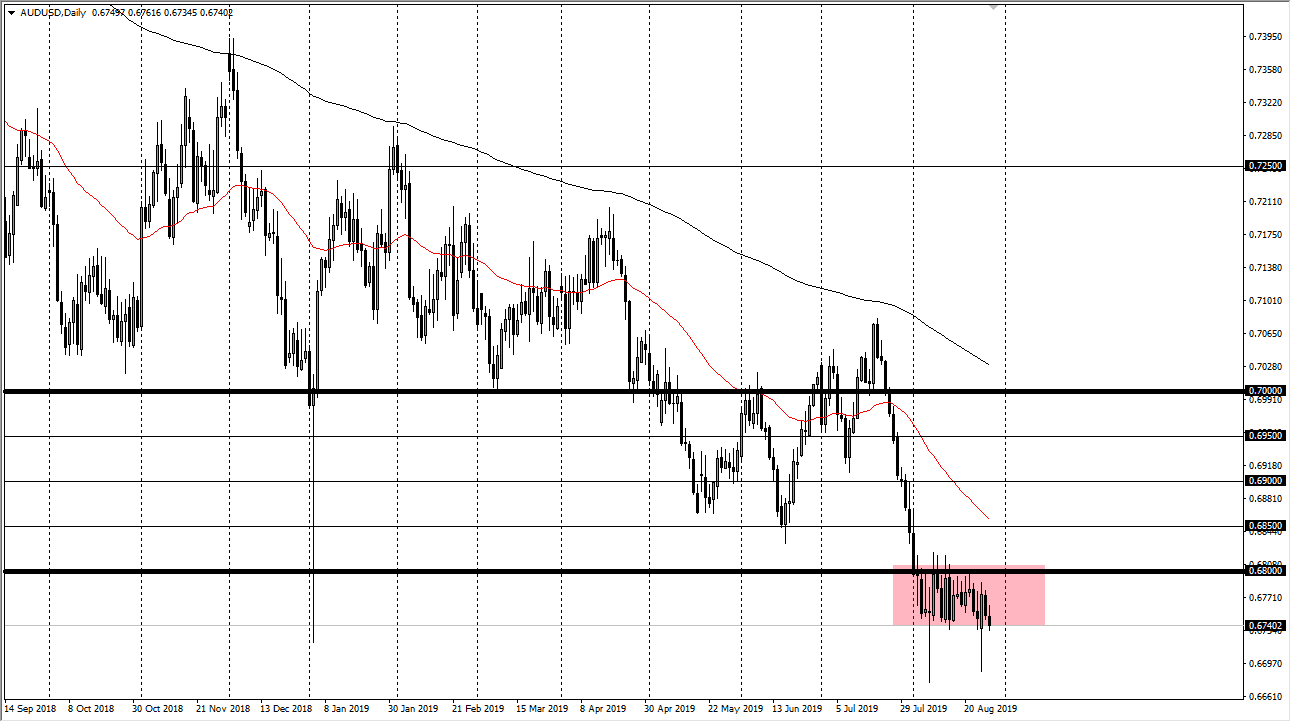

The Australian dollar has initially tried to rally during the trading session on Wednesday but then rolled over to reach down towards the 0.67 handle. This is a market that continues to see a lot of negativity, as we chop around sideways with a slightly negative tilt. Looking at this chart, it’s obvious that there is a significant amount of resistance above at the 0.68 handle, which extends about 25 pips above there.

Looking at this chart, we continue to see a bit of a drift lower overall, and therefore I think that we probably reach down towards the 0.65 handle which is a longer-term support level on monthly charts, and therefore I think it’s very likely that we will see plenty of interest in this pair down at that level. I believe in the short term it’s very likely that we will continue to be looking for exhaustion to take advantage of. After all, the US dollar has been favored for a reason, not the least of which will be the fact that it represents safety.

The US/China trade relations continue to struggle, and therefore it’s likely that the Aussie dollar will be soft due to the fact that Australian supply so much of the raw materials for the Chinese economy. Ultimately, I think that the market will eventually break down but I think that there is a lot of noise in this area that continues offer short-term rallies. Those rallies are treated with suspicion, and it’s not until we break above the red 50 day EMA far above current levels that I would consider buying this market. Even then, I would be a bit concerned, and probably just wait for a selling opportunity at an even higher level, with the sole exception of perhaps getting a US/China trade deal. Realistically, that isn’t going to happen between now and the 2020 election the way things are going, as the Chinese have an interest in trying to deal with somebody besides Donald Trump.

Further complicating the case for a stronger Australian dollar is the fact that we are currently watching the Australian housing bubble come unwound, and the debt burdens in that country will continue to weigh upon the Aussie dollar. The monetary policy is extraordinarily loose at the RBA, and only getting looser. As things stand, the Australian dollar is going to fall even further.