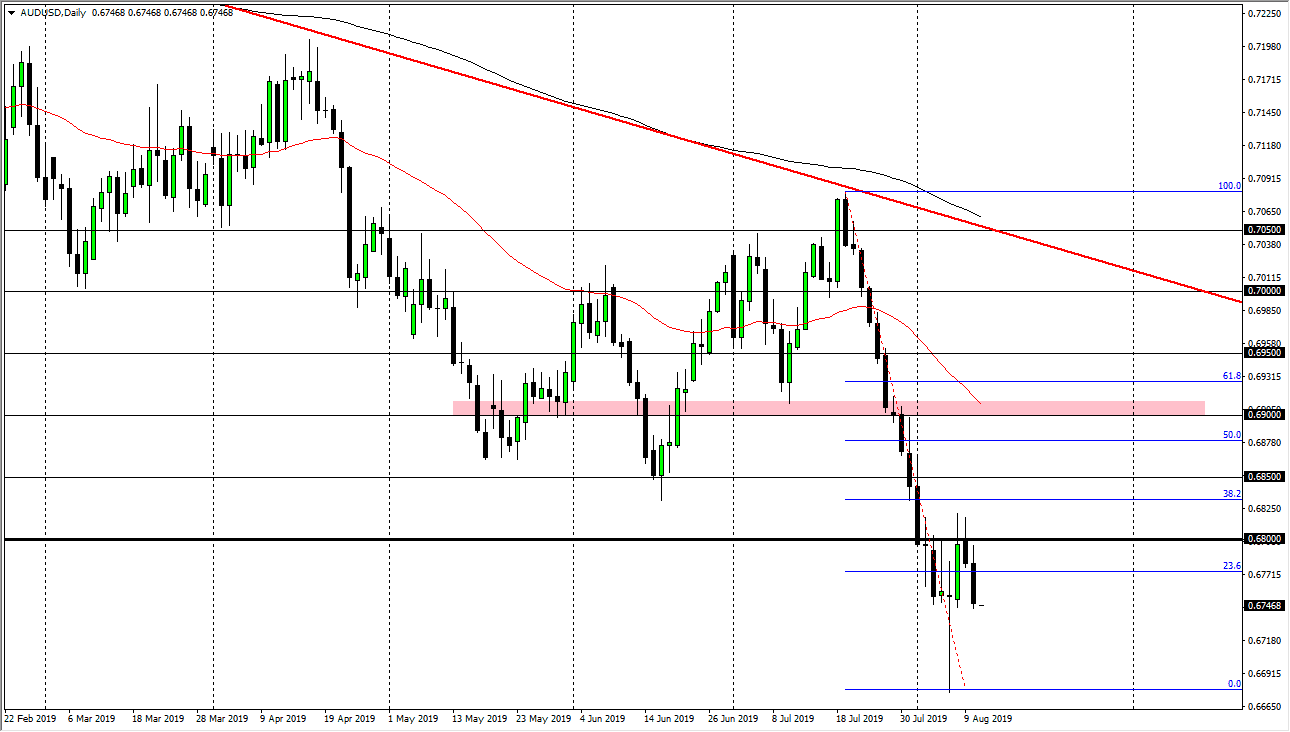

The Australian dollar initially tried to rally during the Monday session but found the 0.68 level to be far too much in the way of resistance to continue going higher. That being the case, it’s very likely that we are going to drift a bit lower, perhaps trying to take out the bottom. The 0.68 level has been important in the past, as well as the recent trading. The market should continue to look to the US dollar for safety, as it is gaining momentum against quite a few of the other currencies around the world.

At this point, we are likely to not only break down a bit towards the lows, but perhaps down to the 0.65 handle as the Aussie dollar is highly supported in that area based upon monthly charts. I believe that ultimately we are going to continue to see a lot of selling pressure every time we rally, and I have no interest in trying to go long of the Aussie dollar as the Australian dollar is so highly levered towards the Chinese economy. With the US/China trade relations souring, it’s very likely that the Aussie will continue to be a victim.

I don’t have any interest in buying this currency pair, at least not at this point. I believe that there should be a massive barrier of resistance at the 0.69 level as well, so even if we do break out to the upside I’m willing to wait until we get past that area before I would be convinced. I believe that if the Australian dollar can’t rally in the face of goal going the exact same thing, then the Aussie is in serious trouble. Beyond that, we are starting to see talk of the Reserve Bank of Australia going to negative interest rates, and that will be horrible for the currency. At this point, it’s only a matter of time before continue to see sellers. If for some reason we were to break down fresh, new lows and then attacked the 0.65 handle, things could get ugly rather quickly. I would expect a lot of volatility, but at this point I’m a seller at the first signs of exhaustion as it continues to work even though we are starting to form a lot of choppiness. Ultimately, I just don’t have any interest in trying to get long of a market that has sold off so drastically over the last several weeks.