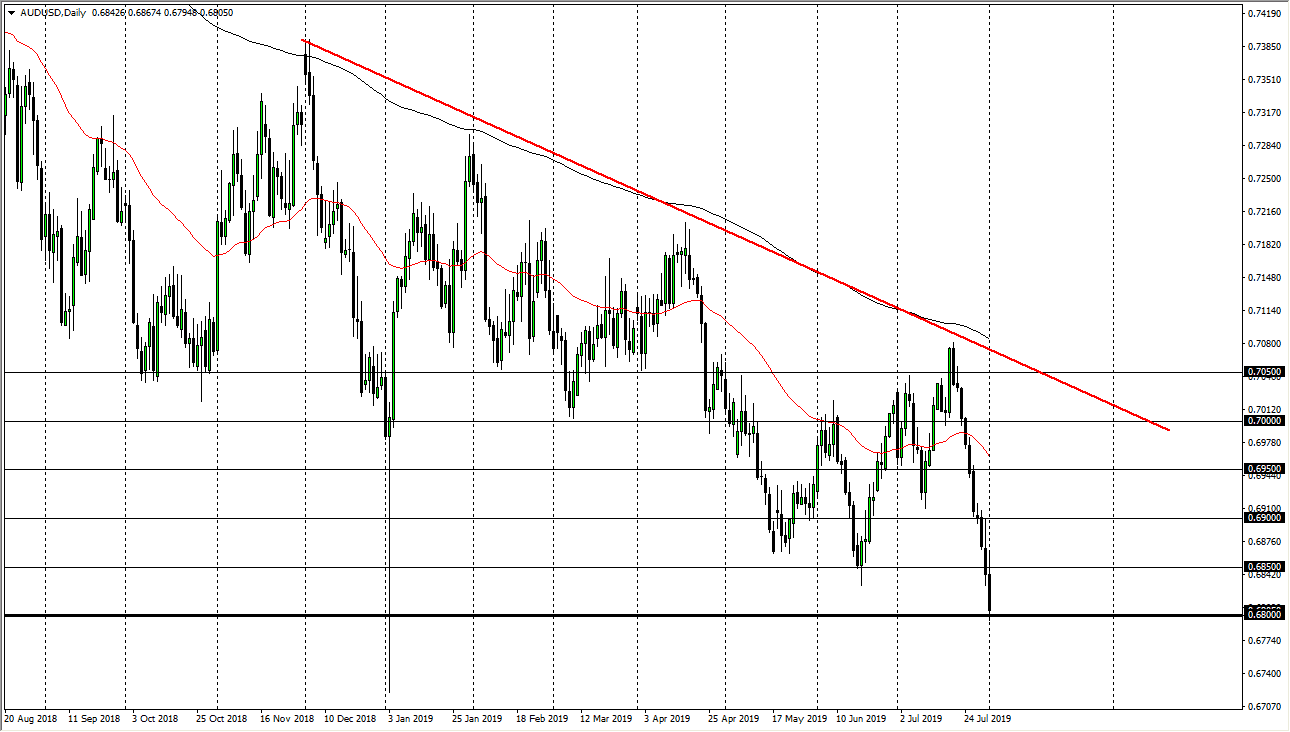

The Australian dollar has had a major turnaround during the trading session on Thursday, initially breaking above the 0.6850 level, but then turned around to break down towards the 0.68 level underneath. That is an area that is massive support based upon longer-term charts, so the fact that we are sitting at that area is very likely that we could see quite a bit of volatility soon. It would not be a huge surprise to see a bounce, but at the same time it wouldn’t be a huge surprise to see this market break down as well.

Massive support

The 0.68 level has been important more than once, and it is a major support level that continues to be important, so therefore I think we will see some type of move. I think at this point we could bounce from here but if we do we will have to keep an eye on every 50 pips or so as they could cause issues. A break above the 0.6850 level would be a good sign and perhaps send this market towards the 0.69 level.

If the support gets broken, then it is likely to reach down towards the 0.6750 level, perhaps even the 0.67 level after that. Longer-term, we could be looking at a move down to the 0.65 handle at this level has been so crucial for so long.

Jobs figures

The United States releases employment figures during the trading session on Friday, and that of course will cause a lot of volatility with any pair that has the “USD” attached to it. The Australian dollar is of course a “risk appetite asset”, so therefore it’s likely that the jobs figure will give us a direction in one way or the other. Beyond that, we now have other things to pay attention to as well.

More tariffs coming

There are more tariffs coming down the road on September 1 according to President Donald Trump, adding another 10% on Chinese imports. That of course has the market is reeling, and it should be noted that the Australian dollar is highly levered to the Chinese economy so it makes sense that the Aussie got hammered in general. That being the case, this is a market that is on the verge of making some type of big moves, and the terrorists have a suddenly looking to the downside. Before the announcement came out, the market actually look like it could turn around. At this point, we are so close to breaking down it’s not even funny.