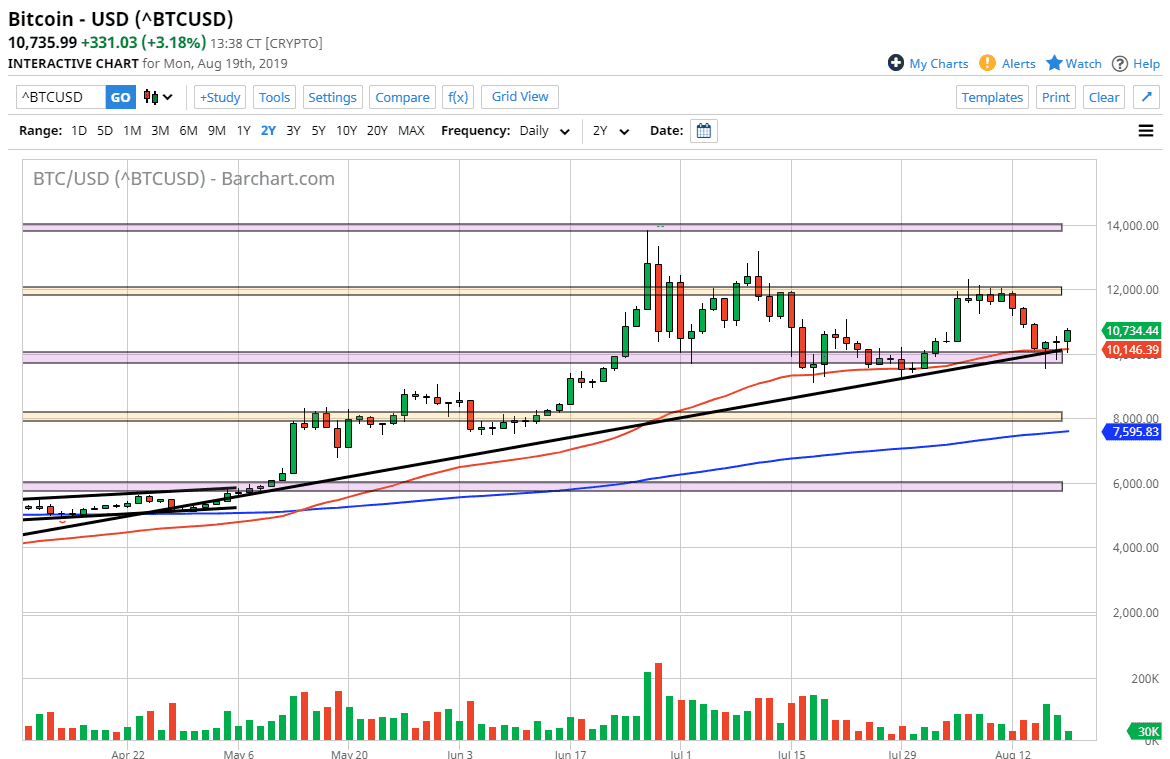

The Bitcoin market initially tried to fall again during the trading session on Friday, but as we have seen over the last several days, buyers continue to jump in and push this market higher. At this point, the market has been testing a major support level over the last several days. The uptrend line that has been tested is strong and has been quite remarkably resilient. Beyond that, we also have the 50-day EMA in that same area as well, so it looks as if there are plenty of reasons to think that we continue to go higher given enough time.

Looking at the chart, you should also notice that I have every $2000 marked as both support and resistance, and we have recently tested the $10,000 level over the last three candles, and as a result it looks like we are finally picking up a bit of momentum. The previous two candles were both hammers, and typically when you get a couple of hammers it’s a sign that we are going to continue to go higher. Now that we are above the top of both of those candlesticks, it looks as if we will probably go to the next obvious target, which is the $12,000 handle. That’s an area where we have seen a lot of selling though, so at this point I think it’s going to be difficult to continue to go higher, but if we do break above there is very likely that we get to the $13,000 level and eventually the $14,000 level.

The alternate scenario is that we break down below the hammer from two previous sessions, and then go looking towards the $8000 level after that. I don’t think at this point it’s very likely, and of course Monday’s trading sessions showed even more resiliency. What I like about this chart is that it goes right along with the idea of fiat currencies being sold off, and therefore it continues to look like Bitcoin is bought in order to preserve wealth as so many other currencies are struggling. We also have money flowing out of places like Venezuela, China, and the Islamic Republic of Iran. The market continues to get a benefit of people trying to export their wealth to protect it from major situations going on in each of those countries. At this point, I think short-term pullbacks continue to be nice buying opportunities in a market that looks well supported and strong.