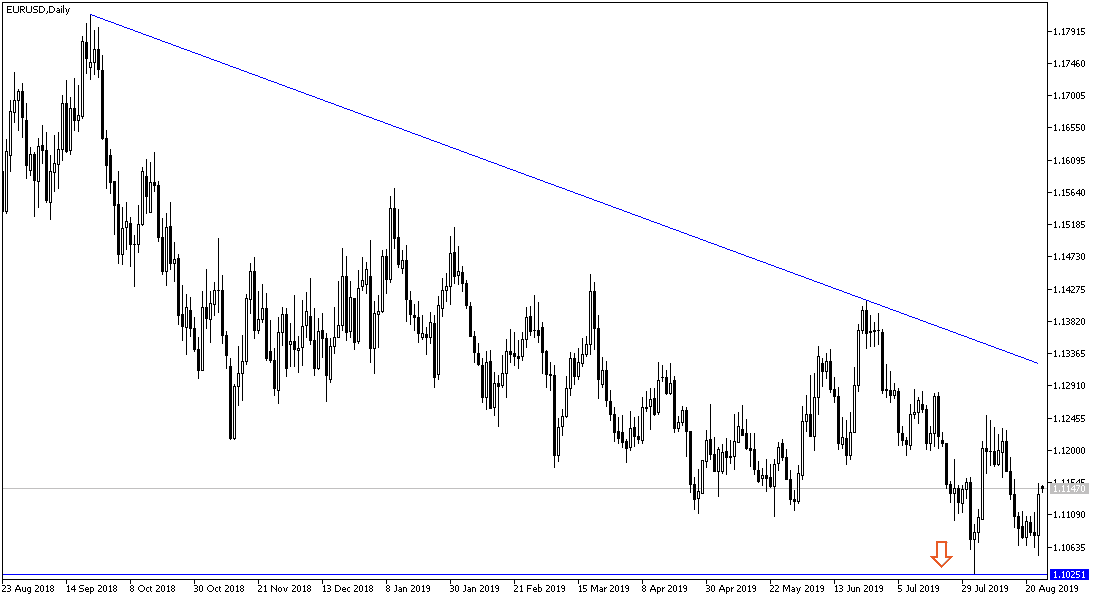

According to the technical analysis, EUR/USD recent attempts to correct have not yet reached the stage of breaking the general downtrend. According to the daily chart below, it still needs to move towards the resistance levels of 1.1227, 1.1290 and 1.1385 respectively to ensure achieving this. Should the pair drop to 1.1090 support level, 1.1000 psychological support, and 1.0930 support, it will confirm the strength of the current downtrend and warn of testing stronger support levels. The divergence in economic performance and monetary policy between the Eurozone and the United States is still in favor of the continued decline.

On the economic data front, today's economic calendar will focus on the release of the German IFO Business Climate Index amid expectations of a further decline amid fears for the future of the Eurozone's largest economy. From the United States, durable goods orders will be announced.