Ahead of the release of the minutes of the last Fed meeting, the EUR/USD stabilizes below the 1.1100 support level. The pair was largely unaffected by the announcement of the Eurozone's largest economy, Germany, to provide more stimulus, especially after the German economy contracted in the second quarter of the year, to avoid another contraction in the third quarter, pushing the economy is in a technical recession. Weak inflation in the Eurozone to its lowest level since mid-2016 ended investors' optimism about the German announcement. Recent economic indicators will force the ECB to introduce more stimulus plans to revive the region's economy.

Before the release of the minutes of the Fed meeting and the remarks of Governor Jerome Powell at the Jackson Hole symposium, US President Trump reiterated his attack on the bank's policy, demanding that they cut US interest rates by a full point along with more stimulus to the economy because the strength of the US dollar harms his business plans based on the America First principle, which is rejected by other world economies who will not mind to enter into trade wars with the United States, as happened for a while now with China until the moment. The US central bank remains confident in the performance of the US economy and has not responded to Trump's latest attack.

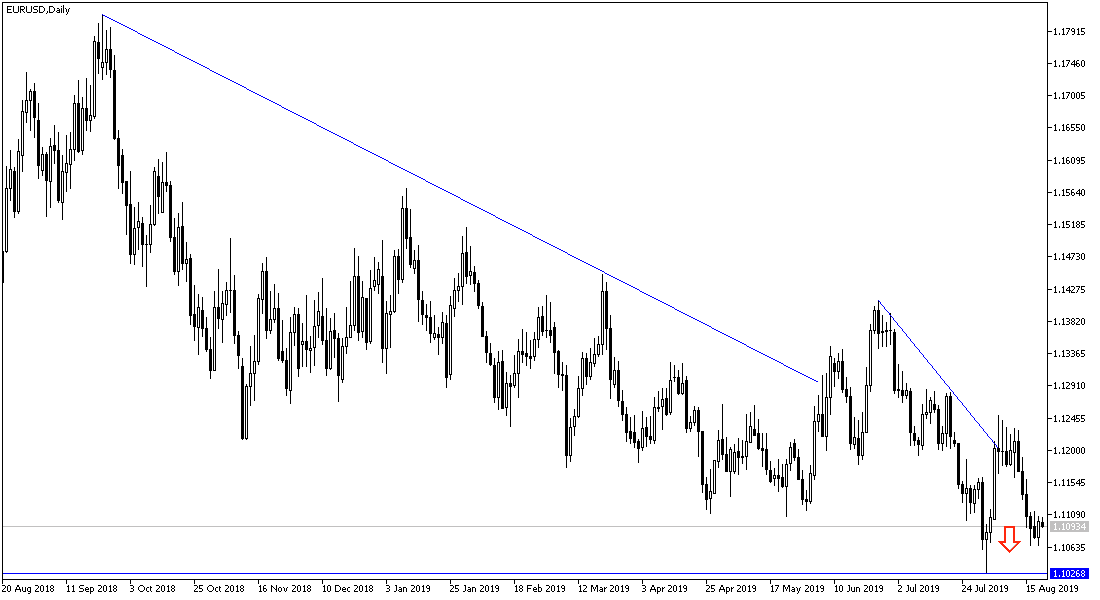

Technically, the EUR / USD is ready to test stronger support levels, and the 1.1000 psychological support might be the stronger at the moment. The pair currently ignores technical indicators reaching oversold areas. According to the daily chart's movements, the nearest support levels for the pair are 1.1045, 1.0960 and 1.0880 respectively, which are supporting the current bearish strength. In case of a correction, the nearest resistance levels are 1.1160, 1.1240 and 1.1300 respectively. We still prefer to sell the pair from every bullish level as the mixed economic performance and monetary policy between the US and the Eurozone will remain a strong pressure card for the EUR.

On the economic data front: Today's economic calendar has no significant economic data from the Eurozone, and the focus will be on the release of the minutes of the US Federal Reserve meeting.